Software for Finance: Streamlining Financial Management for Businesses

As businesses continue to evolve in the digital age, the need for efficient financial management has become more crucial than ever. This is where software for finance comes into play, providing companies with powerful tools to streamline their financial processes, improve accuracy, and enhance decision-making. In this blog article, we will explore the world of finance software, its various types, and how businesses can benefit from implementing these solutions.

From startups to multinational corporations, finance software offers a wide range of functionalities that cater to different aspects of financial management. Whether it's budgeting, forecasting, bookkeeping, or tax compliance, these software solutions provide businesses with the necessary tools to stay organized, save time, and make informed financial decisions. Let's dive deeper into the world of finance software and discover the key benefits they bring to the table.

1. Accounting Software: Simplifying Bookkeeping and Financial Reporting

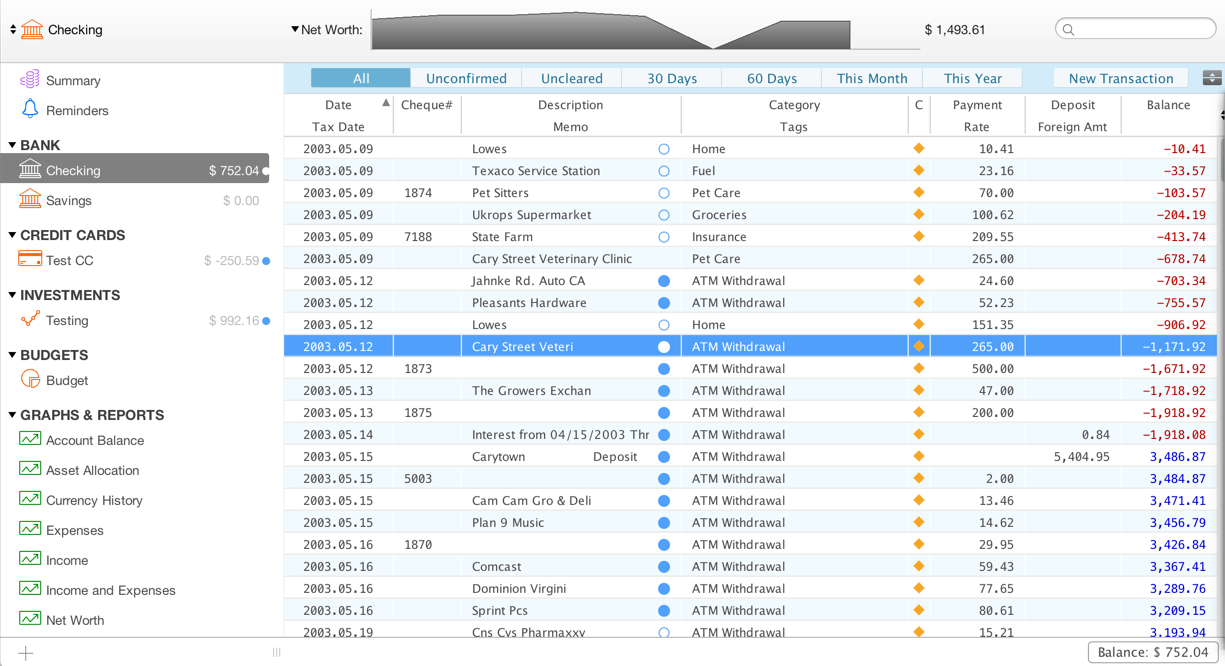

Accounting software is a fundamental tool for businesses of all sizes, helping them track their financial transactions, manage accounts payable and receivable, and generate accurate financial statements. With features like automated invoicing, bank reconciliation, and real-time reporting, accounting software eliminates the need for manual data entry, reduces human errors, and provides businesses with a clear overview of their financial health.

2. Budgeting and Forecasting Software: Optimizing Financial Planning

Effective budgeting and forecasting are essential for businesses to set realistic financial goals and make informed decisions. Budgeting and forecasting software enables businesses to create detailed budgets, track expenses, analyze variances, and forecast future financial scenarios. By providing accurate insights into cash flow and potential risks, these tools empower businesses to allocate resources wisely and adapt their strategies accordingly.

3. Payroll Software: Ensuring Efficient Payroll Management

Managing payroll can be a time-consuming task for businesses, especially as the workforce grows. Payroll software simplifies the payroll process by automating calculations, generating payslips, and ensuring compliance with tax regulations. Moreover, it helps businesses stay organized with employee data, track leaves and attendance, and easily generate reports for tax and audit purposes.

4. Tax Software: Streamlining Tax Compliance

Staying compliant with ever-changing tax regulations can be a daunting task for businesses. Tax software simplifies this process by automating tax calculations, generating tax forms, and providing up-to-date information on tax laws. By minimizing errors and ensuring timely compliance, businesses can avoid penalties and focus on their core operations.

5. Financial Planning and Analysis (FP&A) Software: Driving Informed Decision-Making

Financial Planning and Analysis (FP&A) software helps businesses analyze and interpret financial data to make strategic decisions. By consolidating data from various sources, these tools provide advanced analytics, scenario modeling, and forecasting capabilities. With real-time insights into revenue, costs, and performance metrics, businesses can identify trends, evaluate risks, and make data-driven decisions to drive growth.

6. Invoice Management Software: Streamlining Billing and Collections

Invoice management software simplifies the billing and collections process for businesses, allowing them to create and send professional invoices, track payment statuses, and automate reminders. These tools streamline cash flow management, reduce late payments, and improve customer relationships by providing a seamless invoicing experience.

7. Expense Management Software: Efficiently Tracking and Controlling Expenses

Expense management software helps businesses track, control, and analyze their expenses. By automating expense reporting, these tools streamline reimbursement processes, enforce spending policies, and facilitate accurate expense tracking. This not only saves time for employees but also enables businesses to identify cost-saving opportunities and improve financial efficiency.

8. Risk and Compliance Software: Mitigating Financial Risks

Risk and compliance software helps businesses identify, assess, and mitigate financial risks. These tools enable businesses to monitor compliance with regulations, establish internal controls, and detect potential fraud. By having a comprehensive view of risks and implementing preventive measures, businesses can safeguard their financial integrity and protect their reputation.

9. Investment Management Software: Optimizing Portfolio Management

Investment management software caters to businesses involved in managing portfolios, such as investment firms, asset managers, and wealth advisors. These tools provide functionalities like portfolio tracking, performance analysis, and risk assessment. By providing real-time insights into investments, businesses can make informed decisions, optimize asset allocation, and achieve better returns for their clients.

10. Business Intelligence (BI) Software: Transforming Data into Actionable Insights

Business Intelligence (BI) software helps businesses transform raw data into meaningful insights. These tools enable businesses to gather, analyze, and visualize data from various sources, providing intuitive dashboards and reports. By gaining a comprehensive understanding of their financial performance, businesses can identify trends, uncover opportunities, and drive continuous improvement.

Conclusion

In today's fast-paced business environment, software for finance plays a vital role in enabling businesses to effectively manage their finances. From accounting and budgeting to payroll and tax compliance, these software solutions offer a wide range of functionalities to streamline financial processes and enhance decision-making. By implementing the right finance software, businesses can save time, reduce errors, and gain valuable insights into their financial health. Embrace the power of finance software and take your financial management to new heights!

Q: What types of businesses can benefit from finance software?

A: Finance software can benefit businesses of all sizes and industries. From startups and small businesses to multinational corporations, finance software provides essential tools for efficient financial management.

Q: How does finance software help businesses save time?

A: Finance software automates various financial processes, such as bookkeeping, payroll management, and tax compliance, which saves businesses valuable time and reduces the need for manual data entry.

Q: Can finance software help businesses make informed decisions?

A: Yes, finance software provides businesses with accurate insights into their financial data, enabling them to make informed decisions based on real-time information. Tools like budgeting and forecasting software and financial planning and analysis (FP&A) software empower businesses to analyze trends, evaluate risks, and strategize effectively.

Q: Are finance software solutions customizable to specific business needs?

A: Many finance software solutions offer customization options to adapt to the unique needs of businesses. Whether it's configuring workflows, adding specific modules, or integrating with other systems, businesses can tailor finance software to fit their requirements.

Q: Is finance software secure for storing sensitive financial data?

A: Finance software providers prioritize data security and employ industry-standard measures to protect sensitive financial data. Encryption, access controls, and regular backups are some of the security features implemented to safeguard financial information.

Post a Comment for "Software for Finance: Streamlining Financial Management for Businesses"