The Ultimate Guide to Pursuing a Bachelor's Degree in Finance

Are you intrigued by the world of finance? Do you have a knack for numbers and a passion for analyzing investment opportunities? If so, pursuing a bachelor's degree in finance might be the perfect path for you. In this comprehensive guide, we will dive deep into the details of a finance degree, exploring its benefits, curriculum, career prospects, and more. Whether you're a high school graduate or a professional looking to switch careers, this article will provide you with all the information you need to make an informed decision about pursuing a bachelor's degree in finance.

Section 1: What is a Bachelor's Degree in Finance?

Summary: In this section, we will define what a bachelor's degree in finance entails, including its curriculum, core subjects, and the skills it develops.

Section 2: Benefits of Pursuing a Degree in Finance

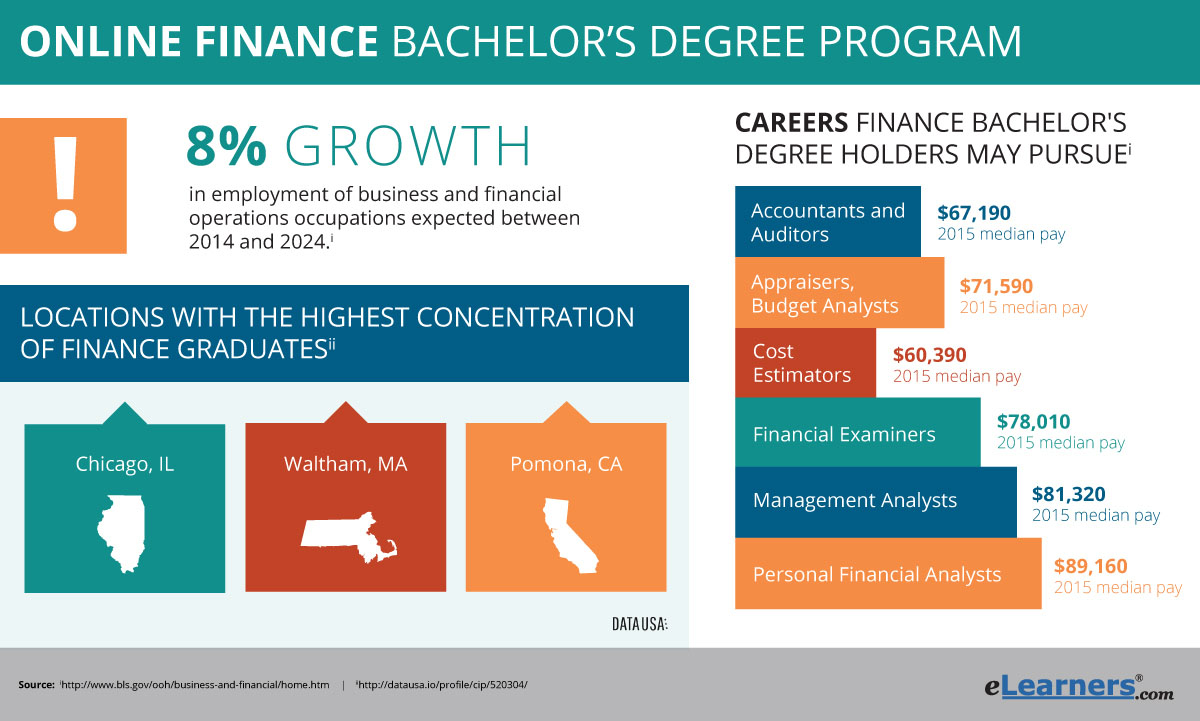

Summary: This section explores the numerous advantages of pursuing a finance degree, such as the potential for high earning potential, job stability, and opportunities for growth and advancement.

Section 3: Core Subjects and Curriculum

Summary: Here, we will delve into the core subjects and curriculum typically covered in a bachelor's degree in finance, including courses in financial management, investments, accounting, economics, and more.

Section 4: Specializations within Finance

Summary: This section highlights various specializations available within the field of finance, such as corporate finance, investment banking, financial planning, and risk management.

Section 5: Career Prospects and Opportunities

Summary: Discover the wide range of career prospects and opportunities available to finance graduates, including roles in banking, consulting, corporate finance, and financial analysis.

Section 6: Choosing the Right Program

Summary: In this section, we offer valuable tips and insights on how to choose the right bachelor's degree program in finance, considering factors such as accreditation, faculty, internships, and networking opportunities.

Section 7: Financing Your Education

Summary: Learn about the different options available to finance your education, including scholarships, grants, student loans, and work-study programs.

Section 8: Online vs. Traditional Programs

Summary: Explore the pros and cons of pursuing a finance degree through online programs versus traditional brick-and-mortar institutions, considering factors such as flexibility, cost, and learning experience.

Section 9: Advanced Degrees and Continuing Education

Summary: Discover the benefits and opportunities that arise from pursuing advanced degrees or continuing education in finance, such as a master's degree or certifications in specialized areas.

Section 10: FAQs about a Bachelor's Degree in Finance

Summary: In this section, we answer some frequently asked questions about pursuing a bachelor's degree in finance, covering topics such as job prospects, salary expectations, and common misconceptions.

Conclusion:

In conclusion, obtaining a bachelor's degree in finance can open the doors to a wide range of rewarding career opportunities in the finance industry. From corporate finance to investment banking, the skills and knowledge gained through this degree can pave the way for success. Whether you choose to pursue a traditional program or opt for online education, it's crucial to select a reputable institution that aligns with your career goals. By investing in your education and continuously seeking opportunities for advancement, you can embark on a prosperous and fulfilling journey in the finance field.

Remember, pursuing a finance degree is just the first step. To excel in this competitive field, it's essential to stay updated with the latest industry trends, continuously enhance your skills, and maintain a strong professional network. Good luck on your journey to obtaining a bachelor's degree in finance!

Question and Answer:Q1: What are the job prospects for finance graduates?A1: Finance graduates enjoy a plethora of career prospects, ranging from financial analyst and investment banker to financial planner and risk manager. The finance industry offers diverse opportunities in both the public and private sectors, ensuring a high demand for qualified professionals.

Q2: Can I pursue a finance degree online?A2: Absolutely! Many reputable universities offer online programs for a bachelor's degree in finance. Online education provides flexibility for individuals who are unable to attend traditional classes due to work or personal commitments.

Q3: How much can I expect to earn with a finance degree?A3: The earning potential for finance graduates varies depending on factors such as experience, location, and job role. However, finance professionals typically earn competitive salaries, with entry-level positions starting around $50,000 per year and experienced professionals earning six-figure salaries.

Q4: Are internships necessary for a finance degree?A4: While not mandatory, internships can significantly enhance your chances of securing employment after graduation. They provide practical experience, networking opportunities, and a chance to apply classroom knowledge in real-world scenarios.

Q5: Is it possible to specialize within the field of finance?A5: Absolutely! Finance offers various specialized areas such as corporate finance, investment banking, financial planning, risk management, and more. Choosing a specialization can help you tailor your education and career path according to your interests and goals.

Post a Comment for "The Ultimate Guide to Pursuing a Bachelor's Degree in Finance"