Accounting vs Finance: Understanding the Key Differences

When it comes to the world of business, two crucial fields play a pivotal role in the financial management of organizations: accounting and finance. While they might seem similar at first glance, accounting and finance are distinct disciplines that serve different functions within a company. In this comprehensive blog article, we will delve into the differences between accounting and finance, shedding light on their unique characteristics and roles.

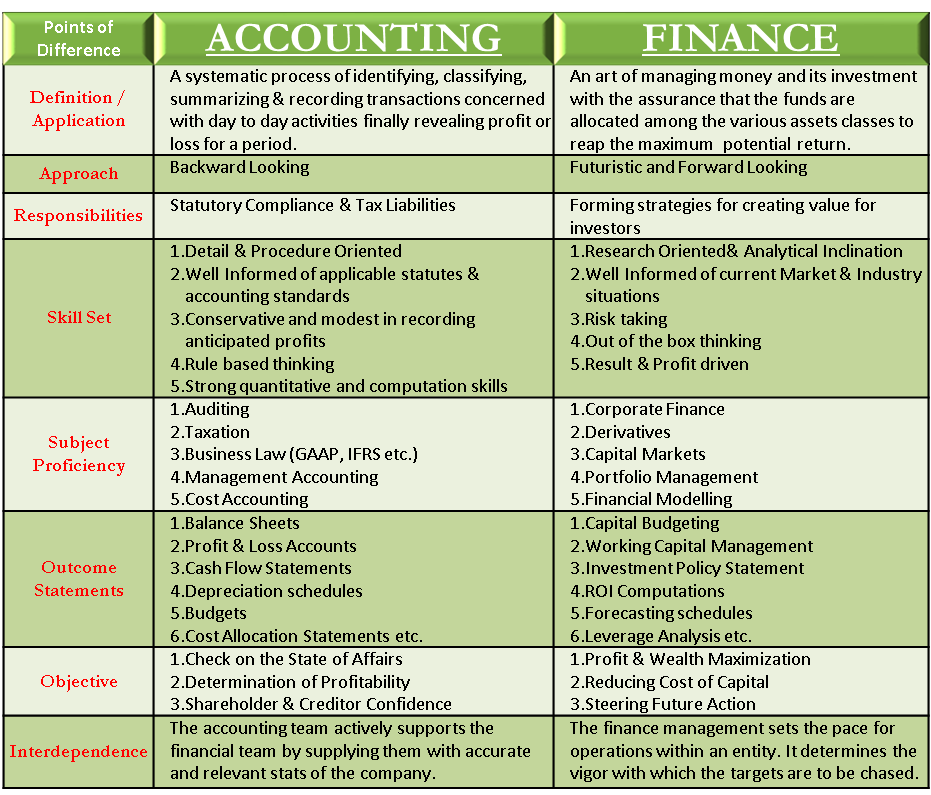

Accounting primarily focuses on tracking, analyzing, and interpreting financial data. It involves recording and organizing financial transactions, preparing financial statements, and ensuring compliance with regulatory standards. In contrast, finance is concerned with managing and optimizing an organization's financial resources. It revolves around making strategic decisions to maximize profits, minimize risks, and allocate funds efficiently.

1. The Scope of Accounting

Accounting encompasses various subfields, such as financial accounting, management accounting, and tax accounting. Financial accounting involves the preparation of financial statements that provide an overview of a company's financial performance. Management accounting focuses on generating internal reports to aid managerial decision-making. Tax accounting involves calculating and filing taxes accurately and in compliance with tax laws.

Summary: Accounting involves tracking financial data, preparing statements, and ensuring compliance with regulations. It includes financial, management, and tax accounting.

2. The Scope of Finance

Finance covers a broader spectrum of activities, including financial planning, investment analysis, and risk management. It involves assessing investment opportunities, estimating potential returns, and determining the most effective ways to raise capital. Finance professionals also analyze market trends, evaluate financial risks, and develop strategies to mitigate them.

Summary: Finance encompasses financial planning, investment analysis, and risk management. It involves assessing opportunities, estimating returns, and mitigating risks.

3. Educational Background

To pursue a career in accounting, individuals often opt for a degree in accounting or a related field. They may further specialize by obtaining certifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA). On the other hand, finance professionals typically pursue degrees in finance, economics, or business administration, and may further enhance their credentials with certifications such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP).

Summary: Accountants usually have an accounting degree and may hold certifications like CPA or CMA. Finance professionals often have degrees in finance, economics, or business administration, and may hold certifications like CFA or CFP.

4. Key Skills Required

Accountants need strong analytical and numerical skills to interpret financial data accurately. They must be detail-oriented, possess excellent organizational skills, and have a solid understanding of accounting principles and regulations. Finance professionals, on the other hand, require strong analytical and problem-solving skills. They must be adept at financial modeling, risk assessment, and have a deep understanding of financial markets and investment strategies.

Summary: Accountants need analytical skills, attention to detail, and knowledge of accounting principles. Finance professionals require analytical and problem-solving skills, financial modeling expertise, and an understanding of markets and investments.

5. Career Opportunities

Accounting offers a wide range of career opportunities, including roles such as financial accountant, auditor, tax consultant, and forensic accountant. Finance professionals can explore careers as financial analysts, investment bankers, portfolio managers, or risk managers. Both fields offer opportunities for advancement and specialization, allowing professionals to pursue rewarding and lucrative careers.

Summary: Accounting offers careers like financial accountant, auditor, tax consultant, and forensic accountant. Finance provides opportunities as financial analysts, investment bankers, portfolio managers, or risk managers.

Conclusion

In conclusion, accounting and finance are integral components of every organization's financial management. While accounting focuses on recording and interpreting financial transactions, finance is concerned with managing and optimizing financial resources. By understanding the key differences between accounting and finance, individuals can make informed decisions about their career paths and organizations can ensure they have the right professionals to handle their financial responsibilities.

So, whether you aspire to be a meticulous accountant or a strategic finance professional, both fields offer exciting prospects and contribute significantly to the success of businesses worldwide.

Question and Answer

Q: Is accounting part of finance?

A: Accounting is a subset of finance. While accounting focuses on recording and interpreting financial transactions, finance encompasses a broader range of activities, including financial planning, investment analysis, and risk management.

Q: Which field has more career opportunities, accounting or finance?

A: Both accounting and finance offer numerous career opportunities. Accounting roles include financial accountant, auditor, tax consultant, and forensic accountant, while finance careers span financial analysts, investment bankers, portfolio managers, and risk managers.

Q: What skills are essential for a career in accounting?

A: Key skills for accountants include analytical abilities, attention to detail, organizational skills, and a solid understanding of accounting principles and regulations.

Q: What qualifications are important for a career in finance?

A: Finance professionals typically pursue degrees in finance, economics, or business administration. Enhancing their credentials with certifications like Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) can further boost their career prospects.

Q: Can one person handle both accounting and finance responsibilities in a small business?

A: In small businesses, it is not uncommon for one person to handle both accounting and finance responsibilities. However, as the business grows, it is advisable to have dedicated professionals for each field to ensure efficient financial management.

Post a Comment for "Accounting vs Finance: Understanding the Key Differences"