The Best Finance Apps for Managing Your Money Efficiently

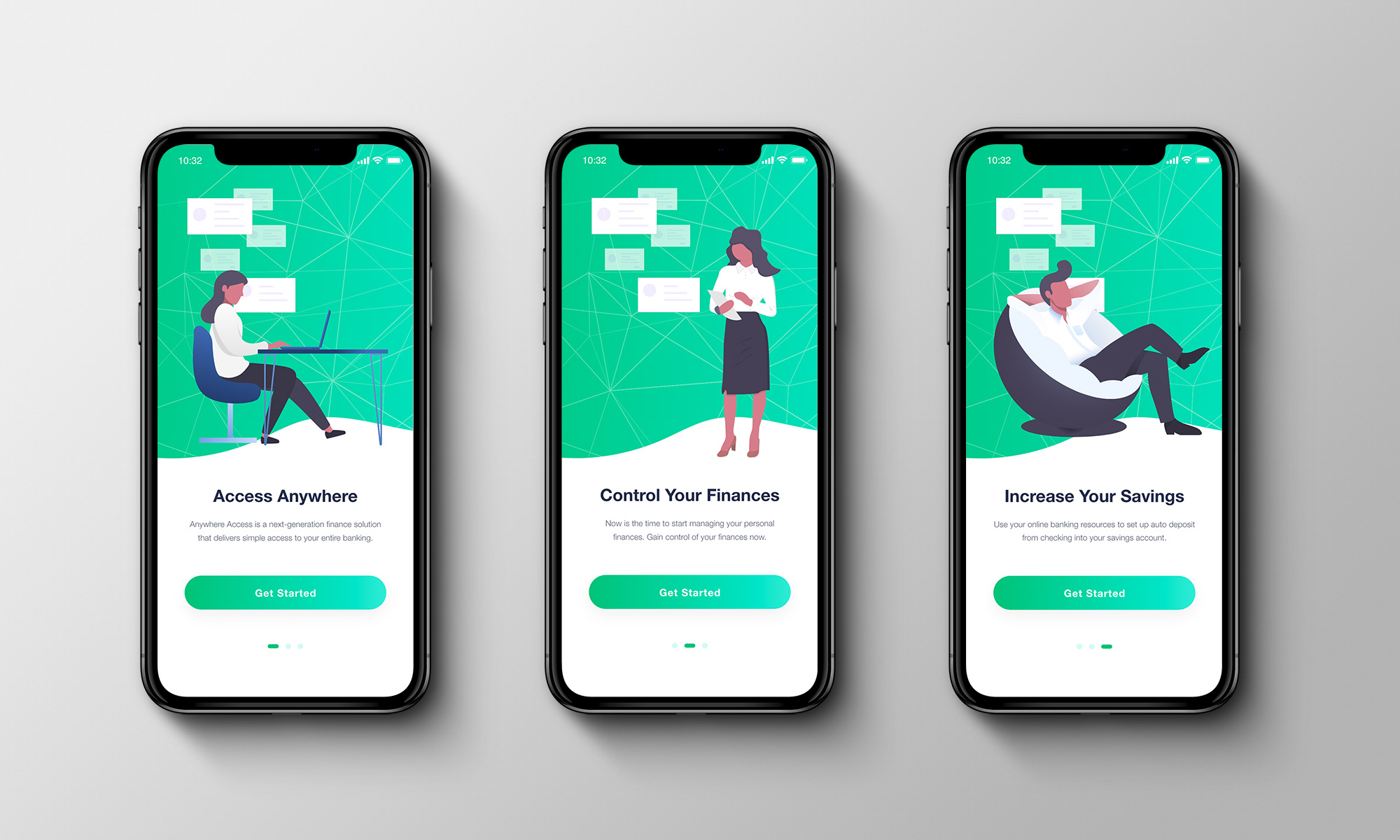

Managing finances can be a daunting task, but with the advancement of technology, it has become easier than ever. Thanks to finance apps, you can now take control of your money, track your expenses, and make informed financial decisions. In this article, we will explore the best finance apps available in the market that can help you manage your finances efficiently.

1. Personal Budgeting Apps: These apps help you set financial goals, track your expenses, and create a budget that suits your lifestyle. They provide insights into your spending habits and offer suggestions to save money.

2. Investment Apps: If you are interested in investing, these apps are perfect for you. They offer a range of investment options, allow you to track your portfolio, and provide real-time market updates.

3. Expense Tracking Apps: These apps help you keep a record of your expenses by automatically categorizing your transactions. They provide visual representations of your spending patterns and help you identify areas where you can cut back.

4. Bill Payment Apps: Say goodbye to late payment fees with bill payment apps. These apps remind you of upcoming bills, allow you to schedule payments, and keep all your bills organized in one place.

5. Saving Apps: Saving money has never been easier with saving apps. These apps analyze your spending habits, round up your purchases to the nearest dollar, and automatically save the spare change for you.

6. Loan and Debt Management Apps: If you have multiple loans or debts, these apps can help you keep track of your payments, calculate interest rates, and create a repayment plan to become debt-free sooner.

7. Credit Score Monitoring Apps: Monitoring your credit score is essential for financial well-being. These apps provide real-time updates on your credit score, offer tips to improve it, and notify you of any suspicious activities.

8. Tax Preparation Apps: Filing taxes can be overwhelming, but tax preparation apps simplify the process. They help you gather necessary documents, calculate deductions, and submit your tax return accurately and on time.

9. Retirement Planning Apps: It's never too early to start planning for retirement. These apps help you set retirement goals, calculate how much you need to save, and provide investment strategies to secure your financial future.

10. Currency Conversion Apps: If you frequently travel or make international transactions, currency conversion apps come in handy. They provide real-time exchange rates, convert currencies, and help you make informed financial decisions.

In conclusion, finance apps have revolutionized the way we manage our money. Whether you want to track your expenses, invest, save, or plan for retirement, there is an app for every financial need. By utilizing these apps, you can take control of your finances, make smarter decisions, and ultimately achieve your financial goals.

So, why wait? Download these finance apps today and embark on a journey towards financial freedom!

Q&A

1. What are the best finance apps for personal budgeting?

2. How can investment apps help in managing your portfolio?

3. Which expense tracking app offers the most comprehensive analysis of spending habits?

4. How can bill payment apps help in organizing your financial obligations?

5. Which saving app is the most efficient in automatically saving spare change?

Post a Comment for "The Best Finance Apps for Managing Your Money Efficiently"