Understanding Trade Finance: A Comprehensive Guide for Business Owners

Are you a business owner looking to expand your horizons and explore global markets? If so, you've likely come across the term "trade finance" in your research. In this detailed and comprehensive blog article, we will dive deep into the world of trade finance, providing you with valuable insights and a clear understanding of how it can benefit your business.

Trade finance refers to the financial instruments and products that facilitate international trade transactions. It encompasses a wide range of activities, including financing imports and exports, mitigating risks, and ensuring the smooth flow of goods and services across borders. In today's interconnected world, trade finance plays a crucial role in enabling businesses to thrive in the global marketplace.

1. The Basics of Trade Finance

In this section, we will cover the fundamental concepts of trade finance, including the various parties involved, common trade finance instruments, and the importance of trade finance in international trade.

Summary: Understand the key components and significance of trade finance in international trade.

2. Types of Trade Finance Instruments

Explore the different types of trade finance instruments available to businesses, such as letters of credit, trade credit insurance, and export financing. Discover how these instruments can help mitigate risks and ensure smooth transactions.

Summary: Learn about the specific tools and instruments used in trade finance and how they benefit businesses.

3. The Role of Banks in Trade Finance

Delve into the role of banks in facilitating trade finance activities. Discover how banks assess the creditworthiness of businesses, provide financing solutions, and offer valuable trade finance services.

Summary: Understand the crucial role that banks play in supporting trade finance activities and how they assist businesses in their international trade endeavors.

4. Benefits and Challenges of Trade Finance

Explore the advantages and potential obstacles associated with trade finance. From reducing payment risks to overcoming complex regulatory environments, gain insights into how trade finance can benefit your business while navigating potential challenges.

Summary: Evaluate the pros and cons of trade finance and discover how its advantages outweigh the challenges for businesses engaged in international trade.

5. Trade Finance for Small and Medium Enterprises (SMEs)

Discover how trade finance can level the playing field for small and medium-sized enterprises, enabling them to compete globally. Learn about specialized trade finance solutions tailored to the unique needs of SMEs.

Summary: Explore the ways in which trade finance empowers SMEs to participate in international trade and expand their businesses.

6. Trade Finance and Risk Mitigation

Understand how trade finance instruments and solutions help mitigate risks associated with international trade, such as political risks, currency fluctuations, and payment delays. Learn how businesses can safeguard their transactions using trade finance tools.

Summary: Explore the risk management aspect of trade finance and how it protects businesses from potential pitfalls in global trade.

7. Emerging Trends in Trade Finance

Stay up-to-date with the latest trends and innovations in the field of trade finance. From digitalization and blockchain technology to sustainable trade practices, explore how these advancements are shaping the future of trade finance.

Summary: Discover the cutting-edge developments and trends that are revolutionizing the trade finance landscape.

8. Trade Finance and Global Supply Chains

Examine the integral role of trade finance in supporting global supply chains. Understand how trade finance enables the smooth movement of goods from suppliers to customers, fostering efficiency and reliability in international trade.

Summary: Learn how trade finance acts as a catalyst for seamless global supply chain operations.

9. Trade Finance and Developing Countries

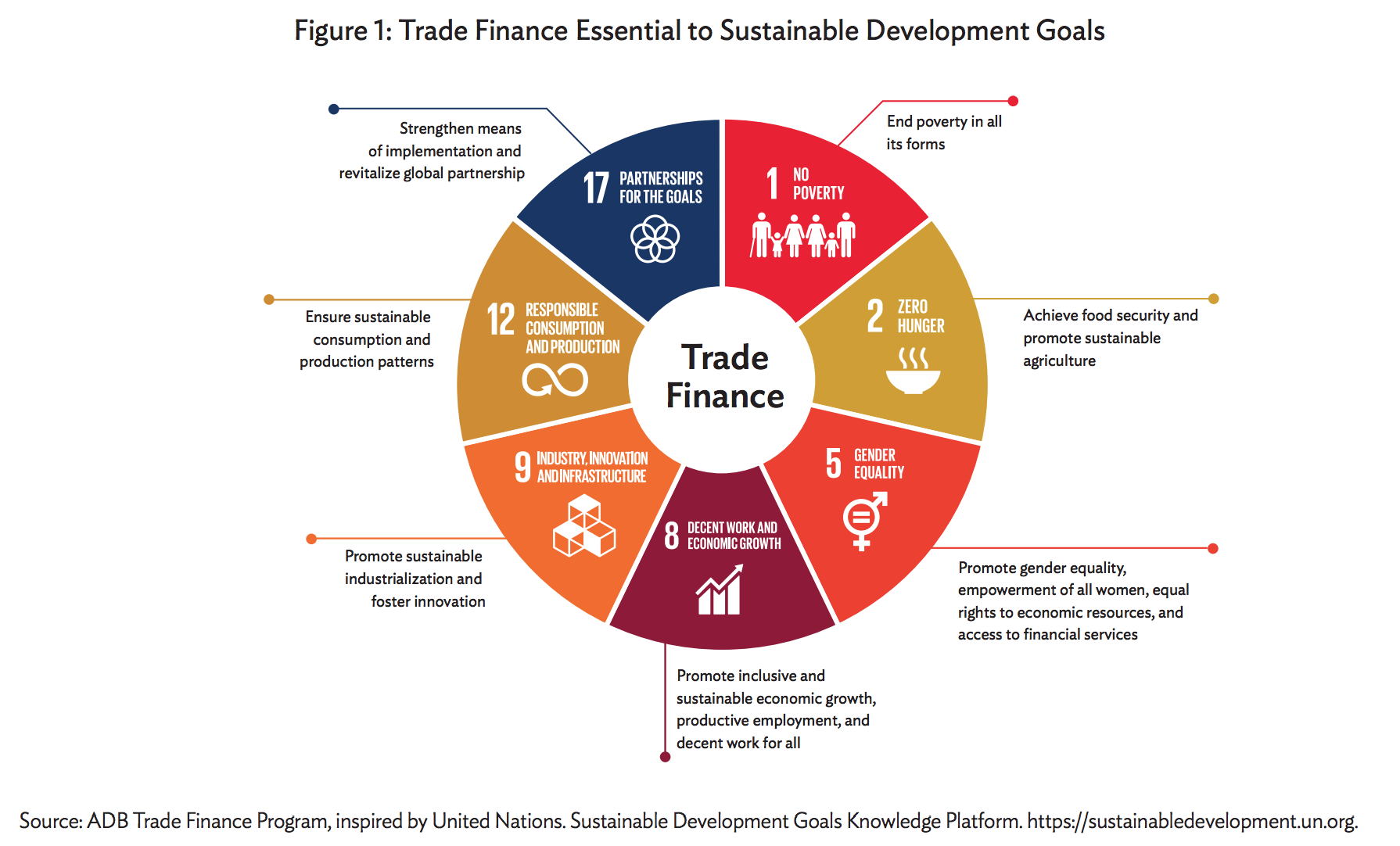

Explore the impact of trade finance on developing countries and their participation in international trade. Discover how trade finance initiatives contribute to economic growth, poverty reduction, and sustainable development in these nations.

Summary: Understand the transformative power of trade finance in fostering economic development in developing countries.

10. How to Choose the Right Trade Finance Provider

Receive practical tips and guidance on selecting the right trade finance provider for your business. Learn about the key factors to consider, such as reputation, expertise, and tailored solutions.

Summary: Gain insights into the selection process of a trade finance provider that aligns with your business needs and goals.

Conclusion

Trade finance serves as the backbone of international trade, enabling businesses to unlock new opportunities and expand their global footprint. From understanding the basics to exploring emerging trends, this comprehensive guide has provided you with the knowledge and insights to navigate the world of trade finance confidently.

As you embark on your international trade journey, remember that trade finance is a powerful tool that can help mitigate risks, secure financing, and foster seamless transactions. By embracing trade finance, your business can thrive in the global marketplace.

Have more questions about trade finance? Check out our Q&A section below:

Q&A Section:

Q1: What is the difference between trade finance and export finance?

A1: Trade finance encompasses a broader range of financial activities involved in international trade, such as financing imports, mitigating risks, and facilitating the flow of goods. On the other hand, export finance specifically focuses on financing and supporting export activities.

Q2: Can trade finance benefit startups and small businesses?

A2: Absolutely! Trade finance solutions are designed to cater to businesses of all sizes. Startups and small businesses can leverage trade finance instruments to gain access to working capital, mitigate risks, and expand their reach in the global market.

Q3: How does trade credit insurance work?

A3: Trade credit insurance protects businesses against the risk of non-payment by their buyers. It provides coverage for losses resulting from insolvency, protracted default, political events, or other specified risks, ensuring businesses receive payment for their goods or services.

Q4: Is trade finance only for importers and exporters?

A4: Trade finance is not limited to importers and exporters. It encompasses various financial instruments and services that support the entire supply chain, including manufacturers, distributors, and service providers involved in international trade.

Q5: How can trade finance contribute to sustainable trade practices?

A5: Trade finance can incentivize sustainable trade practices by offering preferential financing terms for environmentally friendly initiatives. Additionally, trade finance providers may require compliance with sustainability standards, encouraging businesses to adopt sustainable practices throughout their supply chains.

Post a Comment for "Understanding Trade Finance: A Comprehensive Guide for Business Owners"