Finance ERP: Revolutionizing Financial Management for Businesses

Finance ERP, also known as Finance Enterprise Resource Planning, is a comprehensive software solution designed to streamline and optimize financial management processes in businesses. From financial planning and budgeting to reporting and analysis, finance ERP systems provide a centralized platform that integrates all financial functions, enabling organizations to make informed decisions and drive growth.

In today's fast-paced and ever-evolving business landscape, finance ERP has become an invaluable tool for companies of all sizes and industries. This blog article aims to provide a detailed and comprehensive understanding of finance ERP, its key features, benefits, and its role in transforming financial management practices.

1. What is Finance ERP?

Get ready to explore the world of finance ERP! In this section, we will delve into the definition of finance ERP, its core functionalities, and how it differs from traditional accounting systems. Discover how finance ERP can revolutionize your financial management processes and pave the way for growth.

2. The Benefits of Finance ERP

Uncover the numerous advantages that finance ERP brings to businesses. From enhanced efficiency and accuracy to improved decision-making capabilities, finance ERP offers a wide range of benefits. This section will outline the key advantages that organizations can gain by implementing finance ERP systems.

3. Key Features of Finance ERP

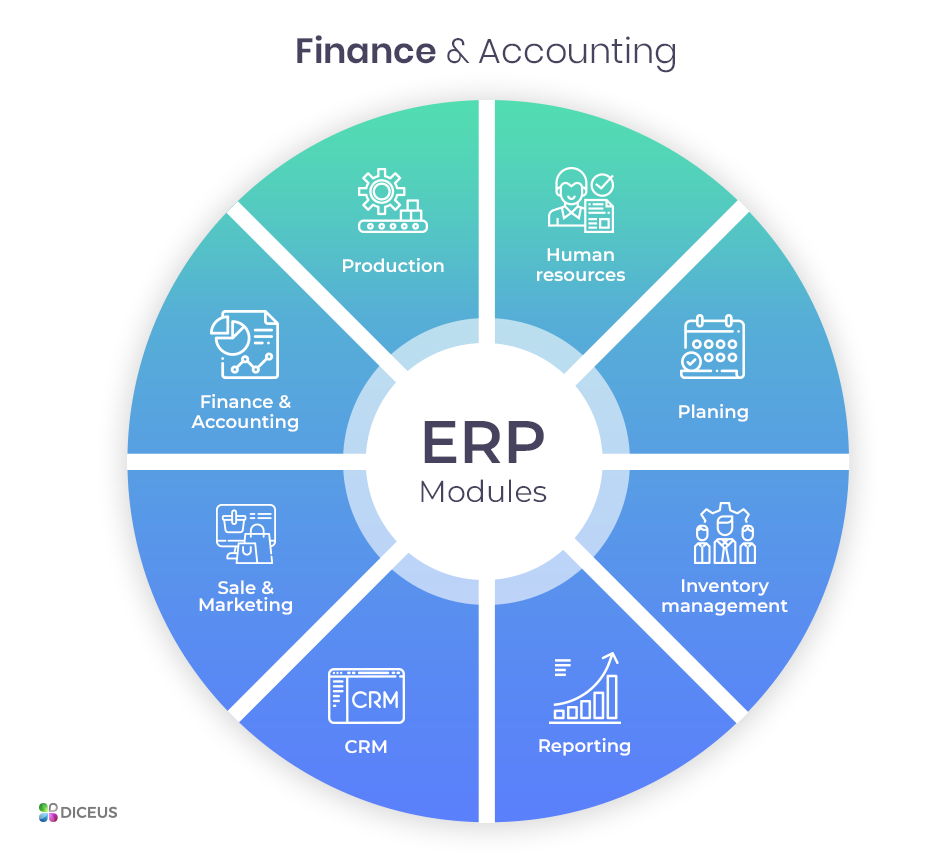

Explore the powerful features that make finance ERP stand out from traditional accounting software. From automated financial reporting and analysis to seamless integration with other business functions, finance ERP systems offer a comprehensive suite of tools. Find out how these features can transform your financial operations.

4. Implementing Finance ERP: Best Practices

Discover the essential steps and best practices for successfully implementing finance ERP in your organization. From selecting the right ERP solution provider to ensuring smooth integration with existing systems, this section will guide you through the process and help you avoid common pitfalls.

5. Overcoming Challenges in Finance ERP Implementation

While finance ERP offers numerous benefits, its implementation can come with its fair share of challenges. In this section, we will explore common obstacles faced during finance ERP implementation and provide practical strategies for overcoming them. Be prepared to navigate potential roadblocks and maximize the effectiveness of your finance ERP system.

6. Finance ERP for Small Businesses

Think finance ERP is only for large enterprises? Think again! Small businesses can also benefit greatly from implementing finance ERP systems. This section will delve into the specific advantages and considerations for small businesses looking to leverage finance ERP to drive growth and success.

7. The Future of Finance ERP

As technology continues to advance, finance ERP is poised to evolve alongside it. In this section, we will explore the emerging trends and future developments in finance ERP. From artificial intelligence and machine learning to predictive analytics, discover what the future holds for finance ERP systems.

8. Case Studies: Real-World Finance ERP Success Stories

Nothing speaks louder than real-world success stories. In this section, we will showcase some of the most inspiring examples of companies that have implemented finance ERP systems and reaped the benefits. Learn from their experiences and gain insights into how finance ERP can transform your own financial management practices.

9. Choosing the Right Finance ERP Solution

With a myriad of finance ERP solutions available in the market, selecting the right one for your organization can be overwhelming. This section will provide guidance on key factors to consider when choosing a finance ERP solution. From scalability and customization options to vendor reputation, make an informed decision that aligns with your business needs.

10. Finance ERP Integration with Other Business Systems

Finance ERP does not operate in isolation. It needs to seamlessly integrate with other business systems to deliver maximum value. In this section, we will explore the importance of integration and discuss strategies for integrating finance ERP with other critical systems, such as CRM and inventory management. Unlock the full potential of your finance ERP system through effective integration.

Finance ERP is a game-changer for businesses, revolutionizing financial management practices and driving growth. From streamlining processes and enhancing efficiency to providing valuable insights for decision-making, finance ERP offers a comprehensive solution to modern-day financial challenges.

As technology continues to advance, finance ERP will only become more powerful and versatile. By staying abreast of emerging trends and best practices, organizations can harness the full potential of finance ERP and propel their financial management to new heights.

So, are you ready to empower your business with finance ERP? Take the first step towards transforming your financial operations and unlock a world of possibilities!

Q: How does finance ERP differ from traditional accounting systems?

A: Finance ERP goes beyond traditional accounting systems by offering a centralized platform that integrates all financial functions. While accounting systems focus on recording and reporting financial transactions, finance ERP provides comprehensive tools for financial planning, budgeting, analysis, and reporting, enabling organizations to make informed decisions based on real-time data.

Q: Can small businesses benefit from finance ERP?

A: Absolutely! Finance ERP systems are not exclusive to large enterprises. Small businesses can also benefit greatly from implementing finance ERP. It helps streamline financial processes, enhances accuracy, improves decision-making, and provides valuable insights for growth. By leveraging finance ERP, small businesses can optimize their financial management practices and pave the way for success.

Q: How can finance ERP help overcome common financial management challenges?

A: Finance ERP offers a range of features and functionalities that address common financial management challenges. From automating manual processes and reducing errors to providing real-time visibility into financial data, finance ERP empowers organizations to overcome challenges such as inefficient processes, lack of data accuracy, and limited financial insights. It enables businesses to make informed decisions and drive financial success.

Q: What factors should be considered when choosing a finance ERP solution?

A: When selecting a finance ERP solution, it is crucial to consider factors such as scalability, customization options, integration capabilities, vendor reputation, and ongoing support. Assess your business requirements, align them with the features and capabilities of different solutions, and choose a finance ERP solution that best fits your organization's needs and long-term goals.

Q: How does finance ERP integrate with other business systems?

A: Finance ERP needs to seamlessly integrate with other critical business systems to ensure smooth operations and maximize its value. Integration with systems like CRM, inventory management, and payroll enables data synchronization, eliminates manual data entry, and provides a holistic view of business operations. This integration empowers organizations to make better-informed decisions and optimize overall business performance.

Post a Comment for "Finance ERP: Revolutionizing Financial Management for Businesses"