Demystifying ERP Finance: Everything You Need to Know

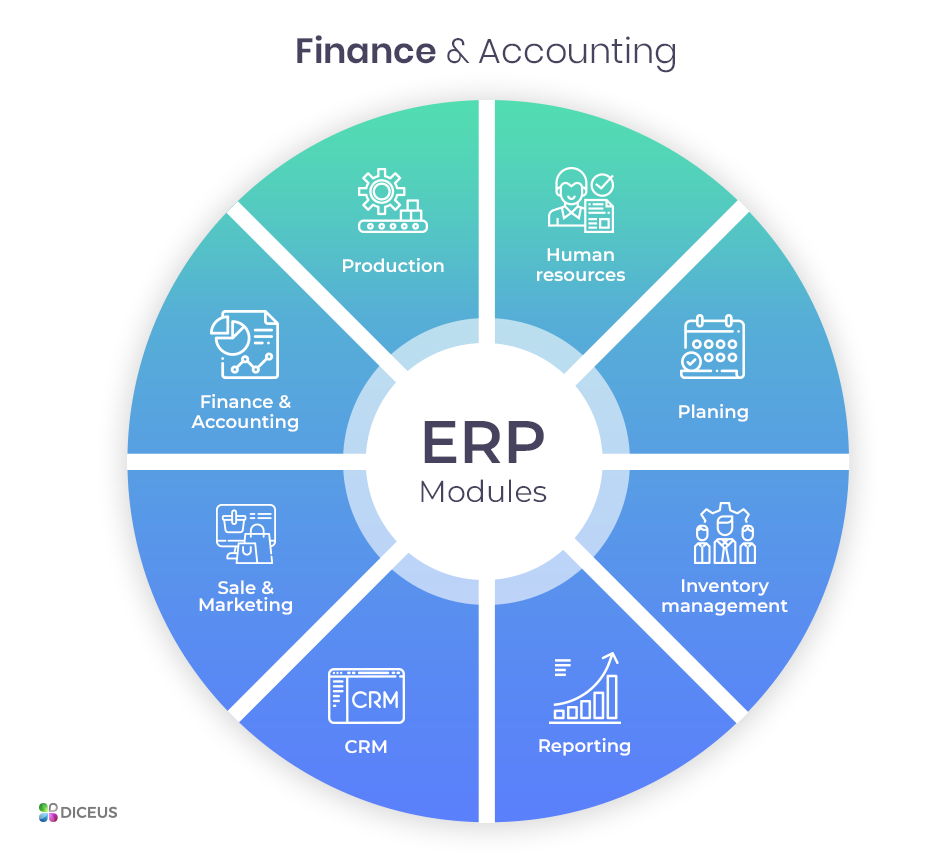

Are you struggling to manage your financial operations efficiently? If so, implementing an Enterprise Resource Planning (ERP) system can revolutionize your finance department. In this blog post, we will delve into the intricacies of ERP finance, exploring its benefits, functionalities, and key considerations. By the end, you'll have a comprehensive understanding of how ERP finance can transform your business.

As a business grows, managing financial activities becomes increasingly complex. From tracking expenses and managing accounts payable to generating financial reports and forecasting budgets, the finance department plays a crucial role. However, relying on manual processes or disconnected software solutions can lead to errors, inefficiencies, and limited visibility into financial data. This is where ERP finance comes to the rescue.

1. Streamlining Financial Operations

Discover how ERP finance streamlines core financial processes, such as accounts payable, accounts receivable, and general ledger management. Learn how automation and integration enhance accuracy and save time.

2. Real-Time Financial Reporting

Uncover the power of real-time financial reporting offered by ERP finance. Explore how dynamic dashboards and customizable reports provide instant access to key financial insights, enabling informed decision-making.

3. Efficient Cash Flow Management

Learn how ERP finance facilitates efficient cash flow management, allowing businesses to optimize working capital, monitor cash inflows and outflows, and forecast future cash positions.

4. Comprehensive Budgeting and Planning

Discover how ERP finance enables comprehensive budgeting and planning, providing businesses with the tools to create accurate budgets, track performance against targets, and adapt to changing market conditions.

5. Enhanced Compliance and Auditability

Explore how ERP finance helps businesses meet regulatory requirements, maintain accurate financial records, and streamline audit processes. Learn how ERP systems provide a robust audit trail and ensure data integrity.

Conclusion

In conclusion, ERP finance revolutionizes financial management by streamlining operations, providing real-time insights, and ensuring compliance. By implementing an ERP system tailored to your business needs, you can enhance financial visibility, improve decision-making, and drive sustainable growth. So, why wait? Embrace the power of ERP finance and unlock your business's full financial potential.

Have any questions about ERP finance? We've got you covered.

Q: What are the key benefits of ERP finance?

A: ERP finance offers streamlined financial operations, real-time reporting, efficient cash flow management, comprehensive budgeting and planning capabilities, and enhanced compliance and auditability.

Q: How can ERP finance improve my business's financial visibility?

A: ERP finance provides instant access to key financial insights through dynamic dashboards and customizable reports. This enhances visibility into financial data and supports informed decision-making.

Q: Is ERP finance suitable for businesses of all sizes?

A: Absolutely! ERP finance solutions can be tailored to meet the specific needs of businesses across various industries and sizes. Whether you're a small startup or a multinational corporation, ERP finance can transform your financial management.

Q: Can ERP finance help with regulatory compliance?

A: Yes, ERP finance systems help businesses meet regulatory requirements by maintaining accurate financial records, providing a robust audit trail, and ensuring data integrity. This streamlines compliance processes and minimizes the risk of penalties.

Q: How can ERP finance support budgeting and planning?

A: ERP finance enables businesses to create accurate budgets, track performance against targets, and adapt to changing market conditions. It provides comprehensive budgeting and planning tools to support strategic financial decision-making.

Post a Comment for "Demystifying ERP Finance: Everything You Need to Know"