Understanding Finance Equity: A Comprehensive Guide

Finance equity refers to the ownership interest or stake that an individual or entity holds in an asset or company. It plays a crucial role in various financial transactions, investments, and business operations. Whether you are planning to invest in stocks, start a new venture, or simply want to enhance your financial literacy, understanding finance equity is essential. In this comprehensive guide, we will delve into the various aspects of finance equity, its types, and its significance in the financial world.

Before we dive into the details, let's first establish a solid foundation by understanding what finance equity entails. Put simply, finance equity represents the residual interest in the assets of an entity after deducting liabilities. It is the net worth or value that belongs to the shareholders or owners. Finance equity can be expressed as a percentage, indicating the ownership stake of an individual or entity in relation to the total value of the asset or company.

Section 1: Types of Finance Equity

In this section, we will explore the different types of finance equity, such as common equity, preferred equity, and convertible equity. Understanding these types will provide insights into the rights, benefits, and risks associated with each form of equity.

Section 2: Significance of Finance Equity in Investments

This section will shed light on the vital role finance equity plays in investment decisions. From evaluating the risk-return tradeoff to analyzing equity valuation methods, we will discuss how understanding finance equity can help investors make informed choices and maximize their returns.

Section 3: Finance Equity and Startups

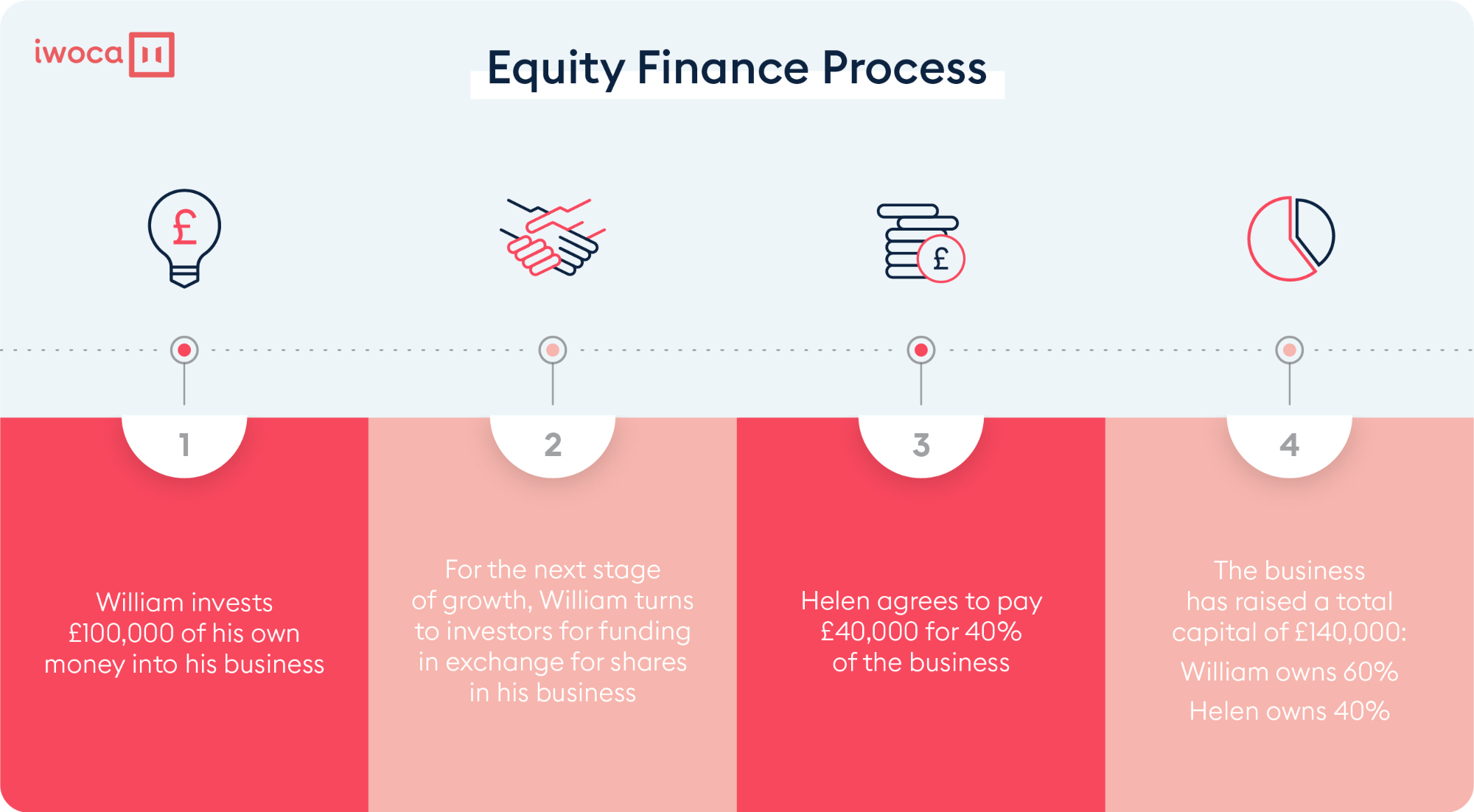

For aspiring entrepreneurs and startup enthusiasts, this section will explore the relevance of finance equity in the startup ecosystem. We will discuss funding options, such as venture capital and angel investments, and how equity financing can fuel the growth and success of startups.

Section 4: Leveraging Finance Equity in Real Estate

Real estate investments often involve substantial capital, and understanding finance equity in this context is crucial. From mortgage equity withdrawal to analyzing real estate investment trusts (REITs), this section will provide valuable insights into using finance equity to optimize real estate investments.

Section 5: Equity Financing for Corporations

Corporations often rely on finance equity to finance their operations, expansions, and acquisitions. In this section, we will explore the advantages and disadvantages of equity financing for corporations, along with the various methods corporations can employ to raise equity capital.

Section 6: Measuring Finance Equity

Measuring finance equity accurately is essential for financial analysis and decision-making. This section will delve into key financial ratios, such as return on equity (ROE) and equity multiplier, providing a comprehensive understanding of how to assess and interpret finance equity metrics.

Section 7: Finance Equity and Personal Wealth Management

Managing personal finances and building wealth require a solid understanding of finance equity. In this section, we will discuss how individuals can leverage finance equity to enhance their financial well-being, including topics such as home equity loans, equity investments, and retirement planning.

Section 8: The Role of Finance Equity in Mergers and Acquisitions

When companies merge or acquire other entities, finance equity becomes a crucial factor. This section will explore how finance equity impacts the valuation, structure, and success of mergers and acquisitions, providing valuable insights into this complex aspect of corporate finance.

Section 9: Finance Equity and Risk Management

Risk management is an integral part of financial decision-making, and finance equity plays a significant role in this domain. From diversification to hedging strategies, we will discuss how finance equity can be utilized to mitigate risks and protect investment portfolios.

Section 10: Emerging Trends in Finance Equity

In this final section, we will explore the latest trends and developments in finance equity. From the rise of equity crowdfunding to the impact of technological advancements, we will provide an overview of the evolving landscape and potential future prospects of finance equity.

Conclusion

Understanding finance equity is essential for individuals, investors, entrepreneurs, and corporations alike. It serves as a fundamental pillar in various financial aspects, from investments to personal wealth management. By grasping the intricacies of finance equity, one can make informed financial decisions, navigate the complexities of the financial world, and unlock opportunities for growth and prosperity.

So, whether you are looking to invest in stocks, start your own business, or simply enhance your financial literacy, don't overlook the significance of finance equity. Empower yourself with knowledge and embark on a rewarding financial journey!

Question and Answer:

Q: How does finance equity impact a company's valuation during a merger?

A: Finance equity plays a crucial role in determining a company's valuation during a merger. The equity held by the acquiring company and the target company directly affects the share exchange ratio or the purchase price paid in cash. A higher finance equity position often leads to a higher valuation, indicating a stronger ownership stake and potential synergistic benefits.

Q: Can individuals use finance equity to fund their retirement?

A: Yes, individuals can utilize finance equity to fund their retirement. By leveraging home equity through reverse mortgages or downsizing, individuals can access the value tied up in their properties. Additionally, investing in equity-based retirement plans, such as individual retirement accounts (IRAs) or 401(k)s, allows individuals to build their finance equity over time, ensuring a comfortable retirement.

Q: Is finance equity the same as debt financing?

A: No, finance equity and debt financing are distinct concepts. Finance equity represents ownership interest or stake in an asset or company, while debt financing involves borrowing funds that need to be repaid with interest over a specified period. Finance equity carries a higher risk but offers potential rewards through capital appreciation and profit-sharing, whereas debt financing involves fixed interest payments but does not grant ownership rights.

Q: How can startups attract equity investors?

A: Startups can attract equity investors by presenting a compelling business plan, demonstrating market potential and scalability, and showcasing a competent and dedicated team. Equity investors seek high-growth opportunities and a significant return on their investment. Startups can also leverage networking events, pitch competitions, and online platforms to connect with potential equity investors and secure the necessary funding.

Q: What are the key factors to consider when evaluating finance equity for investment purposes?

A: When evaluating finance equity for investment purposes, key factors to consider include the company's financial performance, industry trends, competitive landscape, management team, and growth prospects. Additionally, analyzing valuation metrics, such as price-to-earnings (P/E) ratio and price-to-book (P/B) ratio, can provide insights into the relative attractiveness of the equity investment.

Post a Comment for "Understanding Finance Equity: A Comprehensive Guide"