External Finance: Exploring the World of Funding Beyond the Borders

External finance plays a significant role in the growth and development of businesses around the globe. Whether you are a startup entrepreneur or an established company, seeking funding from external sources can provide the necessary capital to fuel your ambitions. In this blog article, we will delve into the intricacies of external finance, exploring its benefits, various options available, and the factors to consider when choosing the right financing solution for your business.

First and foremost, let's understand what external finance entails. External finance refers to the funds obtained from sources outside the company, such as banks, venture capitalists, angel investors, or government institutions. By securing external finance, businesses can access the necessary capital to expand operations, invest in research and development, hire skilled personnel, or launch new products and services.

1. Debt Financing: Borrowing to Fuel Your Business

Debt financing is one of the most common methods of external finance, involving borrowing money that must be repaid over a specified period. This section explores the different types of debt financing, their advantages, and considerations to keep in mind when opting for this funding option.

2. Equity Financing: Sharing Ownership for Growth

Equity financing offers an alternative approach, allowing businesses to raise funds by selling shares of ownership. In this section, we delve into the world of equity financing, discussing its various forms, advantages, and potential drawbacks.

3. Crowdfunding: Harnessing the Power of the Crowd

As technology continues to advance, crowdfunding has emerged as a popular choice for external finance. This section explores the concept of crowdfunding, its different models, and how businesses can leverage this funding method to gain support from a vast network of individuals.

4. Government Grants and Subsidies: Tapping into Public Support

Government grants and subsidies can provide a lifeline to businesses, especially in challenging economic times. In this section, we discuss the various types of grants available, eligibility criteria, and tips for successfully securing government funding.

5. Angel Investors: Finding Financial Guardians

Angel investors are individuals who provide financial support to startups and small businesses in exchange for equity ownership. This section delves into the world of angel investors, their investment preferences, and how entrepreneurs can attract their attention.

6. Venture Capital: Fueling Growth for High-Potential Startups

Venture capital firms specialize in providing funding to high-potential startups in exchange for equity. This section explores the world of venture capital financing, highlighting its benefits, potential risks, and how entrepreneurs can navigate the process to secure funding.

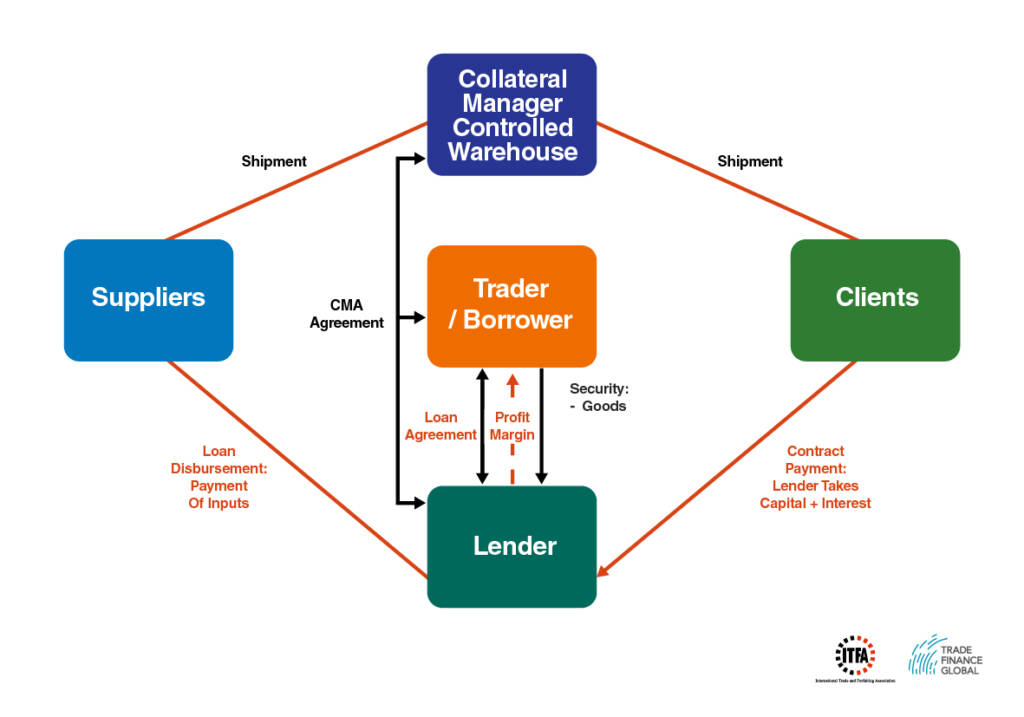

7. Trade Credit: Expanding Business Horizons

Trade credit allows businesses to purchase goods or services on credit from suppliers, enabling them to manage cash flow effectively. In this section, we discuss the advantages, considerations, and strategies for effectively utilizing trade credit as a source of external finance.

8. Peer-to-Peer Lending: Borrowing from the Masses

Peer-to-peer lending platforms have revolutionized the lending landscape by connecting borrowers directly with individual lenders. This section explores the concept of peer-to-peer lending, its benefits, and how businesses can access this funding option.

9. Initial Coin Offerings (ICOs): Unlocking the Potential of Cryptocurrency

Initial Coin Offerings (ICOs) have gained significant attention as a fundraising method for blockchain-based projects. In this section, we delve into the world of ICOs, discussing their advantages, risks, and regulatory considerations for businesses exploring this financing avenue.

10. Alternative Financing: Thinking Outside the Box

Finally, this section explores various alternative financing options available to businesses, including equipment leasing, revenue-based financing, and supply chain financing. By thinking outside the box, businesses can tap into unique funding opportunities tailored to their specific needs.

Conclusion

External finance opens up a world of possibilities for businesses, providing the necessary resources to fuel growth and achieve their goals. Whether it's through debt financing, equity investment, crowdfunding, or government support, choosing the right funding option requires careful consideration and a solid understanding of each available avenue. By exploring the comprehensive landscape of external finance, businesses can make informed decisions, securing the capital needed to thrive in today's competitive market.

In conclusion, external finance acts as a catalyst for innovation, expansion, and success. Embracing the diverse range of financing options available and understanding their respective benefits and considerations empowers businesses to navigate the financial landscape effectively. So, take a leap into the world of external finance and unlock the potential to turn your entrepreneurial dreams into reality!

Question and Answer:

Q: How do I determine which external financing option is best for my business?

A: Choosing the right external finance option depends on various factors, including your business's stage, growth plans, and financial needs. It is essential to carefully evaluate each option's advantages, risks, and suitability to align with your business goals.

Q: What are the common challenges businesses face when securing external finance?

A: Some common challenges include meeting eligibility criteria, providing accurate financial projections, negotiating favorable terms, and maintaining a healthy credit score. Building strong relationships with potential financiers and having a well-prepared business plan can help overcome these challenges.

Q: Can I combine multiple external financing options for my business?

A: Yes, businesses often combine different financing options to meet their capital requirements. However, it is crucial to assess the compatibility and feasibility of combining various external finance sources to ensure they align with your business's long-term financial sustainability.

Q: What role does credit history play in securing external finance?

A: Credit history is an important consideration for many lenders and investors. A strong credit history demonstrates your business's reliability in repaying debts, enhancing your chances of securing external finance on favorable terms. However, there are also financing options available for businesses with less-than-perfect credit histories.

Q: How can I attract investors or lenders to fund my business?

A: To attract investors or lenders, it is crucial to have a well-prepared business plan showcasing your unique value proposition, growth potential, and financial projections. Networking, presenting at industry events, and seeking recommendations from trusted contacts can also enhance your chances of attracting external finance.

Post a Comment for "External Finance: Exploring the World of Funding Beyond the Borders"