Understanding Finance Rates: A Comprehensive Guide to Navigating the World of Interest Rates

When it comes to managing your finances, understanding the concept of finance rates is crucial. Whether you're looking to take out a loan, invest in stocks, or apply for a credit card, finance rates play a significant role in determining your financial obligations. In this blog article, we will delve into the world of finance rates, providing you with a detailed and comprehensive guide to help you make informed decisions.

First, let's start by defining finance rates. Finance rates, also known as interest rates, are the percentage of the loan amount or investment that is charged as an additional cost. These rates are determined by various factors, including the current economic climate, market trends, and your creditworthiness. It is crucial to understand how finance rates work, as they can significantly impact your overall financial well-being.

1. The Basics of Finance Rates

In this section, we will cover the fundamental concepts of finance rates. We will explain the different types of rates, such as fixed and variable rates, and how they can affect your financial decisions. Additionally, we will explore the factors that influence finance rates and provide tips on how to secure the best rates.

2. Loans and Finance Rates

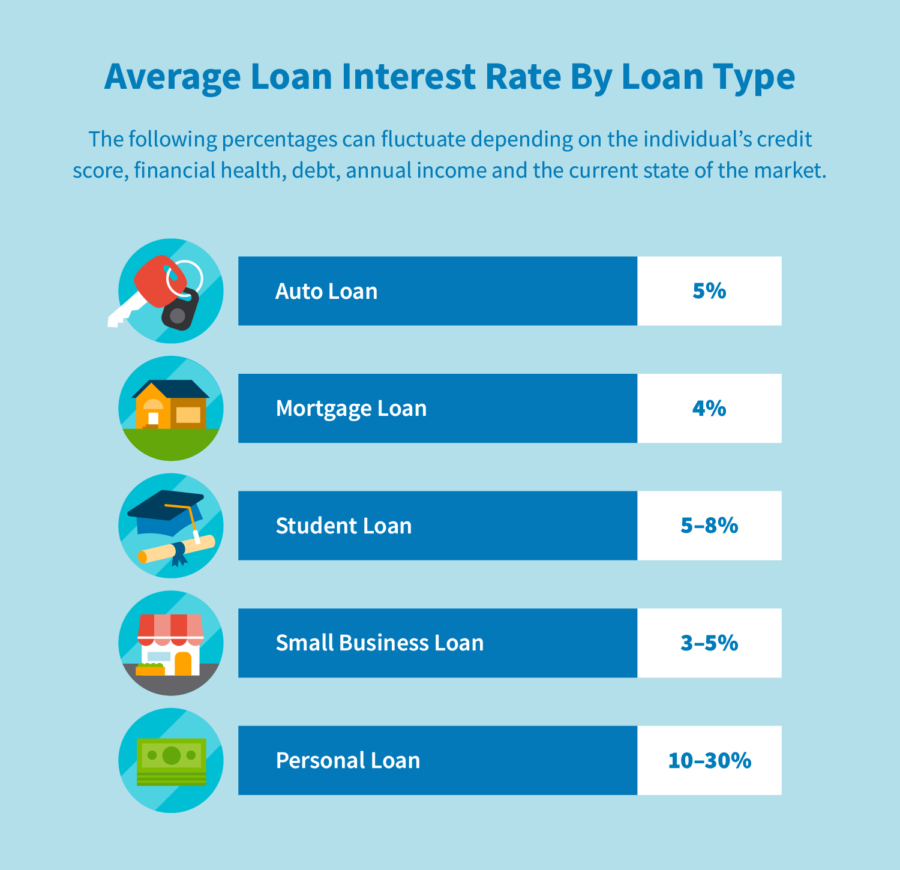

Loans are a common financial tool that often involves finance rates. In this section, we will discuss how finance rates are applied to loans, including mortgages, auto loans, and personal loans. We will explain how to calculate the interest you'll pay over the loan term and provide insights into refinancing options.

3. Credit Cards and Finance Rates

Understanding finance rates related to credit cards is essential for responsible credit card usage. We will explore how credit card interest rates work, how they are calculated, and how to avoid high interest charges. Moreover, we will discuss strategies to negotiate lower rates with credit card companies.

4. Investments and Finance Rates

Investing your money can yield significant returns, but finance rates also come into play. In this section, we will explore how finance rates impact investments, such as stocks, bonds, and mutual funds. We will discuss the relationship between interest rates and market performance and provide tips for managing investments in changing interest rate environments.

5. Finance Rates and Debt Management

For those struggling with debt, finance rates can be a major concern. In this section, we will offer guidance on managing debt in relation to finance rates. We will explore strategies to reduce interest charges, consolidate debt, and improve your credit score to secure more favorable rates.

6. The Impact of Finance Rates on Mortgages

Buying a home is a significant financial decision that involves finance rates. Here, we will delve deeper into mortgage rates, explaining how they are determined and how they affect your monthly payments. We will also discuss the pros and cons of fixed-rate and adjustable-rate mortgages.

7. Finance Rates and Small Business Loans

Entrepreneurs and small business owners often rely on loans to fund their ventures. In this section, we will explore how finance rates impact small business loans, including lines of credit and term loans. We will discuss the importance of interest rates in business financing decisions and provide tips for securing favorable rates.

8. Student Loans and Finance Rates

For many individuals pursuing higher education, student loans are a necessity. Here, we will discuss the finance rates associated with student loans, including federal and private loans. We will explain the difference between subsidized and unsubsidized loans and provide guidance on managing student loan debt.

9. Negotiating Finance Rates

When dealing with finance rates, it's essential to know how to negotiate for better terms. In this section, we will provide practical tips on negotiating finance rates, whether you're applying for a loan, seeking a credit card, or investing. We will share strategies to leverage your creditworthiness and market knowledge to secure more favorable rates.

10. Future Trends in Finance Rates

Finally, we will discuss future trends in finance rates. As the economy and market conditions evolve, finance rates also change. In this section, we will explore predictions and forecasts for interest rates, providing insights into potential shifts and their potential impact on various financial aspects.

In conclusion, finance rates are a significant aspect of personal finance that should not be overlooked. By understanding the intricacies of finance rates, you can make informed decisions and navigate the financial landscape more effectively. Whether you're considering taking out a loan, investing, or managing debt, the knowledge gained from this comprehensive guide will empower you to make sound financial choices.

Have any questions about finance rates? Check out the Q&A section below for some common queries and their answers.

Q&A: Common Questions About Finance Rates

Q: How do finance rates affect my monthly payments?

A: Finance rates directly impact your monthly payments by determining the amount of interest you'll pay on a loan or credit card balance. Higher rates translate to higher payments, while lower rates result in lower payments.

Q: Can I negotiate finance rates when applying for a loan?

A: Yes, it's possible to negotiate finance rates when applying for a loan. Having a good credit score, shopping around for different lenders, and showcasing your financial stability can increase your chances of securing better rates.

Q: How can I improve my credit score to get lower finance rates?

A: Improving your credit score involves paying bills on time, reducing debt, and keeping credit utilization low. Additionally, regularly reviewing your credit report for errors and addressing them can positively impact your credit score.

Q: What factors influence finance rates?

A: Several factors influence finance rates, including the current state of the economy, inflation rates, central bank policies, market demand, and your creditworthiness. These factors collectively determine the risk associated with lending or investing.

Q: Should I choose a fixed or variable finance rate?

A: The choice between a fixed or variable finance rate depends on your financial circumstances and risk tolerance. A fixed rate offers stability with predictable payments, while a variable rate can fluctuate but may offer potential savings if rates decrease.

Remember, finance rates can significantly impact your financial decisions, so always seek professional advice tailored to your unique situation.

Post a Comment for "Understanding Finance Rates: A Comprehensive Guide to Navigating the World of Interest Rates"