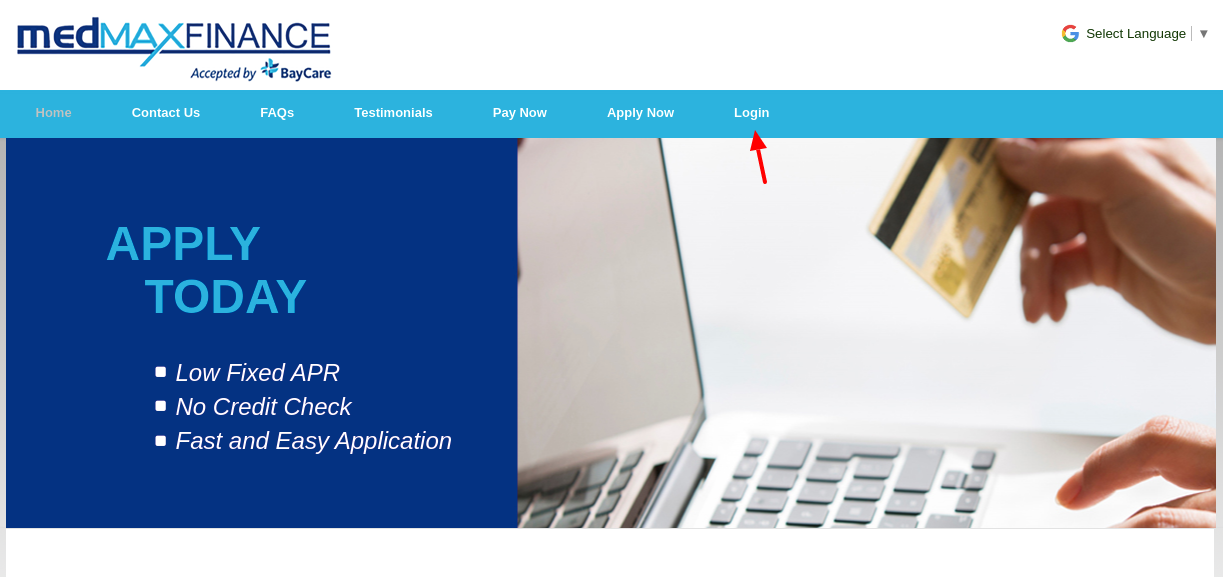

MedMax Finance: Empowering Healthcare Providers with Financial Solutions

As the healthcare industry continues to evolve and face new challenges, medical professionals are constantly seeking innovative financial solutions to support their practices. In this blog article, we will delve into the world of MedMax Finance, a leading provider of tailored financial services specifically designed for healthcare providers. From practice loans to revenue cycle management, MedMax Finance offers a comprehensive range of solutions to help medical professionals thrive in today's competitive market.

Whether you are a small clinic or a large hospital, managing the financial aspects of your practice can be daunting. MedMax Finance understands the unique needs of healthcare providers and aims to simplify the financial complexities so that you can focus on providing quality patient care. In this article, we will explore the various services offered by MedMax Finance, the benefits they bring to healthcare practices, and how they can help you achieve your financial goals.

1. Practice Loans: Funding Your Growth

Summary: Learn how MedMax Finance's practice loans can provide the necessary capital to expand your practice, invest in new equipment, or hire additional staff.

2. Revenue Cycle Management: Maximizing Profitability

Summary: Discover how MedMax Finance's revenue cycle management solutions can streamline your billing processes, reduce claim denials, and improve cash flow for your practice.

3. Equipment Financing: Staying Up-to-Date with Advanced Technology

Summary: Explore how MedMax Finance's equipment financing options can help you acquire the latest medical equipment and technology without straining your budget.

4. Debt Consolidation: Simplifying Your Financial Obligations

Summary: Learn about MedMax Finance's debt consolidation services, which can help you simplify multiple loans into a single, manageable payment, reducing your financial stress.

5. Medical Real Estate Loans: Owning Your Practice Space

Summary: Discover how MedMax Finance can assist you in securing favorable financing for purchasing or refinancing your medical practice real estate.

6. Insurance Services: Protecting Your Practice

Summary: Find out how MedMax Finance's insurance services can safeguard your practice from unforeseen events and liability risks, allowing you to focus on patient care.

7. Working Capital Solutions: Ensuring Financial Stability

Summary: Explore how MedMax Finance's working capital solutions can provide the necessary funds to cover day-to-day expenses, bridge gaps in cash flow, and support your practice's growth.

8. Billing and Collections: Enhancing Efficiency

Summary: Learn about MedMax Finance's billing and collections services, designed to improve accuracy, speed up reimbursements, and boost your practice's revenue.

9. Financial Consulting: Expert Guidance for Financial Success

Summary: Discover how MedMax Finance's team of financial experts can provide personalized guidance and strategic advice to help you achieve your financial goals.

10. Telemedicine Solutions: Embracing the Future of Healthcare

Summary: Explore how MedMax Finance's telemedicine solutions can help you integrate virtual care into your practice, expand your patient reach, and increase revenue opportunities.

In conclusion, MedMax Finance offers a comprehensive suite of financial solutions specifically tailored to meet the unique needs of healthcare providers. Whether you are seeking practice loans, revenue cycle management, equipment financing, or any other financial service, MedMax Finance is committed to empowering your practice's growth and success. With their expert guidance and innovative solutions, you can navigate the financial complexities of the healthcare industry with confidence.

So, why wait? Take the first step towards financial stability and success by partnering with MedMax Finance today!

Question and Answer:

Q: How can MedMax Finance help healthcare providers with their financial needs?

A: MedMax Finance offers a range of tailored financial services, including practice loans, revenue cycle management, equipment financing, and more, to address the unique needs of healthcare providers. By providing expert guidance and innovative solutions, MedMax Finance empowers healthcare providers to navigate the financial complexities of the industry and achieve their financial goals.

Q: What are the benefits of using MedMax Finance's revenue cycle management services?

A: MedMax Finance's revenue cycle management solutions streamline billing processes, reduce claim denials, and improve cash flow for healthcare practices. By maximizing profitability and ensuring timely reimbursements, these services enhance the financial stability and success of healthcare providers.

Q: Can MedMax Finance assist with debt consolidation for healthcare practices?

A: Yes, MedMax Finance offers debt consolidation services specifically designed for healthcare practices. These services enable healthcare providers to simplify multiple loans into a single, manageable payment, reducing financial stress and improving overall financial management.

Q: How can healthcare providers benefit from MedMax Finance's insurance services?

A: MedMax Finance's insurance services protect healthcare practices from unforeseen events and liability risks. By mitigating potential financial losses, healthcare providers can focus on providing quality patient care while having peace of mind.

Q: What makes MedMax Finance's financial consulting services unique?

A: MedMax Finance's financial consulting services provide personalized guidance and strategic advice to healthcare providers. With their industry expertise and deep understanding of the healthcare landscape, their financial experts can help healthcare practices achieve financial success and navigate challenges effectively.

Post a Comment for "MedMax Finance: Empowering Healthcare Providers with Financial Solutions"