Top 10 Finance Apps to Take Control of Your Finances

Managing personal finances can be overwhelming and time-consuming. However, with the advancements in technology, we now have access to a wide range of finance apps that can simplify the process and help us take control of our money. In this blog article, we will explore the top 10 finance apps that are revolutionizing the way we manage our finances.

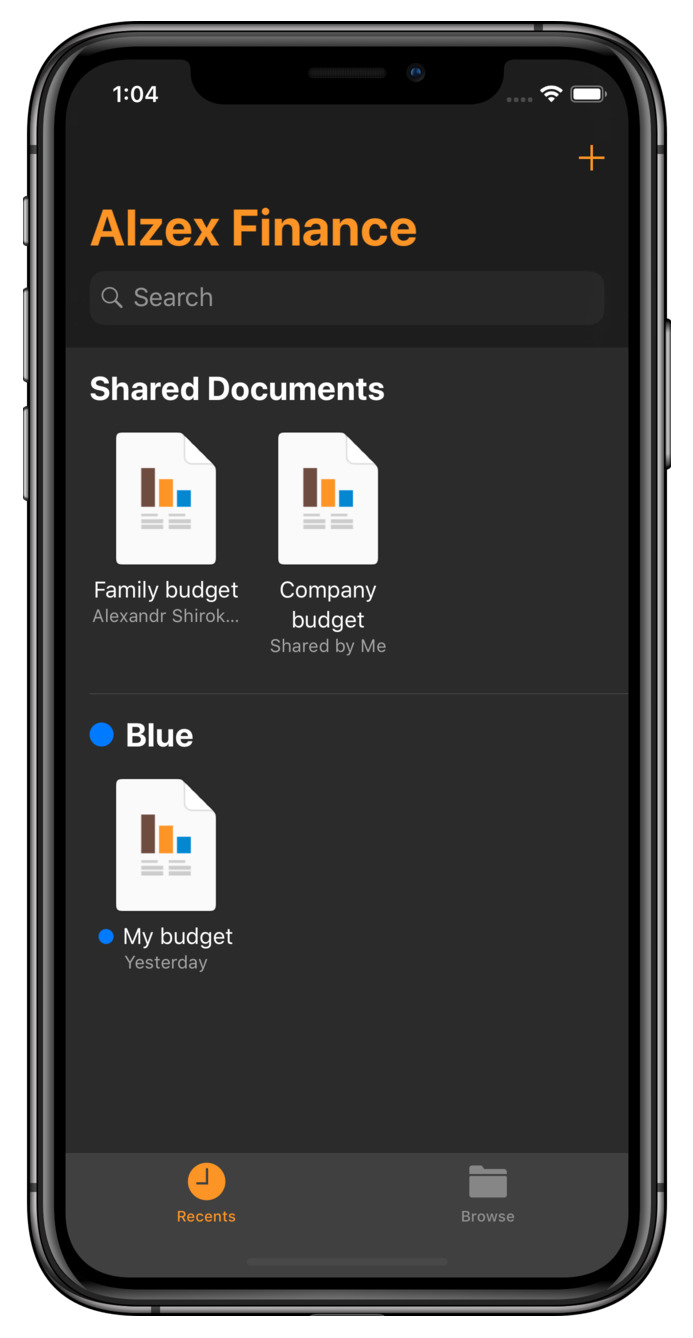

1. Budgeting Made Easy: Discover the best budgeting apps that can help you create and stick to a monthly budget effortlessly. These apps provide a comprehensive overview of your income, expenses, and savings goals, allowing you to make informed financial decisions.

2. Track Your Expenses: Learn about the top expense tracking apps that enable you to effortlessly monitor your spending habits. These apps categorize your expenses, provide detailed reports, and send you notifications to help you stay on track.

3. Investment Management: Dive into the world of investment management apps that allow you to track your investments, receive real-time market updates, and make informed investment decisions. Discover how these apps can help you grow your wealth.

4. Saving for the Future: Explore the best savings apps that make saving money a breeze. These apps offer various features such as automatic savings transfers, goal setting, and personalized recommendations to help you achieve your financial goals faster.

5. Credit Score Monitoring: Find out how credit score monitoring apps can help you stay on top of your credit health. Discover the tools and features these apps offer to help you improve your credit score and access better financial opportunities.

6. Debt Repayment Made Simple: Learn about debt repayment apps that can assist you in managing and paying off your debts effectively. These apps offer strategies, calculators, and personalized plans to help you become debt-free sooner.

7. Tax Planning and Filing: Discover the top tax planning and filing apps that can simplify the tax season for you. From tracking your expenses to filing your taxes, these apps streamline the entire process and ensure you maximize your deductions.

8. Financial Education: Explore apps that provide financial education and resources to improve your financial literacy. These apps offer articles, courses, and quizzes to help you understand complex financial concepts and make informed financial decisions.

9. Secure Banking: Find out about secure banking apps that prioritize your privacy and offer advanced security features. Learn how these apps protect your transactions, provide fraud alerts, and ensure your financial information remains confidential.

10. Personalized Financial Insights: Discover apps that offer personalized financial insights based on your spending patterns and financial goals. These apps analyze your financial data to provide tailored recommendations and strategies to optimize your finances.

In conclusion, finance apps have revolutionized the way we manage our finances by providing us with tools and resources to take control of our money. Whether you need help with budgeting, tracking expenses, investing, or saving, there is an app available to cater to your specific financial needs. Embrace the power of technology and start using these finance apps to achieve your financial goals faster and more efficiently.

Question and Answer:

Q: Are these finance apps suitable for both iOS and Android devices?

A: Yes, most of the finance apps mentioned in this article are available for both iOS and Android devices, ensuring that you can access them regardless of the operating system you use.

Q: Are these finance apps secure? How can I trust them with my financial information?

A: These finance apps prioritize user security and employ advanced encryption methods to protect your financial information. Additionally, they adhere to strict privacy policies to ensure your data remains confidential. It is always recommended to read reviews and choose apps from reputable developers to ensure maximum security.

Q: Can these apps help me improve my credit score?

A: Yes, many of the credit score monitoring apps mentioned in this article provide insights and recommendations to help you improve your credit score. By tracking your spending, managing debts effectively, and making timely payments, you can take steps towards improving your credit health.

Q: Are these finance apps free to use?

A: While many finance apps offer free versions with basic features, some apps may have premium versions or offer additional features through in-app purchases. However, most apps do offer valuable functionalities even in their free versions.

Q: Can I sync these apps with my bank accounts?

A: Yes, most finance apps allow you to securely sync your bank accounts, credit cards, and other financial institutions to provide you with real-time updates and insights into your finances.

Post a Comment for "Top 10 Finance Apps to Take Control of Your Finances"