Understanding Structured Finance: A Comprehensive Guide

In the world of finance, structured finance plays a crucial role in facilitating complex transactions and managing risks. From collateralized debt obligations (CDOs) to asset-backed securities (ABS), structured finance involves the creation of innovative financial instruments that provide investors with new opportunities. This blog article aims to provide a detailed and comprehensive understanding of structured finance, exploring its various components, benefits, and challenges.

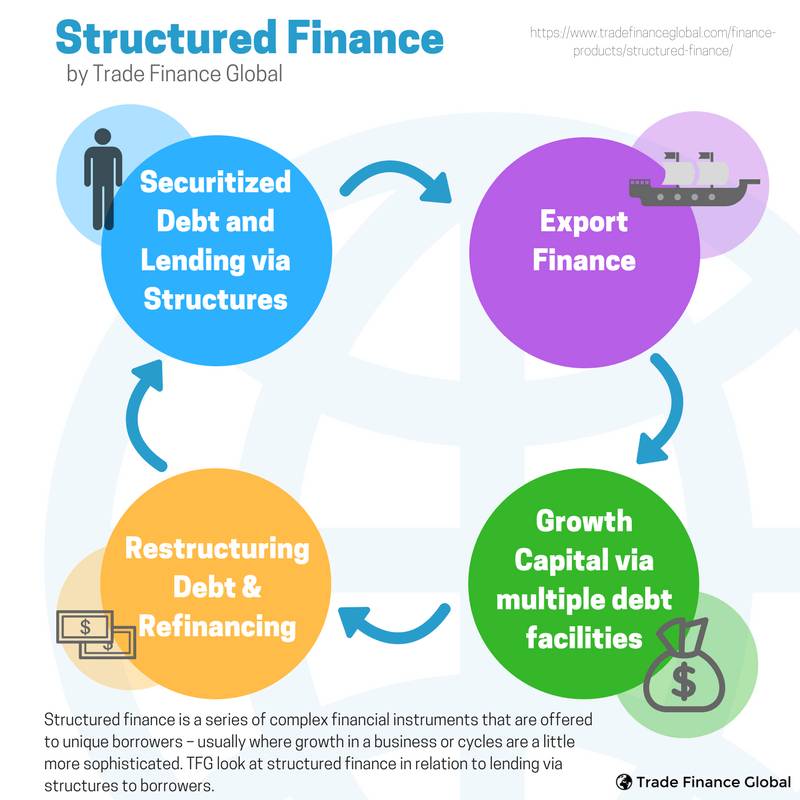

Structured finance refers to the process of creating financial products by combining various financial assets, such as bonds, loans, and mortgages. These products are designed to meet specific objectives, often tailored to address the needs of both issuers and investors. By securitizing assets and transforming them into tradable securities, structured finance enables the efficient allocation of capital while diversifying risk.

1. What is Structured Finance?

This section will delve into the definition of structured finance, highlighting its purpose and significance within the financial industry. It will explore the various types of structured finance instruments and how they differ from traditional financial products.

2. Components of Structured Finance

Here, we will discuss the key components that make up structured finance, including securitization, credit enhancement, and tranching. Each component will be explained in detail, shedding light on their roles and importance in the structured finance process.

3. Benefits of Structured Finance

Structured finance offers numerous benefits to both issuers and investors. This section will outline these advantages, such as risk management, liquidity provision, and access to diverse investment opportunities. Real-life examples will be provided to illustrate these benefits.

4. Challenges and Risks in Structured Finance

While structured finance has its advantages, it also presents challenges and risks. This section will explore these potential pitfalls, including complexity, market volatility, and regulatory concerns. It will offer insights into risk mitigation strategies and best practices.

5. Role of Structured Finance in the Global Economy

Structured finance plays a significant role in shaping the global economy. This section will examine its impact on financial markets, economic growth, and financial stability. It will highlight how structured finance contributes to capital allocation and economic development.

6. Structured Finance and the 2008 Financial Crisis

The 2008 financial crisis exposed vulnerabilities within the structured finance market. This section will analyze the role of structured finance in the crisis, discussing the factors that contributed to its downfall and the subsequent regulatory changes that were implemented.

7. Emerging Trends in Structured Finance

The structured finance landscape is constantly evolving. In this section, we will discuss the latest trends in structured finance, such as the rise of green finance, technology-driven innovations, and the impact of regulatory changes. These trends will shape the future of structured finance.

8. Structured Finance vs. Traditional Finance

Structured finance differs significantly from traditional finance. This section will compare and contrast the two approaches, highlighting the advantages and disadvantages of each. It will provide insights into when and why structured finance might be a preferred option over traditional finance.

9. Key Players in Structured Finance

Structured finance involves various stakeholders who play crucial roles in its functioning. This section will identify and discuss the key players, including investment banks, rating agencies, investors, and regulators. It will shed light on their interactions and the impact they have on structured finance transactions.

10. The Future of Structured Finance

In this final section, we will explore the future prospects of structured finance. It will touch upon the potential impact of technological advancements, regulatory changes, and global economic shifts. This section will conclude with an overview of the opportunities and challenges that lie ahead for structured finance.

In conclusion, structured finance serves as a vital mechanism in the world of finance, enabling the creation of innovative financial instruments and the efficient allocation of capital. This comprehensive guide has explored the various aspects of structured finance, from its definition and components to its benefits, risks, and role in the global economy. By understanding structured finance, investors and issuers can make informed decisions and navigate the complexities of this dynamic field.

Remember, structured finance is a continuously evolving domain, shaped by global trends and regulatory changes. Staying updated with emerging trends and maintaining a robust risk management framework are essential for success in this field.

Q: How does structured finance differ from traditional finance?

A: Structured finance involves the creation of complex financial instruments by combining various assets, while traditional finance deals with more straightforward financial products.

Q: What are the benefits of structured finance?

A: Structured finance offers benefits such as risk management, liquidity provision, and access to diverse investment opportunities.

Q: What are the challenges and risks in structured finance?

A: Structured finance presents challenges such as complexity and market volatility, along with risks associated with regulatory changes and economic downturns.

Q: How did structured finance contribute to the 2008 financial crisis?

A: The 2008 financial crisis exposed vulnerabilities within the structured finance market, primarily due to the securitization of subprime mortgages that were bundled into complex securities.

Q: What are the emerging trends in structured finance?

A: Emerging trends include green finance, technological innovations, and the impact of regulatory changes on structured finance transactions.

Post a Comment for "Understanding Structured Finance: A Comprehensive Guide"