Finance Class: A Comprehensive Guide to Mastering Your Finances

Are you tired of feeling overwhelmed by your finances? Do you want to take control of your money and make informed financial decisions? Look no further! In this blog article, we will delve into the world of finance and provide you with a comprehensive guide to mastering your finances. Whether you're a beginner or looking to enhance your financial knowledge, this article will equip you with the necessary tools to succeed.

Finance can often be a daunting subject, but our aim is to break it down into easily understandable sessions, ensuring that you not only grasp the fundamentals but also gain a deeper understanding of complex financial concepts. From budgeting and saving to investing and retirement planning, we will cover it all. So, let's dive in and embark on this exciting journey towards financial freedom!

Session 1: Introduction to Finance

In this session, we will lay the foundation for your financial journey by introducing you to the basic principles of finance. We will explore key terms and concepts that will be crucial in understanding subsequent sessions.

Session 2: Budgeting and Saving

In this session, we will delve into the art of budgeting and saving. You will learn how to create a realistic budget, track your expenses, and save effectively. We will also discuss various strategies to achieve your financial goals.

Session 3: Managing Debt

Debt can be a significant obstacle on your path to financial freedom. In this session, we will guide you through various debt management techniques, including debt consolidation, repayment strategies, and tips for avoiding debt in the future.

Session 4: Investing Basics

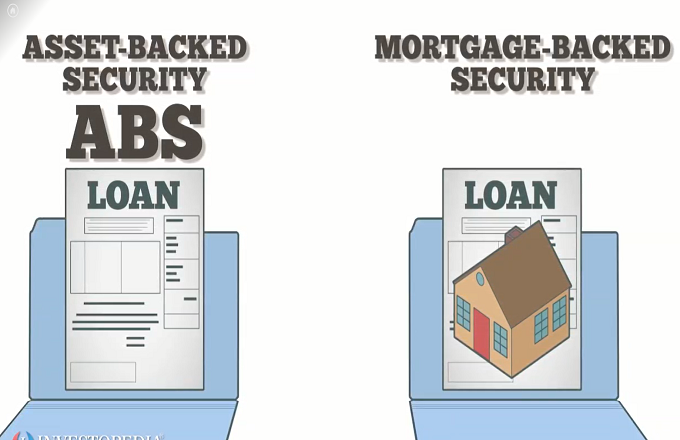

This session will introduce you to the world of investing. We will cover different investment options, such as stocks, bonds, and mutual funds, and provide you with essential tips for building a diversified investment portfolio.

Session 5: Retirement Planning

Planning for retirement is crucial to ensure a comfortable future. In this session, we will explore retirement planning strategies, including calculating retirement needs, understanding various retirement accounts, and maximizing your savings.

Session 6: Understanding Credit

Credit plays a vital role in your financial life. In this session, we will discuss the importance of credit, how credit scores are calculated, and provide tips for maintaining a healthy credit profile.

Session 7: Taxes and Tax Planning

Taxes can be complex, but understanding them is essential. This session will cover the basics of taxes, tax deductions, tax credits, and effective tax planning strategies to minimize your tax liability.

Session 8: Insurance and Risk Management

In this session, we will explore the world of insurance and risk management. You will learn about different types of insurance, including health, life, and property insurance, and understand how to protect yourself and your assets.

Session 9: Financial Planning for Life Events

Life is full of unexpected events, and being financially prepared is crucial. This session will guide you through various life events, such as buying a house, starting a family, and planning for education, and provide you with financial planning strategies for each.

Session 10: Putting It All Together

In our final session, we will recap everything you've learned and help you create a comprehensive financial plan. We will provide you with resources and tools to continue your financial education and empower you to achieve long-term financial success.

Mastering finance is not an overnight process, but with dedication and the knowledge gained from this comprehensive guide, you are well on your way to achieving financial freedom. Remember, the key is to start small and build a solid foundation. Don't hesitate to seek professional advice when needed, and always stay curious about expanding your financial knowledge.

Now, armed with the tools and information provided in this article, it's time to take control of your finances and pave the way for a brighter financial future. Start implementing what you've learned today, and watch as your financial goals become a reality. Good luck on your financial journey!

Q: What is the importance of budgeting?

A: Budgeting is essential as it helps you track your income and expenses, enabling you to make informed financial decisions. It allows you to prioritize your spending, save for future goals, and avoid unnecessary debt.

Q: How can I start investing with a limited budget?

A: Starting small is perfectly fine! Consider investing in low-cost index funds or exchange-traded funds (ETFs) that provide broad market exposure. Additionally, automated investment platforms, such as robo-advisors, can help you get started with minimal investments.

Q: How can I improve my credit score?

A: Improving your credit score involves maintaining a good payment history, keeping credit card balances low, and avoiding excessive credit applications. Regularly reviewing your credit report for errors and disputing inaccuracies can also contribute to a higher credit score.

Q: Is it too late to start saving for retirement?

A: It's never too late to start saving for retirement. Even small contributions can make a significant difference over time. Consider maximizing contributions to retirement accounts, such as 401(k)s or IRAs, and explore catch-up contributions if you're over the age of 50.

Q: How often should I review my insurance coverage?

A: It's advisable to review your insurance coverage annually or whenever a significant life event occurs, such as getting married, having children, or purchasing a new property. Regularly reassessing your insurance needs ensures that you have adequate coverage for your changing circumstances.

Post a Comment for "Finance Class: A Comprehensive Guide to Mastering Your Finances"