Short Term Finance: A Comprehensive Guide to Managing Your Finances

Are you in need of quick financial assistance to cover unexpected expenses or bridge the gap until your next paycheck? Short term finance solutions might be the answer you've been looking for. In this comprehensive guide, we will delve into the world of short term finance, exploring its benefits, options, and the best practices to make the most of these financial resources.

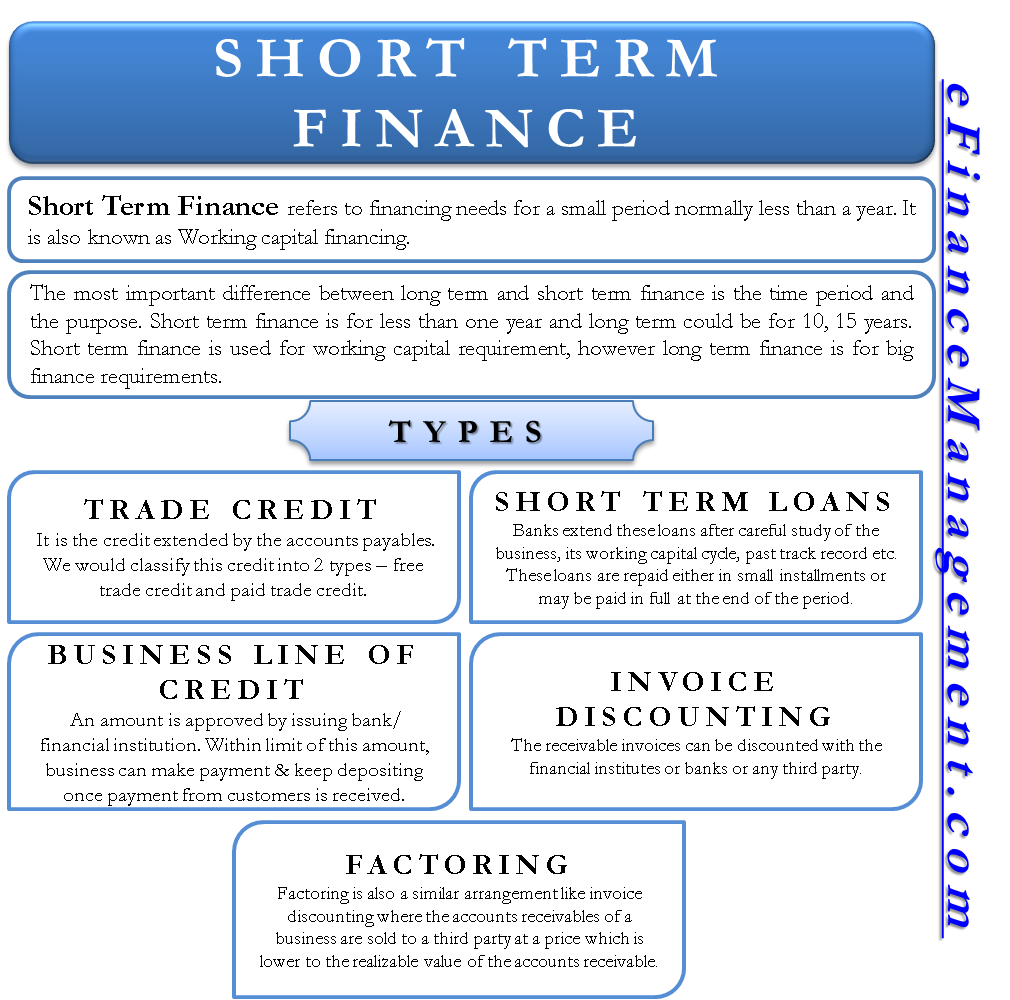

Short term finance refers to borrowing money for a brief period, typically ranging from a few days to a few months. This type of financing can be beneficial in various situations, such as emergency expenses, unforeseen bills, or managing cash flow gaps. By understanding the different options available and making informed decisions, you can effectively navigate short term finance and improve your financial well-being.

1. What is Short Term Finance?

In this section, we will define short term finance, explaining its purpose and the various forms it can take. From payday loans to credit cards, we will explore the advantages and disadvantages of each option, helping you make an informed decision based on your specific needs.

2. The Pros and Cons of Short Term Finance

Short term finance can be a useful tool, but it's essential to weigh the pros and cons before making any financial commitments. In this section, we will discuss the advantages and disadvantages of short term finance, considering factors such as interest rates, repayment terms, and potential risks.

3. Exploring Different Short Term Finance Options

There are numerous short term finance options available in the market, each with its unique features and requirements. From personal loans to lines of credit, we will provide an overview of the most popular short term finance options, helping you choose the one that aligns with your financial goals.

4. How to Qualify for Short Term Finance

Qualifying for short term finance often involves meeting specific criteria set by lenders. In this section, we will outline the common eligibility requirements and share tips to increase your chances of being approved. Understanding these factors will enable you to prepare adequately and streamline the application process.

5. The Importance of Responsible Borrowing

While short term finance can provide immediate relief, responsible borrowing is crucial to maintain a healthy financial outlook. We will discuss the importance of managing your finances wisely, including budgeting, understanding interest rates, and avoiding excessive borrowing.

6. How to Repay Short Term Loans Effectively

Repaying short term loans promptly is vital to avoid accumulating additional interest and potential penalties. In this section, we will provide practical tips on creating a repayment plan, exploring strategies such as budgeting, prioritizing payments, and seeking professional advice when needed.

7. Short Term Finance and Credit Scores

Will short term finance affect your credit score? In this section, we will delve into the relationship between short term finance and credit scores, discussing the potential impact of borrowing decisions, repayment patterns, and how you can maintain a healthy credit profile.

8. Avoiding Short Term Finance Pitfalls

While short term finance offers numerous benefits, it's essential to be aware of potential pitfalls. In this section, we will highlight common mistakes to avoid when utilizing short term finance options, empowering you to make sound financial decisions and safeguard your overall financial well-being.

9. Short Term Finance for Businesses

Short term finance is not only relevant for individuals but also for businesses facing temporary cash flow challenges. We will explore how businesses can benefit from short term finance options, including working capital loans, invoice financing, and merchant cash advances.

10. Planning for Long-Term Financial Stability

While short term finance can offer immediate relief, it's crucial to plan for long-term financial stability. In this section, we will discuss the importance of setting financial goals, establishing emergency funds, and creating a comprehensive budget to ensure your financial well-being in the future.

Short term finance can be a valuable tool when used responsibly and judiciously. By understanding the different options available, qualifying requirements, and repayment strategies, you can effectively manage your finances and bridge temporary gaps in cash flow. Remember, responsible borrowing and sound financial planning are key to achieving long-term financial stability.

Whether you are an individual facing unexpected expenses or a business navigating cash flow challenges, short term finance options can provide the necessary assistance. However, it is crucial to approach these options with caution, weighing the benefits and potential risks. With the insights provided in this comprehensive guide, you are now equipped to make informed decisions and take control of your financial future.

Question and Answer

Q: Are short term finance options suitable for everyone?

A: Short term finance options may not be suitable for everyone, as individual circumstances vary. It is essential to assess your financial situation, evaluate the terms and conditions of each option, and consider alternatives before committing to any short term finance solution.

Q: Will short term finance affect my credit score?

A: Short term finance can impact your credit score, depending on factors such as repayment patterns and overall credit utilization. By managing your short term loans responsibly and making timely repayments, you can maintain or improve your credit score.

Q: Can businesses benefit from short term finance?

A: Yes, short term finance options can be beneficial for businesses facing cash flow challenges. By utilizing short term finance wisely, businesses can bridge temporary gaps, ensure smooth operations, and seize growth opportunities.

Q: How can I avoid falling into short term finance pitfalls?

A: To avoid falling into short term finance pitfalls, it is crucial to carefully evaluate the terms and conditions, understand the potential risks, and borrow only what you can comfortably repay. Additionally, seeking financial advice and exploring alternatives can help you make well-informed decisions.

Q: What are some long-term financial planning strategies to complement short term finance?

A: Long-term financial planning strategies can include setting financial goals, building an emergency fund, investing in retirement plans, and creating a comprehensive budget. Combining short term finance with these strategies can help you achieve both immediate relief and long-term financial stability.

Post a Comment for "Short Term Finance: A Comprehensive Guide to Managing Your Finances"