Car Finance with Bad Credit: How to Get Approved and Drive Your Dream Car

Are you dreaming of driving your dream car but worried about your bad credit history? Don't let that stop you! In this comprehensive guide, we will explore the world of car finance with bad credit and provide you with all the information you need to make your dream a reality. From understanding the impact of bad credit on car finance to tips for improving your chances of approval, we've got you covered.

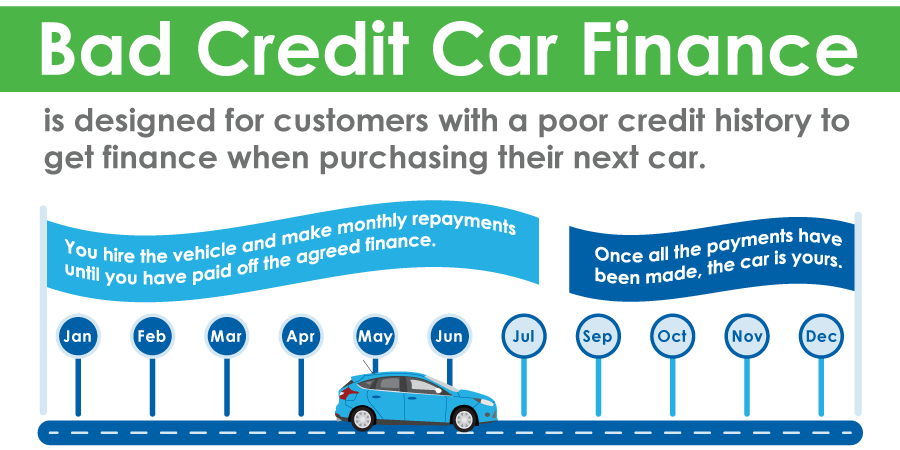

When it comes to car finance, having bad credit can make the process challenging. Lenders are often hesitant to provide loans to individuals with a less-than-perfect credit score. However, with the right knowledge and preparation, you can increase your chances of getting approved and driving off in the car of your dreams.

1. Understanding Bad Credit and Its Impact on Car Finance

In this section, we will dive into the concept of bad credit and how it affects your ability to secure car finance. We will explain credit scores, factors that contribute to bad credit, and why lenders are cautious when it comes to offering loans to individuals with poor credit history.

Summary: This section will help you understand why bad credit is a hurdle when it comes to car finance and provide insights into how lenders evaluate creditworthiness.

2. Options for Car Finance with Bad Credit

Just because you have bad credit doesn't mean you have no options. In this section, we will explore various avenues for car finance, including specialized lenders, dealerships that offer in-house financing, and other alternatives that cater specifically to individuals with bad credit.

Summary: Discover the different options available to you for securing car finance despite your bad credit, and learn about the pros and cons of each.

3. Steps to Take Before Applying for Car Finance

Before diving into the car finance application process, it's essential to take certain steps to improve your chances of approval. In this section, we will outline these steps, including assessing your credit report, budgeting, and considering a co-signer.

Summary: Learn about the necessary preparatory steps you should take before applying for car finance to enhance your chances of approval.

4. How to Find the Right Car That Fits Your Budget

Buying a car is a significant financial commitment, and with bad credit, it becomes even more crucial to find a vehicle that fits your budget. This section will provide you with practical tips for finding the right car that suits your needs and financial situation.

Summary: Discover strategies for finding a car that not only meets your preferences but also aligns with your budget limitations.

5. The Importance of Researching and Comparing Lenders

Not all lenders are created equal, and this holds true when it comes to car finance with bad credit. In this section, we will emphasize the importance of researching and comparing lenders to find the best deal that suits your circumstances.

Summary: Understand why thorough research and comparison are vital in order to secure the most favorable car finance terms.

6. Tips for Negotiating and Securing Favorable Loan Terms

Negotiating loan terms can be intimidating, especially with bad credit. However, armed with the right knowledge, you can still secure favorable terms. This section will provide you with essential tips and strategies for negotiating with lenders.

Summary: Learn effective negotiation techniques to help you secure the best possible loan terms, even with bad credit.

7. The Role of Down Payments in Car Finance with Bad Credit

Down payments can play a significant role in securing car finance, particularly if you have bad credit. In this section, we will explore the importance of down payments, how they affect loan terms, and strategies for saving up to make a substantial down payment.

Summary: Understand the impact of down payments on car finance, and learn how to save up for a substantial down payment to improve your chances of approval.

8. Tips for Rebuilding Your Credit Score

Bad credit doesn't have to be a permanent state. In this section, we will provide you with practical tips for rebuilding your credit score over time, enhancing your future financial prospects.

Summary: Discover effective strategies for improving your credit score, which will have a positive impact on your ability to secure car finance in the future.

9. How to Avoid Common Pitfalls and Scams

Unfortunately, individuals with bad credit can be targeted by scams or fall into common pitfalls. This section will arm you with knowledge to help you avoid such situations and ensure a smooth car finance experience.

Summary: Learn about common pitfalls and scams that individuals with bad credit may encounter during the car finance process, and discover how to protect yourself.

10. Frequently Asked Questions about Car Finance with Bad Credit

In this section, we will address some of the most frequently asked questions about car finance with bad credit. From eligibility requirements to the impact of bankruptcy, we aim to provide you with comprehensive answers to clarify any remaining doubts.

Summary: Find answers to commonly asked questions about car finance with bad credit, allowing you to make informed decisions.

Securing car finance with bad credit may seem challenging, but it's not impossible. By understanding the impact of bad credit, exploring different options, and taking the necessary steps to improve your creditworthiness, you can increase your chances of approval. Remember to research and compare lenders, negotiate favorable loan terms, and make a substantial down payment when possible. Additionally, focus on rebuilding your credit for a brighter financial future.

Don't let bad credit deter you from driving your dream car. With the right knowledge and determination, you can overcome the obstacles and hit the road in style!

Question and Answer

Q: Can I get car finance with bad credit?

A: Yes, you can still secure car finance with bad credit. It may require exploring specialized lenders or dealerships that offer in-house financing.

Q: How can I improve my chances of getting approved for car finance with bad credit?

A: Taking steps such as assessing your credit report, budgeting, considering a co-signer, and making a substantial down payment can improve your chances of approval.

Q: Can car finance with bad credit help me rebuild my credit score?

A: Yes, by making timely payments on your car finance, you can gradually rebuild your credit score over time and improve your financial prospects.

Q: Are there any scams or pitfalls to watch out for when getting car finance with bad credit?

A: Yes, individuals with bad credit may be targeted by scams or fall into common pitfalls. It's important to stay vigilant, research thoroughly, and avoid any suspicious or untrustworthy offers.

Q: How long does it take to rebuild credit after bad credit?

A: Rebuilding credit takes time and varies for each individual. Consistently practicing good credit habits, such as making payments on time and keeping credit utilization low, will gradually improve your credit score over time.

Post a Comment for "Car Finance with Bad Credit: How to Get Approved and Drive Your Dream Car"