The Ultimate Guide to SAP Finance: Everything You Need to Know

Are you curious about SAP Finance and how it can revolutionize your business? Look no further! In this comprehensive guide, we will delve into the intricacies of SAP Finance, providing you with a detailed overview of its features, benefits, and implementation process. Whether you are an entrepreneur, finance professional, or simply interested in the world of finance, this article is your one-stop resource for all things SAP Finance.

In the fast-paced world of finance, staying ahead of the curve is crucial. SAP Finance, also known as SAP Financial Accounting (SAP FI), is a robust software solution that enables companies to streamline their financial processes, improve decision-making, and enhance overall efficiency. With its wide range of features, SAP Finance caters to the diverse needs of businesses, regardless of their size or industry.

1. Understanding SAP Finance: An Overview

In this section, we will provide a comprehensive introduction to SAP Finance, outlining its key features, modules, and benefits. We will explore how SAP Finance integrates with other SAP modules, such as SAP Controlling (SAP CO), to provide a holistic financial management solution.

2. Implementing SAP Finance: A Step-by-Step Guide

Ready to implement SAP Finance in your organization? This section will walk you through the entire implementation process, from planning and preparation to configuration and go-live. We will discuss the critical factors to consider, potential challenges, and best practices for a successful SAP Finance implementation.

3. Mastering SAP Finance: Key Concepts and Terminology

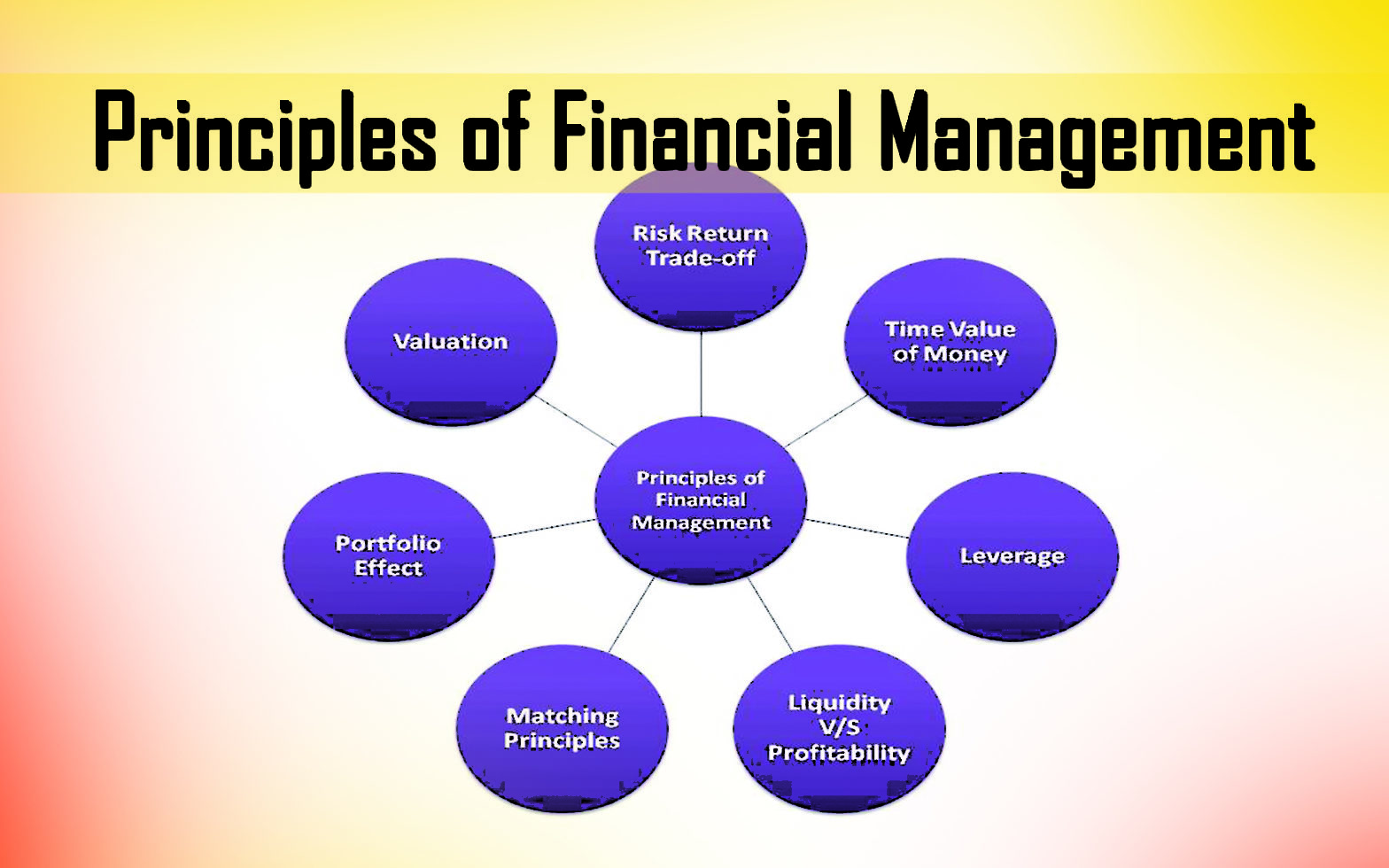

Every field has its jargon, and SAP Finance is no exception. In this section, we will demystify the key concepts and terminologies used in SAP Finance, ensuring you have a solid understanding of the language and principles behind the software.

4. Enhancing Financial Reporting with SAP Finance

Accurate and timely financial reporting is crucial for strategic decision-making. In this section, we will explore how SAP Finance enables organizations to generate comprehensive financial reports, analyze data, and gain valuable insights. We will also discuss the various reporting tools available within SAP Finance.

5. Optimizing Financial Processes with SAP Finance

SAP Finance offers a plethora of features that streamline and automate financial processes. From accounts payable and receivable to general ledger management, this section will delve into how SAP Finance simplifies everyday financial tasks, reduces errors, and improves overall efficiency.

6. Integrating SAP Finance with Other Systems

In today's interconnected business landscape, seamless integration between systems is vital. In this section, we will explore how SAP Finance integrates with other SAP modules, such as SAP Sales and Distribution (SAP SD), SAP Materials Management (SAP MM), and more. We will also discuss the benefits of integration and the challenges organizations may face.

7. Ensuring Compliance and Risk Management with SAP Finance

Compliance and risk management are critical aspects of financial management. In this section, we will discuss how SAP Finance helps organizations maintain compliance with regulatory requirements, manage risks effectively, and ensure data integrity and security.

8. SAP Finance in the Cloud: Exploring the Benefits

The cloud has revolutionized business operations, and SAP Finance is no exception. This section will delve into the advantages of deploying SAP Finance in the cloud, including increased flexibility, scalability, and cost-effectiveness. We will also address common concerns and considerations when migrating to the cloud.

9. Training and Certification in SAP Finance

To harness the full potential of SAP Finance, adequate training and certification are essential. In this section, we will explore the various training options available, including classroom training, online courses, and certification programs. We will also discuss the benefits of becoming a certified SAP Finance professional.

10. The Future of SAP Finance: Trends and Innovations

As technology continues to evolve, so does SAP Finance. In this final section, we will discuss the emerging trends and innovations in SAP Finance, such as artificial intelligence, machine learning, and predictive analytics. We will explore how these advancements are shaping the future of financial management.

In conclusion, SAP Finance is a powerful tool that revolutionizes financial management for organizations of all sizes. From streamlining processes and enhancing reporting capabilities to ensuring compliance and enabling strategic decision-making, SAP Finance offers a comprehensive solution to elevate your financial operations.

By understanding the key concepts, implementing best practices, and staying updated with the latest trends, you can fully unlock the potential of SAP Finance and drive your business forward. So, embrace the power of SAP Finance and embark on a journey towards financial excellence!

Q: How can SAP Finance benefit my business?

A: SAP Finance offers numerous benefits, such as streamlining financial processes, generating comprehensive reports, enabling accurate decision-making, ensuring compliance, and enhancing overall efficiency. By implementing SAP Finance, businesses can achieve better control over their finances, reduce errors, and gain valuable insights to drive growth.

Q: Is SAP Finance suitable for small businesses?

A: Absolutely! SAP Finance caters to businesses of all sizes, including small and medium enterprises (SMEs). Its modular structure allows organizations to choose the functionalities that best suit their needs and scale up as they grow. With SAP Finance, small businesses can optimize their financial management and compete on a level playing field with larger enterprises.

Q: How long does it take to implement SAP Finance?

A: The implementation timeline for SAP Finance depends on various factors, such as the complexity of your organization's financial processes, the number of modules being implemented, and the level of customization required. On average, a successful SAP Finance implementation can take anywhere from a few months to a year. However, thorough planning, efficient project management, and expert guidance can expedite the process.

Q: Can SAP Finance be integrated with our existing systems?

A: Yes, SAP Finance is designed to integrate seamlessly with other SAP modules, as well as external systems. Whether you are using SAP Sales and Distribution, Materials Management, or any other system, SAP Finance offers integration capabilities to ensure a unified and holistic financial management solution.

Q: How can I become a certified SAP Finance professional?

A: To become a certified SAP Finance professional, you can enroll in SAP's official training programs and pursue the relevant certification exams. SAP offers a range of training options, including classroom training and online courses. By obtaining certification, you can enhance your career prospects, gain recognition in the industry, and demonstrate your expertise in SAP Finance.

Post a Comment for "The Ultimate Guide to SAP Finance: Everything You Need to Know"