Boost Your Financial Planning with a Personal Finance Excel Template

Are you tired of struggling to keep track of your personal finances? Do you find it difficult to stick to a budget or plan for your financial goals? Look no further! In this comprehensive blog article, we will explore the power of using a personal finance Excel template to take control of your money and set yourself up for financial success.

With its user-friendly interface and powerful features, an Excel template can revolutionize the way you manage your finances. Whether you are a novice or an experienced Excel user, this article will guide you through the process of using a personal finance template effectively, enabling you to track your income and expenses, create budgets, and plan for the future with ease.

1. Understanding the Benefits of a Personal Finance Excel Template

Summary: Discover the advantages of using an Excel template for your personal finances, including organization, automation, and customization.

2. Finding the Perfect Personal Finance Excel Template

Summary: Learn how to choose the right template that suits your financial needs and preferences, considering factors such as design, functionality, and compatibility.

3. Getting Started: Setting Up Your Personal Finance Excel Template

Summary: Follow a step-by-step guide to set up your template, including inputting your financial data, categorizing expenses, and personalizing the layout.

4. Tracking Your Income and Expenses

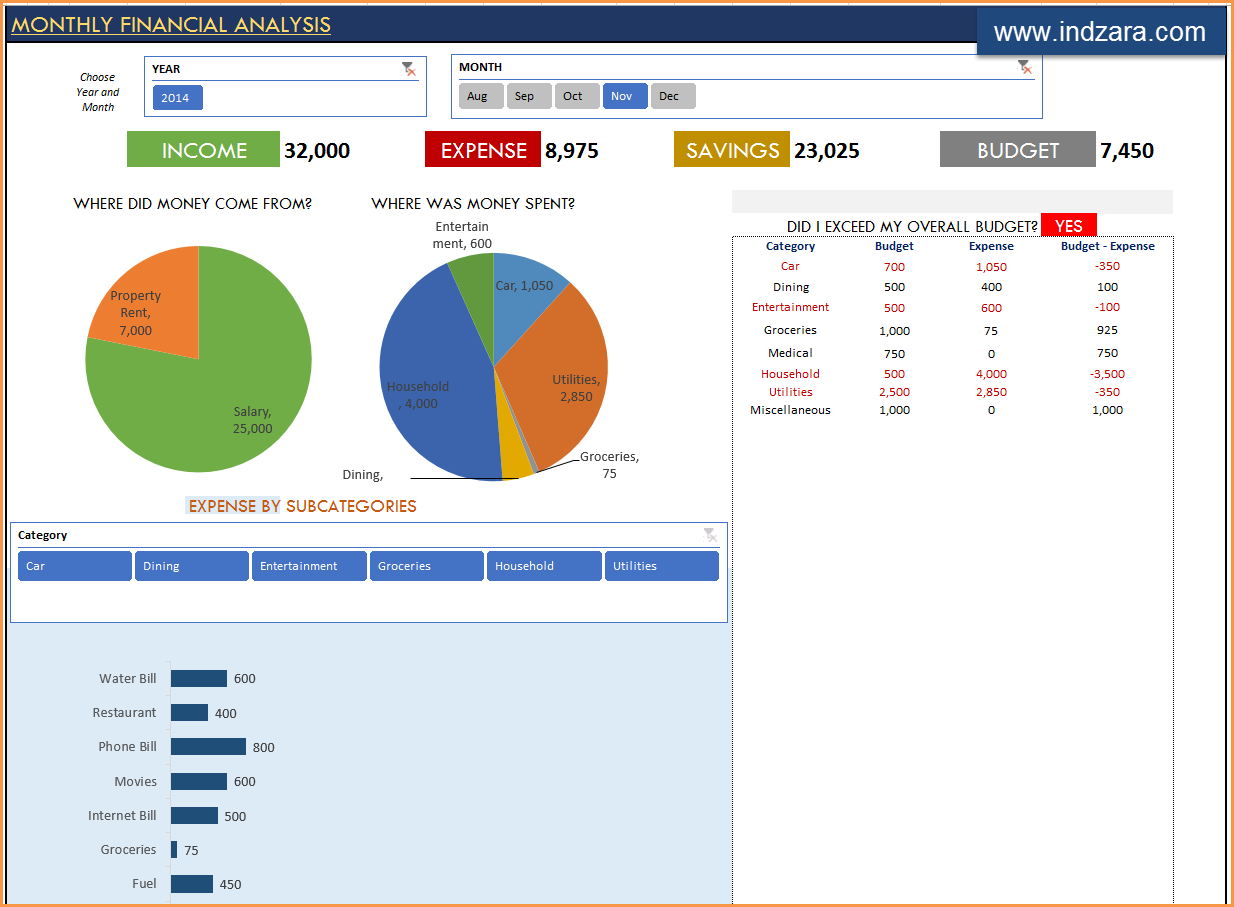

Summary: Explore how to use your personal finance Excel template to record and monitor your income sources and expenditures accurately, ensuring a clear overview of your financial situation.

5. Creating and Managing Budgets

Summary: Discover how to leverage the power of Excel templates to create realistic budgets, allocate funds to different categories, and track your progress throughout the month.

6. Visualizing Your Financial Goals

Summary: Learn how to use charts and graphs within your personal finance Excel template to visualize your financial goals and stay motivated on your journey towards financial freedom.

7. Analyzing Your Financial Data

Summary: Dive into the analytical capabilities of your Excel template, including generating reports, identifying spending patterns, and making informed financial decisions based on the insights gained.

8. Automating Your Personal Finance Management

Summary: Discover time-saving techniques to automate repetitive tasks within your personal finance Excel template, such as importing bank statements, categorizing transactions, and generating recurring expense reports.

9. Troubleshooting and Tips for Excel Template Users

Summary: Explore common issues and challenges that Excel template users may encounter, along with valuable tips and tricks to enhance your experience and overcome any obstacles.

10. Taking Your Personal Finance Excel Template to the Next Level

Summary: Learn advanced techniques and customization options to maximize the potential of your personal finance Excel template, including adding macros, integrating external data sources, and collaborating with others.

Conclusion

In conclusion, a personal finance Excel template can be a game-changer for anyone seeking to improve their financial management skills. By using this comprehensive tool, you can gain control over your money, track your income and expenses, create budgets, and plan for a secure financial future. So why wait? Get started today and take the first step towards achieving your financial goals!

Have more questions about using a personal finance Excel template? Check out the Q&A section below for further insights.

Q&A

Q: Can I use a personal finance Excel template on my Mac?

A: Absolutely! Excel templates are compatible with both Windows and Mac operating systems. Simply download the template and start managing your finances on your Mac with ease.

Q: Are there any free personal finance Excel templates available?

A: Yes, you can find numerous free personal finance Excel templates online. However, it's important to ensure that the template you choose meets your specific requirements and provides accurate calculations and features.

Q: Can I customize my personal finance Excel template to suit my preferences?

A: Certainly! Excel templates offer great flexibility for customization. You can modify the layout, add or remove categories, and tailor it to align with your unique financial goals and needs.

Q: Can I import my bank statements into a personal finance Excel template?

A: Yes, many personal finance Excel templates allow you to import your bank statements directly. This feature saves time and ensures accurate recording of your transactions.

Q: Is it possible to collaborate with others using a personal finance Excel template?

A: Excel templates can be easily shared with others, allowing for collaborative financial planning. You can grant specific permissions to individuals, such as read-only access or editing capabilities, depending on your requirements.

Remember, taking control of your personal finances is the first step towards achieving financial independence and peace of mind. With a personal finance Excel template, the journey becomes more manageable and enjoyable. Start using this powerful tool today and witness the positive impact it can have on your financial well-being.

Post a Comment for "Boost Your Financial Planning with a Personal Finance Excel Template"