Mastering Your Personal Finance: A Comprehensive Guide to Financial Success

Are you tired of living paycheck to paycheck? Do you dream of a secure future, free from financial worries? Look no further! In this comprehensive guide, we will delve into the world of personal finance, equipping you with the knowledge and tools to take control of your money and achieve your financial goals. Whether you're just starting your journey or looking to fine-tune your existing strategies, this article will provide you with valuable insights and practical advice to help you make informed decisions and build a solid financial foundation.

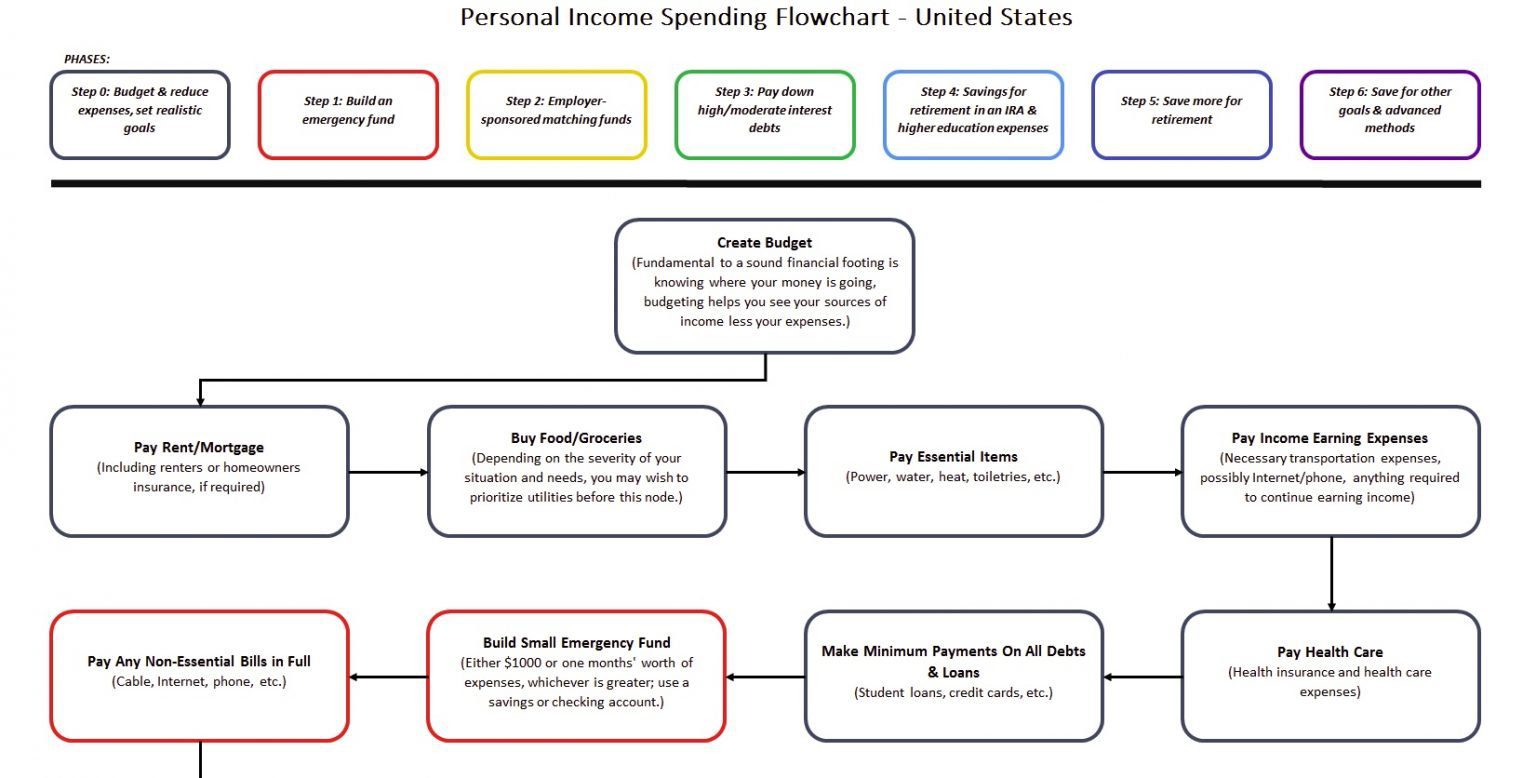

Section by section, we will explore various aspects of personal finance, from budgeting and saving to investing and retirement planning. With each topic, we will delve into the details, providing you with a comprehensive understanding and actionable steps to implement in your own life. So, let's dive in and unlock the secrets to financial success!

1. Understanding Your Financial Goals

In this section, we will help you identify and prioritize your financial goals. By understanding what you want to achieve, you can create a roadmap to guide your financial decisions. We will discuss short-term and long-term goals, and how to align your actions with your aspirations.

2. Creating a Budget That Works

A solid budget is the foundation of financial stability. Here, we will guide you through the process of creating a realistic budget that suits your lifestyle. We will explore different budgeting methods and provide tips to help you stick to your budget and achieve your financial targets.

3. The Art of Saving: Building an Emergency Fund

An emergency fund is your safety net in times of unexpected expenses or financial setbacks. In this section, we will explain why having an emergency fund is crucial and provide strategies to build and maintain one. You'll learn how to overcome common saving challenges and ensure your financial security.

4. Tackling Debt: Strategies for Debt Repayment

Debt can be a heavy burden on your financial well-being. We will explore effective strategies to pay off debt, including the snowball and avalanche methods. Learn how to prioritize your debts, negotiate with creditors, and ultimately become debt-free.

5. Building Wealth Through Investing

Investing is a key component of wealth creation. In this section, we will introduce you to the world of investing, from stocks and bonds to real estate and retirement accounts. Gain insights into different investment options and understand how to create a diversified portfolio that aligns with your risk tolerance and goals.

6. The Power of Compound Interest

Compound interest is a powerful force that can work in your favor when saving and investing. Discover the magic of compound interest, and learn how to harness its potential to grow your wealth over time. We'll provide examples and calculations to illustrate its impact on your financial journey.

7. Planning for Retirement: Securing Your Future

Retirement may seem far away, but it's never too early to start planning for it. In this section, we will guide you through the process of retirement planning, including estimating your retirement needs, choosing the right retirement accounts, and maximizing your savings for a comfortable future.

8. Navigating Taxes and Maximizing Deductions

Taxes can significantly impact your finances. Here, we will help you understand the basics of income tax, deductions, and credits. Learn strategies to minimize your tax liability and take advantage of available deductions, ultimately keeping more money in your pocket.

9. Protecting Your Finances: Insurance and Estate Planning

Protecting your financial well-being is as important as growing your wealth. We will explore different types of insurance, such as health, life, and property insurance, and discuss their significance in safeguarding your assets. Additionally, we will touch on estate planning and the importance of wills and trusts.

10. Achieving Financial Freedom: Mindset and Habits

Financial success is not only about numbers; it also requires the right mindset and habits. In this final section, we will explore the psychology of money, helping you develop a healthy relationship with your finances. We will discuss effective habits that promote financial well-being and empower you to achieve lasting financial freedom.

In conclusion, mastering your personal finance is a journey that requires dedication, knowledge, and discipline. By implementing the strategies and principles discussed in this comprehensive guide, you can take control of your financial destiny. Remember, financial success is within your reach, and with the right mindset and actions, you can create a brighter and more secure future for yourself and your loved ones.

Do you have any burning questions about personal finance? Let's address some common queries:

Q1: How can I start saving money?

A1: Starting to save money begins with creating a budget and identifying areas where you can cut back on expenses. By setting specific saving goals and automating your savings, you can gradually build a nest egg for emergencies and future investments.

Q2: Is it too late to start investing for retirement?

A2: It's never too late to start investing for retirement. While the earlier you begin, the more time your investments have to grow, there are still opportunities to build a solid retirement fund even if you're closer to retirement age. Consulting with a financial advisor can help you create a tailored plan to maximize your savings.

Q3: How can I pay off my debt faster?

A3: Paying off debt faster requires a strategic approach. Consider the snowball or avalanche method, where you either focus on paying off the smallest debt first or the one with the highest interest rate. Additionally, increasing your income or negotiating with creditors can accelerate your debt repayment journey.

Q4: What insurance coverage do I need?

A4: The insurance coverage you need depends on your individual circumstances. Health insurance is essential for medical expenses, while life insurance provides financial protection for your loved ones. Property insurance safeguards your assets, and disability insurance offers income replacement in case of unforeseen events. Consulting with an insurance professional can help you determine the coverage that suits your needs.

Q5: How can I develop better financial habits?

A5: Developing better financial habits starts with setting clear goals, creating a budget, and tracking your expenses. Automating bill payments and savings can help you stay on track. Additionally, educating yourself about personal finance through books, podcasts, or courses can enhance your knowledge and empower you to make informed financial decisions.

Post a Comment for "Mastering Your Personal Finance: A Comprehensive Guide to Financial Success"