Understanding Project Finance: A Comprehensive Guide to Funding Your Ventures

Are you an entrepreneur or a business owner looking to bring your ambitious project to life? Project finance might just be the solution you're seeking. In this blog article, we will delve into the world of project finance, exploring its intricacies, benefits, and how it can help you secure the necessary funds to turn your dreams into reality.

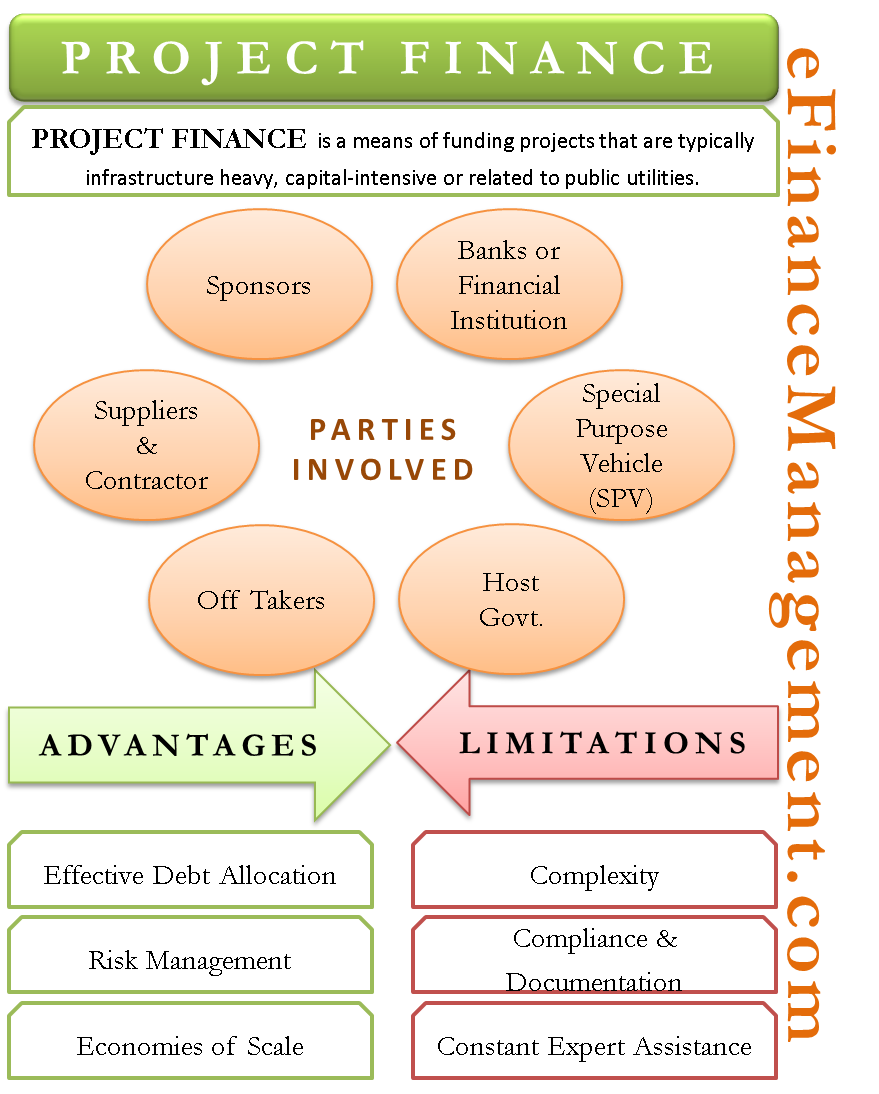

Paragraph 1: Project finance is a specialized form of financing that focuses on funding large-scale, long-term projects. Unlike traditional financing methods, project finance involves creating a separate legal entity solely dedicated to the project, shielding the project sponsors from personal liability. Through this structure, project finance allows businesses to undertake ambitious ventures that may require substantial capital investments.

Paragraph 2: The key advantage of project finance lies in its ability to attract funding by leveraging the project's own assets and cash flows, rather than relying solely on the creditworthiness of the project sponsors. This unique financing approach mitigates risks for lenders and investors, making it an attractive option for projects that may carry a higher level of uncertainty or have a longer payback period.

1. The Basics of Project Finance

Summary: In this section, we will provide a comprehensive overview of project finance, including its definition, key players, and the different stages involved in the project finance process.

2. Advantages and Limitations of Project Finance

Summary: Explore the advantages and limitations of project finance, such as risk allocation, tax benefits, and potential challenges faced by project sponsors.

3. Key Parties Involved in Project Finance

Summary: Dive into the roles and responsibilities of the various parties involved in project finance, including lenders, sponsors, contractors, and government entities.

4. Structuring a Project Finance Deal

Summary: Understand the essential elements of structuring a project finance deal, including project contracts, financing agreements, and risk management strategies.

5. Evaluating Project Feasibility

Summary: Learn how to conduct a thorough feasibility study for your project, assessing its economic viability, market demand, and potential risks.

6. Securing Project Finance: Sources and Instruments

Summary: Explore the various sources of project finance, such as commercial banks, development banks, export credit agencies, and the different financial instruments used to fund projects.

7. Case Studies: Successful Project Finance Examples

Summary: Examine real-life case studies of successful project finance initiatives, highlighting their key features, challenges faced, and lessons learned.

8. Project Finance in Renewable Energy Sector

Summary: Explore the growing role of project finance in renewable energy projects, including solar, wind, and hydroelectric power plants.

9. Risks and Mitigation Strategies in Project Finance

Summary: Identify the potential risks associated with project finance and discover effective strategies to mitigate them, ensuring the success of your venture.

10. Future Trends in Project Finance

Summary: Gain insights into the emerging trends and innovations shaping the future of project finance, such as green finance, blockchain technology, and public-private partnerships.

Paragraph 1: In conclusion, project finance offers a powerful tool for entrepreneurs and businesses to finance large-scale projects with reduced risks. By understanding the basics of project finance, evaluating feasibility, and leveraging the right sources and instruments, you can pave the way for the successful realization of your ventures.

Paragraph 2: So, if you're ready to embark on your next ambitious project, consider embracing project finance as your financial strategy. With the right knowledge and expertise, you can unlock the doors to funding opportunities that will bring your dreams to life.

Question and Answer:

Question 1: How is project finance different from traditional financing methods?

Answer: Project finance differs from traditional financing methods as it creates a separate legal entity solely dedicated to the project, protecting project sponsors from personal liability. It also relies on the project's own assets and cash flows for funding, rather than solely relying on the creditworthiness of the sponsors.

Question 2: What are the advantages of project finance?

Answer: Some advantages of project finance include risk allocation, tax benefits, and the ability to attract funding by leveraging the project's own assets and cash flows. It also allows businesses to undertake ambitious projects that may require significant capital investments.

Question 3: What are some common risks in project finance?

Answer: Common risks in project finance include construction delays, cost overruns, regulatory changes, and fluctuations in commodity prices. Mitigation strategies, such as comprehensive risk management plans and insurance coverage, can help address these risks.

Question 4: How does project finance contribute to the renewable energy sector?

Answer: Project finance plays a crucial role in financing renewable energy projects, such as solar, wind, and hydroelectric power plants. It provides the necessary funds to develop and operate these projects, supporting the transition towards a more sustainable and clean energy future.

Question 5: What are some future trends in project finance?

Answer: Future trends in project finance include the rise of green finance, which focuses on funding environmentally-friendly projects, the integration of blockchain technology for enhanced transparency and efficiency, and the growth of public-private partnerships to address complex infrastructure challenges.

Post a Comment for "Understanding Project Finance: A Comprehensive Guide to Funding Your Ventures"