Finance vs Accounting: Understanding the Key Differences

When it comes to the world of business and numbers, finance and accounting are two fundamental disciplines that play a crucial role. While both fields revolve around money and financial management, they have distinct areas of focus and unique responsibilities. In this blog article, we will delve deep into the comparison between finance and accounting, exploring their similarities, differences, and the various career paths they offer.

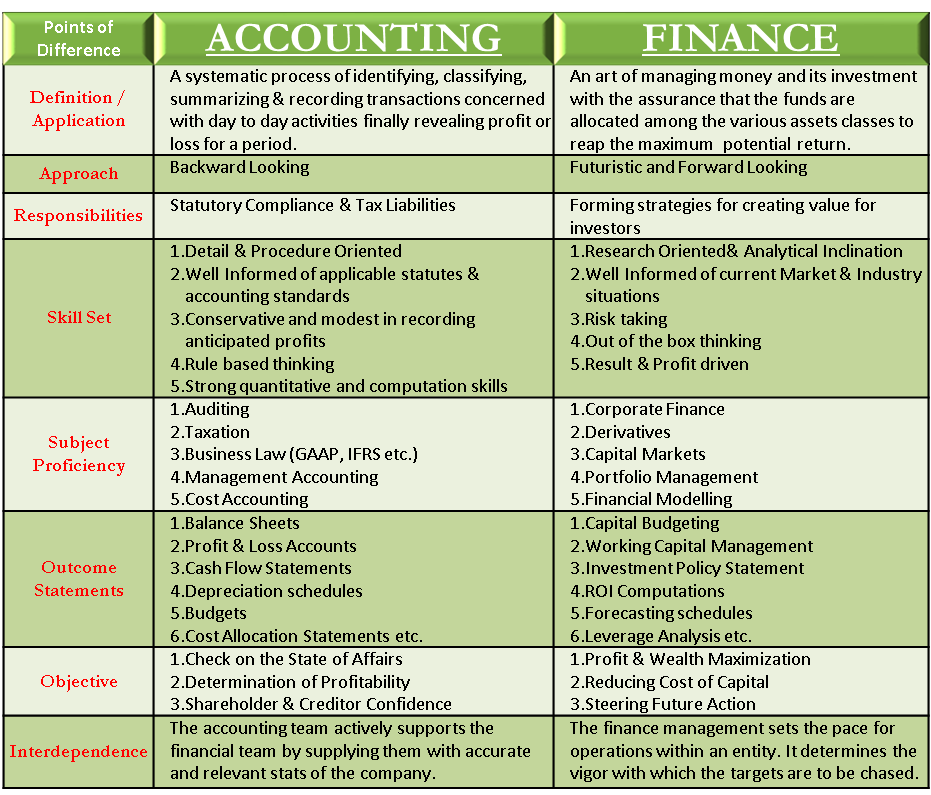

Firstly, let's understand the essence of finance. Finance is a broad term that encompasses the management, creation, and study of money, investments, and various financial assets. It involves analyzing risks, making informed decisions, and ensuring the optimal utilization of resources to maximize profitability. On the other hand, accounting is primarily concerned with recording, summarizing, analyzing, and reporting financial transactions. It provides a detailed and accurate picture of a company's financial health, enabling stakeholders to make informed decisions.

1. Education and Training

In terms of education, a finance professional typically requires a bachelor's degree in finance, economics, or a related field. Additional certifications such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) can enhance career prospects. Conversely, accountants often pursue a degree in accounting or finance, and many opt to become Certified Public Accountants (CPAs) by passing the respective exams.

Summary: Finance professionals usually hold degrees in finance, while accountants often specialize in accounting and can become CPAs.

2. Scope and Focus

Finance deals with broader aspects such as investment management, risk analysis, financial planning, and raising capital. It involves evaluating investment opportunities, managing portfolios, and creating financial strategies to achieve organizational goals. Accounting, on the other hand, focuses on recording financial transactions, preparing financial statements, and providing insights into a company's financial performance.

Summary: Finance encompasses investment management, while accounting concentrates on recording transactions and analyzing financial data.

3. Job Roles and Responsibilities

Professionals in finance often work as financial analysts, investment bankers, wealth managers, or financial planners. They analyze market trends, assess investment opportunities, and develop strategies to optimize financial resources. Accountants, on the other hand, work as auditors, tax consultants, controllers, or financial accountants. They handle financial records, ensure compliance with tax laws, and provide accurate financial reports.

Summary: Finance professionals work as analysts and planners, while accountants fulfill roles such as auditors and tax consultants.

4. Key Skills Required

Proficiency in financial analysis, risk assessment, and strategic planning are vital skills for finance professionals. They should have a strong understanding of financial markets, trends, and investment strategies. Accountants, on the other hand, need excellent attention to detail, knowledge of accounting principles, and expertise in financial software to accurately record and analyze financial data.

Summary: Finance professionals require skills in analysis and strategic planning, while accountants need attention to detail and accounting knowledge.

5. Career Outlook and Opportunities

Both finance and accounting offer promising career prospects. Finance professionals can explore opportunities in investment banking, corporate finance, financial consulting, or portfolio management. Accountants, on the other hand, can work as auditors, tax consultants, financial analysts, or even start their own accounting firms.

Summary: Finance professionals can pursue careers in investment banking or financial consulting, while accountants can become auditors or tax consultants.

In conclusion, while finance and accounting are intertwined fields, they have distinct roles, responsibilities, and skill sets. Finance focuses on managing money, making investment decisions, and optimizing financial resources, while accounting centers around recording transactions, preparing financial statements, and providing financial insights. Understanding the differences between finance and accounting is crucial for aspiring professionals to choose the right career path that aligns with their interests and strengths.

Have any more questions about finance vs accounting? Let's address some common queries:

1. What is the main difference between finance and accounting?

The main difference lies in their core functions. Finance involves managing money, making investment decisions, and optimizing financial resources, while accounting centers around recording transactions, preparing financial statements, and providing financial insights.

2. Can a person work in both finance and accounting?

Absolutely! Many professionals have skills and knowledge in both finance and accounting, allowing them to work in roles that require a combination of expertise from both fields.

3. Which field offers better career prospects?

Both finance and accounting offer promising career prospects. The choice ultimately depends on an individual's interests, strengths, and long-term career goals.

4. Do finance professionals need accounting knowledge?

While a solid foundation in accounting principles can be beneficial for finance professionals, it is not always a prerequisite. However, understanding financial statements and basic accounting concepts can certainly enhance their decision-making abilities.

5. Is a degree in finance or accounting more valuable?

Both degrees hold value and can lead to successful careers. The choice depends on an individual's specific interests and career aspirations within the finance or accounting domains.

Post a Comment for "Finance vs Accounting: Understanding the Key Differences"