Understanding Finance Charges on Loans: What You Need to Know

When taking out a loan, it's crucial to understand all the associated costs and fees. One such fee that borrowers often encounter is the finance charge. But what exactly is a finance charge on a loan? In this comprehensive guide, we'll dive into the details of finance charges, helping you grasp their significance and implications.

So, let's get started and unravel the mystery behind finance charges!

1. What is a Finance Charge?

In this section, we'll define what a finance charge is and explain how it is calculated. We'll also discuss the importance of understanding the finance charge before committing to a loan.

Summary: This section provides a clear definition of a finance charge, highlights its calculation methods, and emphasizes the significance of awareness for borrowers.

2. Different Types of Finance Charges

Not all finance charges are the same. In this section, we'll explore various types of finance charges that borrowers may encounter, including interest charges, origination fees, and late payment penalties.

Summary: This section provides an overview of the different types of finance charges borrowers may face, elucidating their respective purposes and implications.

3. How Finance Charges Impact Loan Costs

Understanding how finance charges affect the overall cost of a loan is crucial for borrowers. This section will delve into the relationship between finance charges and loan costs, ensuring borrowers can make informed decisions.

Summary: This section explains how finance charges influence the total cost of a loan, equipping borrowers with the knowledge to evaluate the affordability of different loan options.

4. Disclosure Requirements for Finance Charges

In order to protect consumers, loan providers are required to disclose finance charges. This section will outline the disclosure requirements imposed on lenders, empowering borrowers to demand transparency.

Summary: This section sheds light on the disclosure obligations of loan providers, emphasizing the importance of transparent communication regarding finance charges.

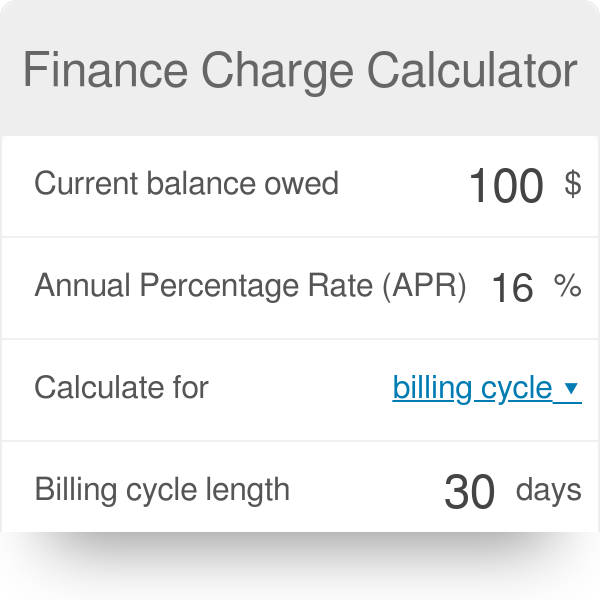

5. How to Calculate Finance Charges

Curious about the nitty-gritty of calculating finance charges? In this section, we'll guide you through the process, providing examples and step-by-step explanations.

Summary: This section offers a comprehensive guide on calculating finance charges, enabling borrowers to estimate the costs they will incur.

6. Finance Charges vs. Interest Rates: What's the Difference?

Finance charges and interest rates are often confused, but they are distinct concepts. This section will clarify the difference between the two and explain their respective roles in loan agreements.

Summary: This section highlights the disparity between finance charges and interest rates, ensuring borrowers comprehend their separate functions.

7. Negotiating Finance Charges with Lenders

Borrowers may have some flexibility when it comes to negotiating finance charges. In this section, we'll provide useful tips and strategies to help you secure more favorable terms.

Summary: This section offers practical advice on negotiating finance charges, equipping borrowers with the tools to potentially reduce their loan costs.

8. The Impact of Credit Scores on Finance Charges

Your credit score can significantly influence the finance charges you'll encounter. In this section, we'll explore how credit scores impact the terms and conditions of loans, including finance charges.

Summary: This section elucidates the relationship between credit scores and finance charges, emphasizing the importance of maintaining a good credit score.

9. Common Pitfalls to Avoid with Finance Charges

Unfortunately, borrowers can sometimes fall into traps related to finance charges. This section will highlight common pitfalls and provide guidance on how to avoid them, ensuring a smoother borrowing experience.

Summary: This section alerts borrowers to potential pitfalls associated with finance charges, offering valuable insights on how to steer clear of them.

10. Seeking Professional Advice on Finance Charges

When in doubt, it's always wise to seek professional guidance. In this section, we'll discuss the benefits of consulting financial experts who can help navigate the complexities of finance charges and loans.

Summary: This section emphasizes the advantages of seeking professional advice when dealing with finance charges, encouraging borrowers to make informed decisions.

Conclusion

In conclusion, understanding finance charges is essential for anyone considering a loan. By grasping the intricacies of finance charges, borrowers can make informed decisions, avoid unnecessary costs, and ensure a smooth borrowing experience. Remember, it's crucial to thoroughly assess the terms and disclosure of finance charges before committing to any loan agreement.

So, the next time you consider taking out a loan, be sure to familiarize yourself with finance charges and their implications to make the best financial choice for your needs.

Question and Answer

Q: How can I calculate the finance charges on my loan?

A: To calculate finance charges, you need to know the interest rate, the principal loan amount, and the length of the loan term. The specific calculation method varies depending on the type of loan you have, so it's best to consult with your lender or use online calculators for accurate results.

Q: Can I negotiate finance charges with my lender?

A: While some lenders may be open to negotiating finance charges, it ultimately depends on the lender's policies and your individual circumstances. It's worth discussing your concerns and exploring the possibility of negotiating with your lender to potentially secure more favorable terms.

Q: How do finance charges affect my credit score?

A: Finance charges themselves do not directly impact your credit score. However, if you fail to make timely payments and accrue late payment penalties or other fees, it can have a negative effect on your credit score. It's crucial to manage your finances responsibly to maintain a good credit score and minimize the impact of finance charges.

Q: Are finance charges the same as interest rates?

A: No, finance charges and interest rates are not the same. Interest rates represent the cost of borrowing money, while finance charges encompass all fees and costs associated with the loan. Finance charges can include interest, origination fees, late payment penalties, and other costs, depending on the terms of the loan agreement.

Q: Are there any legal requirements for lenders to disclose finance charges?

A: Yes, lenders are legally obligated to disclose finance charges to borrowers. The Truth in Lending Act (TILA) in the United States, for example, mandates lenders to provide borrowers with a clear breakdown of all fees and costs associated with the loan, including finance charges. It's important to review these disclosures carefully before committing to a loan.

Post a Comment for "Understanding Finance Charges on Loans: What You Need to Know"