Managerial Finance: A Comprehensive Guide to Financial Management

Managing finances is an essential aspect of any organization's success. The field of managerial finance focuses on making informed financial decisions that drive profitability, growth, and sustainability. Whether you are a business owner, a finance professional, or simply interested in understanding the intricacies of financial management, this blog article will provide you with a detailed and comprehensive guide to managerial finance.

In this article, we will delve into various aspects of managerial finance, including financial analysis, budgeting, investment decisions, risk management, and more. By the end of this read, you will have a solid understanding of the key principles and practices involved in effective financial management.

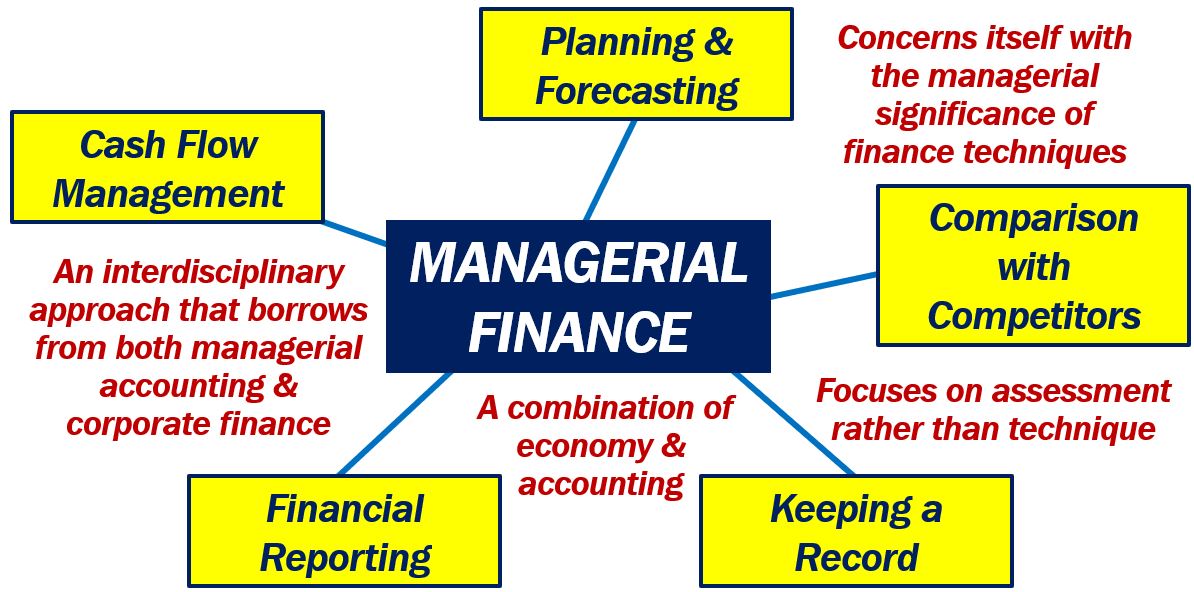

1. Understanding Managerial Finance

In this section, we will explore the fundamentals of managerial finance and its significance in organizational decision-making. We will discuss the role of a financial manager, the importance of financial planning, and the impact of financial decisions on the overall success of a business.

2. Financial Analysis and Planning

This section will focus on the process of financial analysis and planning. We will delve into techniques such as ratio analysis, trend analysis, and cash flow analysis. Additionally, we will explore how financial planning aids in setting realistic goals and developing strategies to achieve them.

3. Budgeting and Forecasting

Budgeting plays a crucial role in managing finances effectively. In this section, we will discuss the budgeting process, including creating a budget, analyzing variances, and making necessary adjustments. Furthermore, we will explore the significance of accurate financial forecasting in decision-making.

4. Capital Budgeting and Investment Decisions

Capital budgeting involves evaluating potential investments and determining their feasibility. We will explore various methods of capital budgeting, such as payback period, net present value (NPV), and internal rate of return (IRR). This section will provide valuable insights into making sound investment decisions.

5. Risk Management and Financial Markets

Risk management is an integral part of financial management. In this section, we will discuss different types of risks faced by organizations and how to mitigate them. Additionally, we will delve into financial markets, including stocks, bonds, and derivatives, and their role in managing financial risk.

6. Working Capital Management

Effective management of working capital is vital for maintaining liquidity and operational efficiency. This section will cover topics such as cash management, inventory control, and accounts receivable management. We will explore strategies to optimize working capital and enhance overall financial performance.

7. Financial Reporting and Analysis

Financial reporting provides crucial information for stakeholders to assess the financial health of an organization. In this section, we will discuss financial statements, including balance sheets, income statements, and cash flow statements. Furthermore, we will explore techniques for analyzing financial statements to gain insights into an organization's performance.

8. Cost of Capital and Capital Structure

The cost of capital and capital structure decisions have a significant impact on a company's profitability and value. This section will delve into concepts such as weighted average cost of capital (WACC), capital structure theories, and their implications on financing decisions.

9. International Financial Management

In an increasingly globalized business environment, understanding international financial management is essential. This section will explore topics such as foreign exchange markets, exchange rate risk management, and the impact of international operations on financial decision-making.

10. Ethical Considerations in Managerial Finance

Financial managers face ethical dilemmas in their roles, and ethical decision-making is crucial for long-term success. In this section, we will discuss ethical considerations in managerial finance, including transparency, integrity, and social responsibility.

Conclusion

In conclusion, managerial finance is a multifaceted field that encompasses various aspects of financial management. By gaining a comprehensive understanding of managerial finance principles, you can make informed decisions that drive organizational success. Whether you are a business owner, a finance professional, or simply interested in the subject, this guide has provided you with valuable insights into the world of managerial finance.

Remember, effective financial management is the backbone of any successful organization, and continuously updating your knowledge in this field is key to staying ahead in today's dynamic business environment.

Question and Answer

1. What is the role of a financial manager in managerial finance?

A financial manager plays a crucial role in managerial finance by overseeing and directing the organization's financial activities. They are responsible for financial planning, analyzing financial data, making investment decisions, managing risks, and ensuring the overall financial health of the organization.

2. How does financial analysis aid in decision-making?

Financial analysis involves evaluating an organization's financial data to gain insights into its performance, strengths, and weaknesses. This helps decision-makers make informed choices regarding investments, budgeting, and strategic planning. Financial analysis provides a clear understanding of the organization's financial standing and aids in identifying areas for improvement.

3. What are the key components of working capital management?

Working capital management involves managing a company's short-term assets and liabilities to ensure smooth operations. The key components of working capital management include cash management, inventory control, accounts receivable management, and accounts payable management. Efficient working capital management helps maintain liquidity and supports the organization's day-to-day operations.

4. How does ethical decision-making impact managerial finance?

Ethical decision-making in managerial finance is crucial for maintaining trust, credibility, and long-term success. Financial managers must consider ethical principles such as transparency, integrity, and social responsibility when making financial decisions. Ethical behavior ensures fair practices, builds a positive reputation, and fosters sustainable relationships with stakeholders.

5. Why is international financial management important in today's business landscape?

International financial management is essential due to the increasing globalization of businesses. It involves managing financial operations in multiple countries, dealing with foreign currencies, and assessing the impact of international operations on financial decision-making. Understanding international financial management helps businesses navigate the complexities of global markets and seize opportunities for growth and expansion.

Post a Comment for "Managerial Finance: A Comprehensive Guide to Financial Management"