Building a Comprehensive Finance Portfolio: A Guide to Financial Success

When it comes to achieving financial success, having a well-rounded and diversified finance portfolio is crucial. Your finance portfolio is a collection of your investments, assets, and financial instruments, all working together towards your financial goals. This blog article aims to provide you with a comprehensive understanding of finance portfolios, their importance, and how to build one that suits your needs.

Whether you are a beginner starting from scratch or an experienced investor looking to enhance your portfolio, this guide will walk you through the key aspects of creating a successful finance portfolio. We will cover various investment options, risk management strategies, and tips for optimizing your returns. So, let's embark on this journey towards financial prosperity!

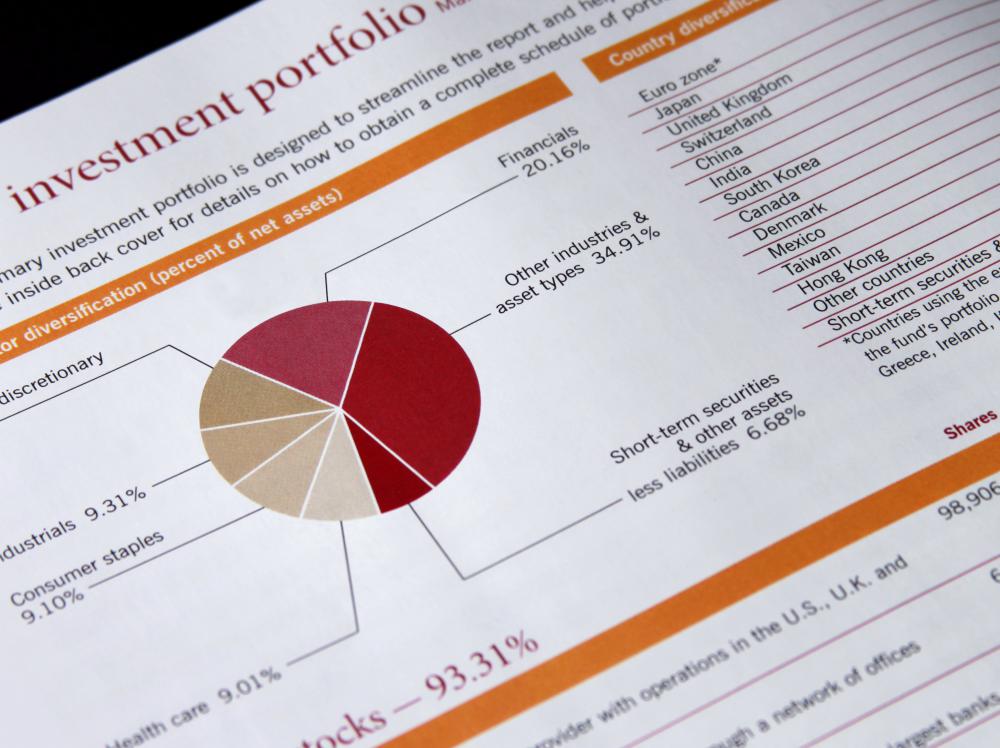

1. Understanding Finance Portfolios: A Primer

In this section, we will delve into the fundamentals of finance portfolios. We'll define what a finance portfolio is, discuss its purpose, and highlight the benefits of having one.

2. Setting Clear Financial Goals

Before diving into creating a finance portfolio, it's essential to set clear financial goals. In this section, we will explore the importance of goal-setting, how to define your goals, and align them with your risk tolerance and time horizon.

3. Asset Allocation Strategies: Spreading the Risk

Asset allocation is a critical aspect of portfolio management. We will explore different asset classes, such as stocks, bonds, real estate, and more, and discuss strategies to diversify your investments effectively.

4. Evaluating Investment Options: Stocks, Bonds, and More

In this section, we will dive into various investment options available in the market. We'll analyze the pros and cons of investing in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other financial instruments.

5. Risk Management: Mitigating Potential Losses

No investment is entirely risk-free. We will explore risk management techniques, such as hedging, diversification, and setting stop-loss orders, to protect your portfolio from potential downturns.

6. Investing in the Digital Age: Cryptocurrencies and Fintech

The world of finance is rapidly evolving, and digital assets like cryptocurrencies and emerging fintech platforms are gaining popularity. We'll discuss the opportunities and risks associated with these new investment avenues.

7. Monitoring and Rebalancing Your Portfolio

A finance portfolio requires regular monitoring and rebalancing to stay aligned with your goals. We'll provide tips on how to assess the performance of your investments, make necessary adjustments, and stay on track.

8. Seeking Professional Guidance: Financial Advisors and Robo-Advisors

If you feel overwhelmed or require expert advice, seeking the assistance of a financial advisor or utilizing robo-advisory services can be beneficial. We'll explore the different types of advisors and how to choose the right one for you.

9. Tax Considerations: Maximizing Returns and Minimizing Liabilities

Taxes play a significant role in portfolio management. In this section, we'll discuss tax-efficient investment strategies, tax-saving instruments, and ways to optimize your portfolio's tax implications.

10. The Future of Finance Portfolios: Trends and Innovations

Lastly, we'll look into the future of finance portfolios. We'll discuss emerging trends, such as impact investing, sustainable finance, and the integration of artificial intelligence, and how these factors may shape the portfolios of tomorrow.

Conclusion

Building a comprehensive finance portfolio requires careful planning, diversification, and continuous monitoring. By understanding the fundamentals, setting clear goals, and exploring various investment options, you can create a portfolio tailored to your financial aspirations. Remember to stay informed, seek professional guidance when needed, and adapt your portfolio as your circumstances change. With the right approach, your finance portfolio can become a powerful tool for achieving financial success and securing your future.

Have more questions about finance portfolios? Check out the frequently asked questions below:

FAQs

1. What is the ideal mix of assets for a finance portfolio?

Every individual's ideal asset mix depends on their risk tolerance, time horizon, and financial goals. It is recommended to consult a financial advisor to determine the most suitable asset allocation for your specific circumstances.

2. How often should I rebalance my finance portfolio?

The frequency of portfolio rebalancing depends on your investment strategy and market conditions. Generally, it is advisable to review your portfolio at least annually or when significant changes occur in your financial situation.

3. Is it better to invest in individual stocks or mutual funds?

Both individual stocks and mutual funds have their advantages and disadvantages. Investing in individual stocks requires thorough research and can be riskier, while mutual funds offer diversification and professional management. Consider your risk tolerance and investment expertise before making a decision.

4. Are cryptocurrencies a good addition to a finance portfolio?

Cryptocurrencies can be highly volatile and speculative. While they have the potential for significant returns, they also carry substantial risks. Consider cryptocurrencies as a high-risk investment and allocate a portion of your portfolio accordingly.

5. How can I minimize taxes on my finance portfolio?

To minimize taxes on your portfolio, consider tax-efficient investment strategies like holding investments for more than one year to qualify for long-term capital gains tax rates. Utilize tax-advantaged accounts like IRAs or 401(k)s and explore tax-loss harvesting opportunities.

Post a Comment for "Building a Comprehensive Finance Portfolio: A Guide to Financial Success"