Understanding Software Finance: A Comprehensive Guide

Software finance is a crucial aspect for businesses seeking to optimize their operations and drive growth in the digital age. In this article, we will delve into the world of software finance, exploring its significance, key components, and how it can be effectively managed. Whether you are a business owner, a financial professional, or simply someone interested in understanding the intricacies of software finance, this comprehensive guide will equip you with the knowledge you need.

In today's fast-paced and technology-driven world, software plays an integral role in the success of businesses across industries. From accounting software to project management tools, companies heavily rely on software solutions to streamline their processes, enhance productivity, and gain a competitive edge. However, acquiring and implementing software can be a significant investment, requiring careful financial planning and analysis.

1. The Importance of Software Finance

Summary: This section will highlight the importance of software finance and how it impacts businesses in terms of efficiency, cost savings, and innovation. It will emphasize the need for strategic financial planning when acquiring software solutions.

2. Understanding Software Costs

Summary: This section will break down the different components of software costs, including licensing fees, maintenance expenses, customization, and training. It will provide insights into how businesses can effectively estimate and manage these costs.

3. Financing Options for Software Investments

Summary: This section will explore various financing options available to businesses for software investments, such as outright purchase, leasing, and software-as-a-service (SaaS) models. It will discuss the pros and cons of each option and provide guidance on choosing the most suitable approach.

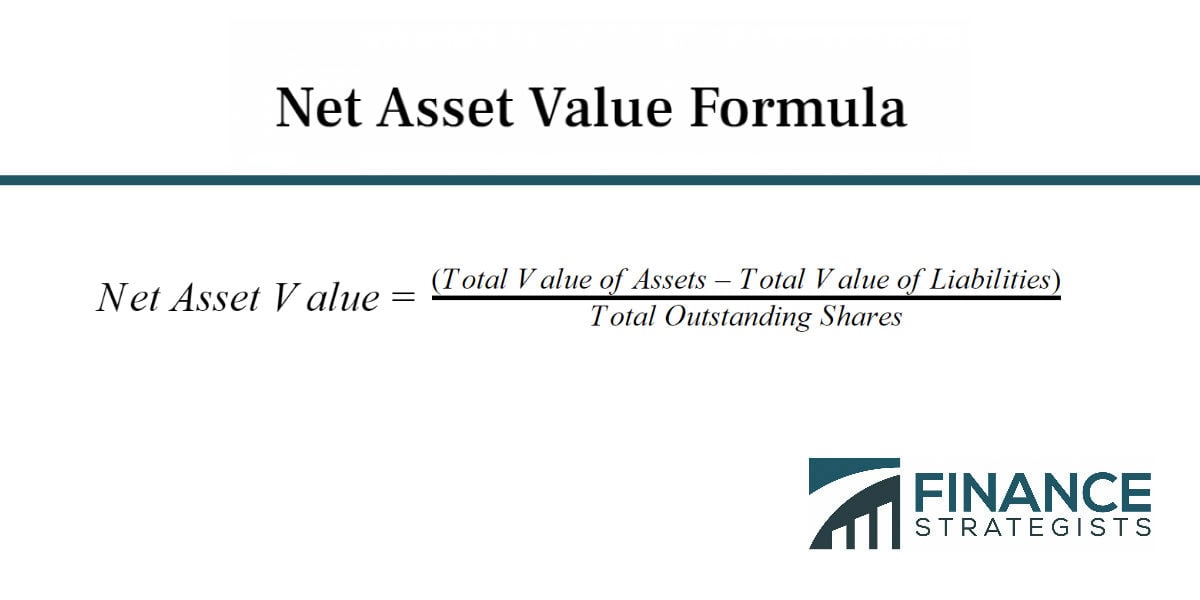

4. Evaluating Return on Investment (ROI)

Summary: This section will explain how businesses can evaluate the ROI of software investments. It will discuss key metrics to consider, such as cost savings, increased productivity, and revenue growth. Practical examples and case studies will be included to illustrate the concept.

5. Budgeting for Software Expenses

Summary: This section will guide businesses on how to effectively budget for software expenses, considering factors like upfront costs, recurring fees, and potential upgrades. It will provide tips on creating a realistic budget that aligns with the organization's overall financial goals.

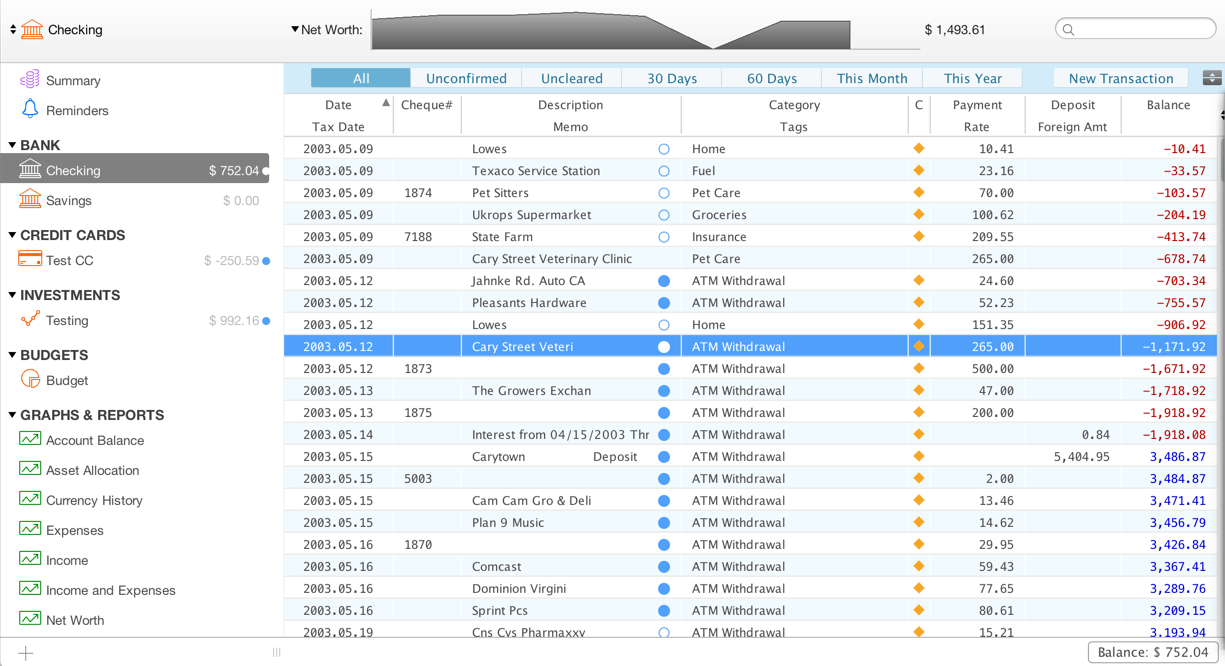

6. Managing Software Assets

Summary: This section will focus on managing software assets throughout their lifecycle. It will cover aspects like software inventory, license compliance, upgrades, and retirements. Best practices for optimizing software assets will be discussed.

7. Mitigating Risks in Software Finance

Summary: This section will explore potential risks associated with software finance, including vendor lock-in, security vulnerabilities, and compatibility issues. It will provide strategies for mitigating these risks and ensuring a smooth software implementation process.

8. Software Finance for Startups and Small Businesses

Summary: This section will address the specific challenges faced by startups and small businesses when it comes to software finance. It will offer practical advice and resources tailored to their unique circumstances.

9. The Future of Software Finance

Summary: This section will discuss emerging trends and technologies that will impact software finance in the future. It will touch upon topics like cloud computing, artificial intelligence, and subscription-based models, highlighting their implications for businesses.

10. Building a Software Finance Strategy

Summary: This final section will guide businesses in developing a comprehensive software finance strategy. It will emphasize the importance of aligning software investments with overall business goals and provide actionable steps to create an effective strategy.

In conclusion, software finance is a critical aspect of modern business operations. By understanding the intricacies of software costs, evaluating ROI, and implementing effective financial strategies, businesses can optimize their software investments and unlock their full potential. Stay ahead of the curve by embracing the evolving landscape of software finance and harnessing the power of technology to drive growth and innovation.

Q1: How can businesses estimate software costs?

A1: To estimate software costs, businesses should consider licensing fees, maintenance expenses, customization, and training. Conducting thorough research, engaging with vendors, and seeking expert advice can help in making accurate cost estimations.

Q2: What are the financing options available for software investments?

A2: Financing options include outright purchase, leasing, and software-as-a-service (SaaS) models. Each option has its own advantages and businesses should choose the one that aligns with their financial goals and requirements.

Q3: How can businesses evaluate the ROI of software investments?

A3: Businesses can evaluate ROI by considering cost savings, increased productivity, and revenue growth. Tracking key metrics, setting benchmarks, and analyzing real-life case studies can provide insights into the return on software investments.

Q4: What are the risks associated with software finance?

A4: Risks include vendor lock-in, security vulnerabilities, and compatibility issues. To mitigate these risks, businesses should conduct thorough due diligence, seek legal advice, and implement robust security measures.

Q5: How can startups and small businesses approach software finance?

A5: Startups and small businesses should carefully evaluate their software needs, explore cost-effective options like SaaS models, and leverage available resources such as grants, subsidies, and open-source software.

Post a Comment for "Understanding Software Finance: A Comprehensive Guide"