The Ultimate Guide to Finance Planner: Managing Your Finances with Ease

Are you struggling to keep track of your finances? Do you find it challenging to achieve your financial goals? Look no further – a finance planner can be your saving grace! In this comprehensive guide, we will walk you through the ins and outs of finance planning, helping you take charge of your money and secure a stable financial future. Whether you're a novice or an experienced investor, this article will provide you with valuable insights and practical tips to make the most of your finances.

Understanding the importance of finance planning is crucial, and in the first section of this guide, we will delve into the fundamentals. We will explore what finance planning entails, why it is essential, and how it can benefit you in the long run. By grasping the basics, you will be equipped with the knowledge to make informed decisions and take control of your financial journey.

1. Setting Financial Goals: Mapping Your Path to Success

In this section, we will discuss the significance of setting financial goals and how they serve as a roadmap to success. We will provide step-by-step guidance on how to set achievable and measurable goals, ensuring you stay motivated throughout your finance planning journey.

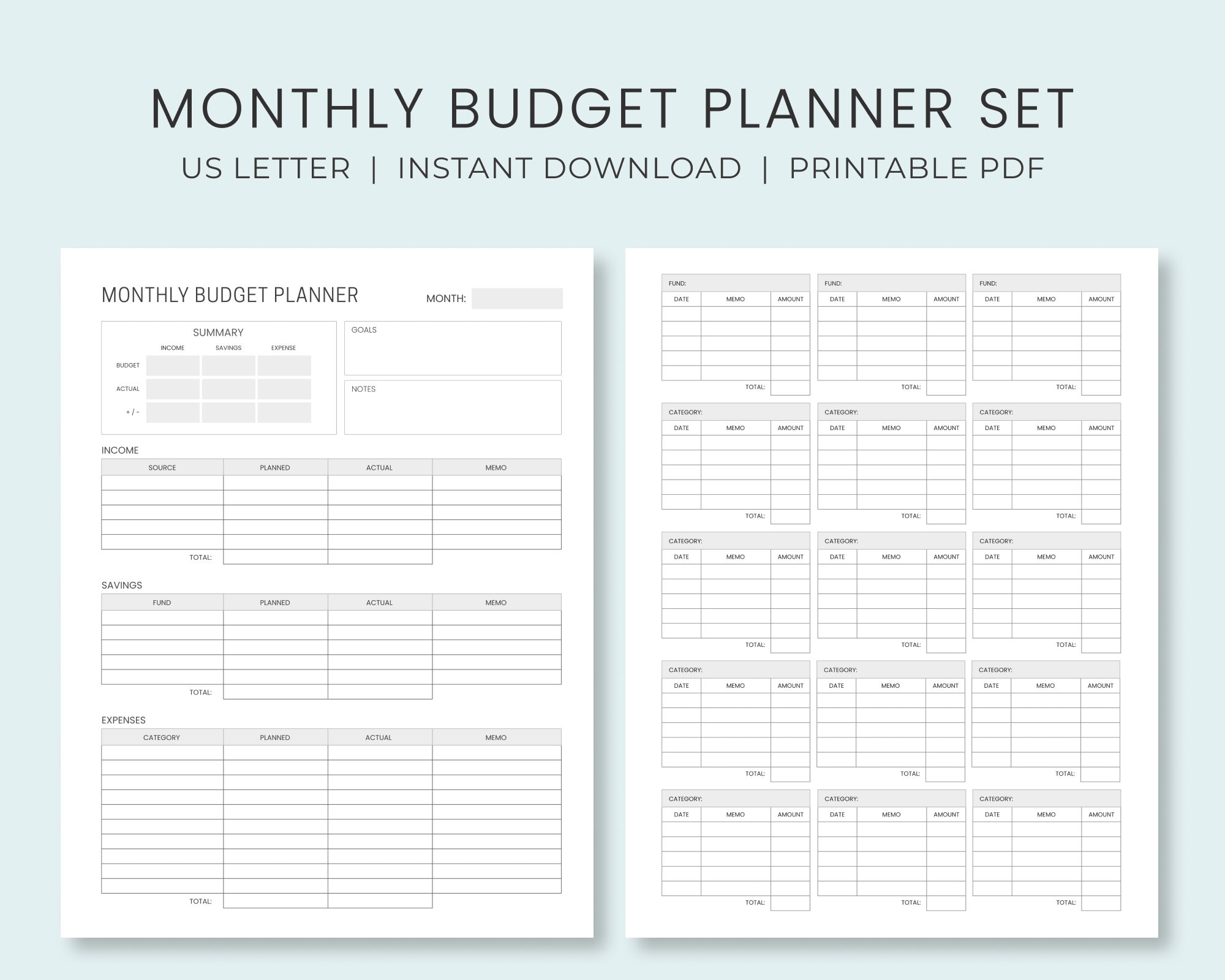

2. Budgeting: Your Key to Financial Stability

Learn the art of budgeting and discover how it can transform your financial situation. We will share practical tips and strategies for creating an effective budget, helping you manage your income and expenses more efficiently. Say goodbye to financial stress and hello to financial stability!

3. Saving and Investing: Growing Your Wealth

In this section, we will explore the world of saving and investing. Discover different saving methods and investment options that can help grow your wealth over time. From stocks and bonds to real estate and retirement accounts, we will guide you through the various avenues to make your money work for you.

4. Debt Management: Breaking Free from Financial Burden

Dealing with debt can be overwhelming, but fear not – we are here to assist you in managing and ultimately eliminating it. Learn effective debt management strategies, understand the importance of credit scores, and explore debt consolidation options. Regain control of your finances and pave the way to a debt-free future.

5. Insurance and Protection: Safeguarding Your Financial Well-being

Protecting yourself and your loved ones from unexpected financial risks is vital. In this section, we will discuss the importance of insurance and provide insights into various types of coverage. From life insurance to health insurance and everything in between, we will help you make informed decisions to secure your financial well-being.

6. Tax Planning: Maximizing Your Returns

Taxes can often be confusing and overwhelming. However, with proper tax planning, you can legally minimize your tax burden and maximize your returns. Learn about tax deductions, credits, and other strategies to optimize your tax situation in this informative section.

7. Retirement Planning: Securing Your Golden Years

Retirement may seem far off, but it is never too early to start planning for it. Discover the importance of retirement planning and explore different retirement savings options. From 401(k)s and IRAs to pension plans and Social Security, we will guide you on your journey towards a comfortable and worry-free retirement.

8. Estate Planning: Leaving a Legacy

Ensure that your assets are distributed according to your wishes by diving into the world of estate planning. In this section, we will discuss wills, trusts, and other essential components of estate planning. Take control of your legacy and provide for your loved ones even after you're gone.

9. Monitoring and Evaluating: Fine-tuning Your Financial Plan

Once you have implemented your finance plan, it's crucial to monitor and evaluate its effectiveness. In this section, we will share tips on how to track your progress, make necessary adjustments, and stay on top of your financial goals. Learn how to adapt your plan to life's changing circumstances and ensure continued financial success.

10. Seeking Professional Help: When to Consult a Financial Advisor

While you can manage your finances independently, there may come a time when seeking professional help becomes necessary. In this final section, we will discuss the signs that indicate it may be time to consult a financial advisor. Understand the benefits of working with an expert and gain insights into finding the right advisor for your unique needs.

In conclusion, finance planning is the key to achieving financial freedom and security. By following the steps outlined in this comprehensive guide, you can take control of your financial future and make informed decisions that align with your goals. Remember, no matter where you are on your finance planning journey, it's never too late to start. So, why wait? Start planning your finances today!

Question and Answer Section:

Q: How often should I review my finance plan?

A: It is recommended to review your finance plan at least once a year. However, major life events such as marriage, having children, or changing careers may require more frequent reviews.

Q: Is it necessary to hire a financial advisor?

A: While managing your finances independently is possible, a financial advisor can provide valuable expertise and guidance, especially during complex financial situations. Consider consulting a financial advisor if you feel overwhelmed or need assistance with specific financial goals.

Q: Can finance planning help me get out of debt?

A: Absolutely! Finance planning can help you develop effective strategies to manage and eliminate debt. By creating a budget, prioritizing debt payments, and exploring debt consolidation options, you can take significant steps towards becoming debt-free.

Q: How can I maximize my retirement savings?

A: To maximize your retirement savings, consider contributing the maximum amount allowed to retirement accounts such as a 401(k) or IRA. Additionally, take advantage of employer matching contributions and explore other retirement investment options to grow your savings over time.

Q: Is estate planning only for the wealthy?

A: No, estate planning is essential for everyone, regardless of their wealth. It ensures that your assets are distributed according to your wishes and can help avoid unnecessary disputes among family members. Estate planning also involves appointing guardians for minor children and making healthcare decisions in case of incapacitation.

Post a Comment for "The Ultimate Guide to Finance Planner: Managing Your Finances with Ease"