The Ultimate Guide to Fire Finance: Achieving Financial Independence and Retiring Early

Are you tired of the daily grind and dreaming of financial freedom? Look no further! In this comprehensive guide, we will delve into the exciting world of Fire Finance – a movement that aims to help individuals achieve early retirement through smart financial planning and strategic investments. Whether you're a seasoned investor or just starting your financial journey, this article will provide you with valuable insights and practical tips to help you take control of your financial future.

Before we dive into the nitty-gritty, let's understand what Fire Finance is all about. Fire stands for Financial Independence, Retire Early – a concept that gained traction in recent years. It's a simple yet powerful idea: save aggressively, invest wisely, and retire early to enjoy a life of financial independence. Sounds intriguing, right? Let's explore the key components of Fire Finance and how you can apply them to your own life.

1. Understanding the Fire Movement

In this section, we will take an in-depth look at the Fire movement, its origins, and its core principles. You'll gain a solid understanding of what it means to achieve financial independence and retire early, and how it can transform your life.

2. Assessing Your Current Financial Situation

Before embarking on your Fire Finance journey, it's crucial to assess your current financial standing. We'll guide you through the process of evaluating your income, expenses, and savings rate. By gaining a clear picture of where you stand financially, you'll be better equipped to set achievable goals.

3. Creating a Budget that Works for You

Achieving financial independence requires discipline and careful budgeting. In this section, we'll walk you through the steps of creating a personalized budget that aligns with your financial goals. You'll learn how to prioritize expenses, cut unnecessary costs, and allocate funds towards your savings and investment goals.

4. Maximizing Your Income

Increasing your income is a crucial aspect of Fire Finance. We'll explore various strategies to boost your earning potential, whether through side hustles, career advancement, or passive income streams. Discover practical tips to diversify your income and accelerate your journey towards financial independence.

5. Understanding Investments and Asset Allocation

Investing wisely is key to achieving financial independence. In this section, we'll demystify the world of investments and guide you through the process of building a well-diversified portfolio. Gain insights into different asset classes, risk management, and long-term wealth accumulation strategies.

6. Strategies for Accelerating Your Savings

Looking to supercharge your savings rate? We've got you covered. Learn effective strategies to optimize your expenses, save more, and invest smarter. From frugal living tips to cutting-edge budgeting techniques, you'll discover actionable steps to accelerate your journey towards early retirement.

7. Navigating Challenges Along the Way

While working towards financial independence, you may encounter various challenges and roadblocks. We'll discuss common hurdles and provide practical solutions to overcome them. From managing debt to dealing with market volatility, this section will equip you with the knowledge and tools to stay on track towards your goals.

8. Building a Supportive Community

Embarking on a Fire Finance journey can feel overwhelming at times. That's why building a supportive community is crucial. We'll explore different resources, online communities, and networking opportunities where you can connect with like-minded individuals. Surround yourself with a supportive network to stay motivated and inspired throughout your journey.

9. Balancing Fire Finance and Enjoying Life

While Fire Finance emphasizes financial independence and early retirement, it's essential to strike a balance between your financial goals and enjoying life along the way. Discover how to find joy in the present moment while working towards your long-term goals. Learn about the concept of "lean fire" and explore creative ways to live a fulfilling life on your terms.

10. Putting Your Plan into Action

Now that you have gained a comprehensive understanding of Fire Finance, it's time to put your plan into action. We'll provide you with a step-by-step roadmap to kick-start your journey towards financial independence and early retirement. Get ready to take charge of your financial future and embark on a life-changing adventure!

Conclusion

Fire Finance offers a transformative approach to achieving financial independence and retiring early. By following the principles outlined in this guide, you can take control of your finances, build wealth, and create a life of freedom and flexibility. Remember, the journey may have its ups and downs, but with determination and the right strategies, you can turn your dreams of early retirement into a reality. Start your Fire Finance journey today and pave the way for a brighter and more fulfilling future.

Have any burning questions about Fire Finance? Check out the Q&A section below for answers to some commonly asked questions!

Q&A: Frequently Asked Questions about Fire Finance

1. How much money do I need to achieve Fire Finance?

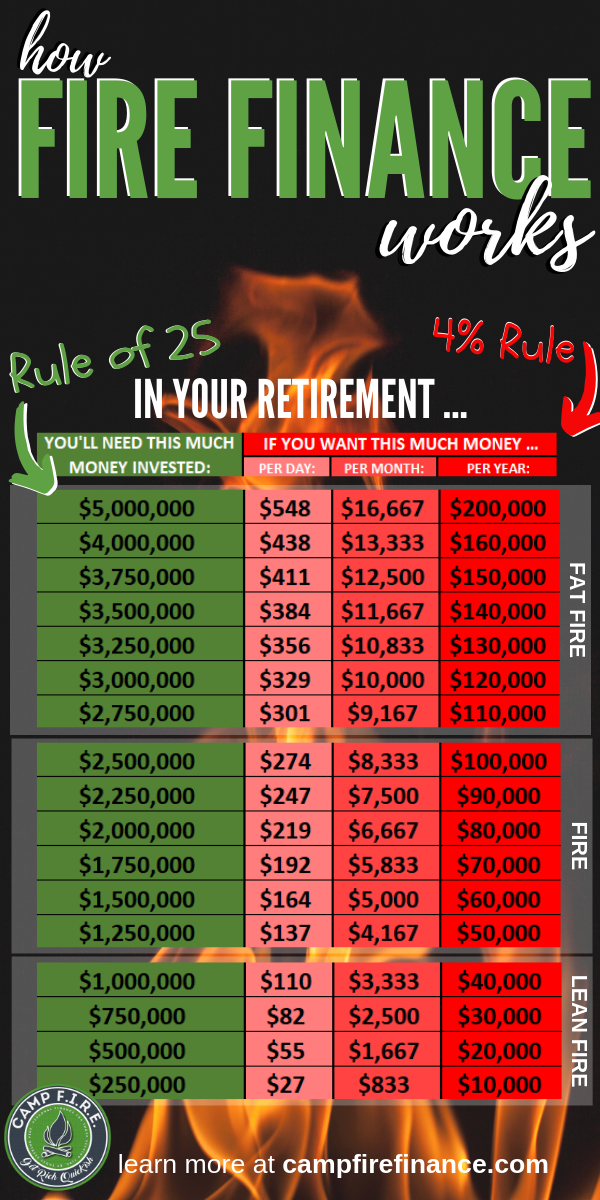

While the exact amount varies depending on individual circumstances, a commonly used rule of thumb is the "4% rule." This rule suggests that you need to save and invest enough to sustain an annual withdrawal rate of 4% from your portfolio to cover your expenses in retirement.

2. Is Fire Finance only for high-income earners?

No, Fire Finance is for everyone! While a higher income can accelerate your journey towards financial independence, the principles of Fire Finance can be applied to any income level. It's all about optimizing your expenses, maximizing your savings rate, and making wise investment decisions.

3. How long does it take to achieve Fire Finance?

The timeline for achieving Fire Finance varies depending on your savings rate, investment returns, and desired lifestyle. It could take anywhere from a decade to several decades. The key is to stay committed to your financial goals and consistently work towards them.

4. What if I love my job and don't want to retire early?

Fire Finance doesn't necessarily mean you have to retire early; it's about gaining financial independence and having the freedom to choose how you want to spend your time. If you love your job, you can continue working while enjoying the peace of mind that comes with financial security.

5. How do I stay motivated on my Fire Finance journey?

Maintaining motivation is crucial on a long-term journey like Fire Finance. Find ways to celebrate milestones, track your progress, and connect with a supportive community. Remember your "why" – the reasons you embarked on this journey in the first place – and envision the future you're working towards.

Post a Comment for "The Ultimate Guide to Fire Finance: Achieving Financial Independence and Retiring Early"