The Ultimate Guide to Personal Finance Software: Manage Your Money Like a Pro

Are you looking for an efficient way to take control of your finances? Look no further! In this comprehensive guide, we will delve into the world of personal finance software and explore how it can revolutionize the way you manage your money. Whether you are a budgeting novice or a seasoned pro, this article will provide you with all the information you need to make an informed decision and find the perfect software for your financial needs.

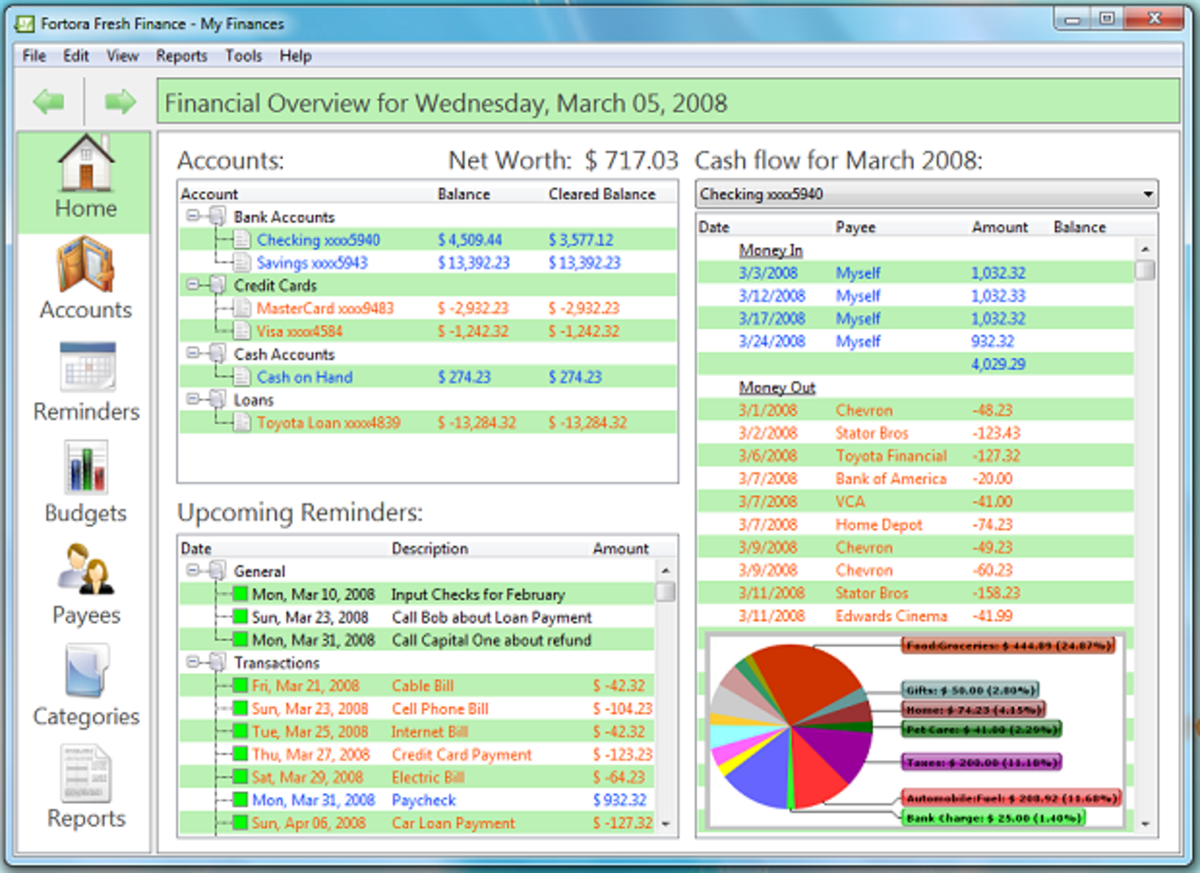

Managing personal finances can often be a daunting task, but with the right software, it becomes a breeze. Personal finance software offers a range of features that can help you track your income and expenses, create budgets, and even set financial goals. With a user-friendly interface and robust functionality, these tools allow you to gain a comprehensive view of your financial health and make informed decisions about your money.

1. Understanding Personal Finance Software

In this section, we will explore what personal finance software is and how it can benefit you. From its basic features to the advanced tools available, we will cover everything you need to know to get started.

2. Types of Personal Finance Software

Not all personal finance software is created equal. In this section, we will discuss the different types of software available, including budgeting tools, investment trackers, and tax preparation software, helping you choose the one that aligns with your financial goals.

3. Key Features to Consider

Personal finance software comes with a plethora of features, but which ones are essential for your needs? We will highlight the key features to look for, such as account syncing, bill tracking, and reporting capabilities, ensuring you find the software that ticks all the boxes.

4. Top Personal Finance Software of the Year

With so many options on the market, it can be challenging to decide which personal finance software to choose. Fear not! In this section, we will present a curated list of the top software solutions, providing a brief overview of their features, pricing, and user reviews.

5. How to Set Up Your Personal Finance Software

Once you have chosen the perfect personal finance software, it's time to set it up. In this section, we will guide you through the installation and setup process, ensuring you can start managing your money effectively right away.

6. Tips and Tricks for Maximizing Personal Finance Software

Want to make the most of your personal finance software? Look no further! This section will provide you with valuable tips and tricks to optimize your usage, from creating effective budgets to leveraging advanced features.

7. Common Mistakes to Avoid

Even with the best personal finance software, mistakes can happen. In this section, we will outline common pitfalls to avoid, such as inaccurate data entry and overlooking important features, helping you make the most of your software without any hiccups.

8. Enhancing Security and Privacy

Your financial information is precious, and personal finance software should prioritize security and privacy. In this section, we will discuss the measures you should take to enhance the security of your software and protect your sensitive data.

9. Mobile Apps for Personal Finance Software

In today's fast-paced world, managing your finances on the go is essential. This section will explore the top mobile apps for personal finance software, allowing you to stay on top of your money management wherever you are.

10. Future Trends in Personal Finance Software

The world of personal finance software is constantly evolving. In this final section, we will take a glimpse into the future and discuss the emerging trends and technologies that are shaping the industry, keeping you ahead of the curve.

Conclusion

Personal finance software is a powerful tool that can transform the way you manage your money. By providing a comprehensive overview of your finances and offering valuable insights, these software solutions empower you to make informed decisions and achieve your financial goals. Whether you are looking for budgeting assistance, investment tracking, or tax preparation, personal finance software has got you covered.

So, what are you waiting for? Take the plunge and explore the world of personal finance software today. With the guidance provided in this guide, you'll be well-equipped to find the perfect software for your needs and take control of your financial future.

Questions and Answers

1. Can personal finance software help me save money?

Absolutely! Personal finance software enables you to create budgets, track expenses, and identify areas where you can cut back. By gaining a clear understanding of your spending habits, you can make smarter financial decisions and save money.

2. Is personal finance software safe to use?

Most personal finance software employs robust security measures to protect your data. However, it's essential to choose reputable software providers and take additional steps, such as using strong passwords and keeping your software up to date, to enhance security and privacy.

3. Can I access personal finance software on my mobile device?

Yes! Many personal finance software solutions offer mobile apps, allowing you to manage your finances conveniently on your smartphone or tablet. These apps often provide the same features and functionality as their desktop counterparts.

4. How often should I update my personal finance software?

It's a good practice to update your personal finance software regularly to ensure you have the latest features and security patches. Additionally, updating your software allows you to take advantage of any bug fixes or performance improvements the provider may have released.

5. Can personal finance software help me with tax preparation?

Many personal finance software solutions offer tax preparation features, such as tracking deductible expenses and generating reports for tax purposes. However, it's important to note that personal finance software is not a substitute for professional tax advice, especially for complex tax situations.

Post a Comment for "The Ultimate Guide to Personal Finance Software: Manage Your Money Like a Pro"