Understanding Public Finance: A Comprehensive Guide

Public finance plays a crucial role in the functioning of governments and economies worldwide. It encompasses the management of resources, revenue generation, and allocation of funds by public entities. Whether you are an economics enthusiast, a government official, or simply curious about how public finances work, this article will provide you with a comprehensive overview of the subject.

In the following sections, we will delve into various aspects of public finance, ranging from its definition and importance to the key principles and techniques used in this field. We will explore the sources of government revenue, examine different types of public expenditure, and shed light on the mechanisms through which governments manage their finances. By the end of this article, you will have a solid understanding of the intricacies of public finance and its significance in shaping economies and societies.

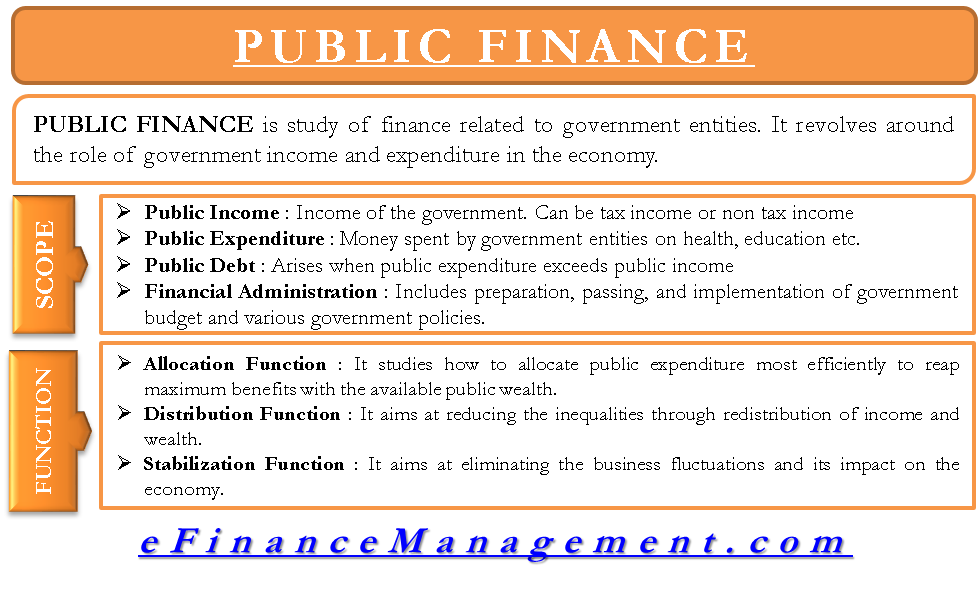

1. What is Public Finance?

In this section, we will define public finance and explore its scope and objectives. We will discuss the role of governments in managing public finances and highlight the key areas this discipline covers.

Summary: This section provides an overview of public finance, including its definition, scope, objectives, and the role of governments in its management.

2. Importance of Public Finance

This section will delve into the significance of public finance at both macro and micro levels. We will explore how well-managed public finances contribute to economic stability, sustainable development, and the overall well-being of society.

Summary: This section emphasizes the importance of public finance in achieving economic stability, sustainable development, and societal well-being.

3. Sources of Government Revenue

In this section, we will examine the various sources from which governments generate revenue. We will discuss taxation, borrowing, grants, and other means through which public entities finance their activities.

Summary: This section provides an overview of the different sources of government revenue, including taxation, borrowing, and grants.

4. Types of Public Expenditure

Here, we will explore the different categories of public expenditure, such as capital expenditure, social welfare programs, infrastructure development, and defense spending. We will discuss the purposes and implications of each type of expenditure.

Summary: This section highlights the various types of public expenditure, including capital expenditure, social welfare programs, infrastructure development, and defense spending.

5. Budgeting and Financial Planning

In this section, we will delve into the budgeting process and financial planning in the context of public finance. We will discuss the key steps involved in creating a government budget and the importance of effective financial planning for optimal resource allocation.

Summary: This section explores the budgeting process and the significance of financial planning in public finance.

6. Public Debt and Deficit Financing

Here, we will examine the concept of public debt and its implications. We will discuss deficit financing, its pros and cons, and its role in stimulating economic growth or potential risks it may pose.

Summary: This section provides insights into public debt, deficit financing, and their impact on economic growth and stability.

7. Public Financial Management Systems

In this section, we will explore the frameworks and systems governments use to manage their finances effectively. We will discuss the importance of transparency, accountability, and efficiency in public financial management.

Summary: This section highlights the significance of robust public financial management systems, including transparency, accountability, and efficiency.

8. Public Finance and Economic Policy

Here, we will examine the relationship between public finance and economic policy. We will discuss how governments use fiscal policy tools to influence economic growth, inflation, and employment rates.

Summary: This section explores the interplay between public finance and economic policy, focusing on the use of fiscal policy tools.

9. International Public Finance

In this section, we will touch on international public finance, including concepts like foreign aid, international organizations, and global financial management. We will highlight the role of international cooperation in addressing global challenges through financial mechanisms.

Summary: This section provides an overview of international public finance, focusing on foreign aid, international organizations, and global financial management.

10. Public Finance and Sustainable Development

Here, we will discuss the role of public finance in achieving sustainable development goals. We will explore how governments allocate funds for environmental protection, social equity, and inclusive economic growth.

Summary: This section emphasizes the importance of public finance in promoting sustainable development through investments in environmental protection, social equity, and economic growth.

Conclusion

Public finance is a multidimensional field that underpins the functioning of governments and economies. Through effective management of resources and finances, public entities can foster economic stability, sustainable development, and societal well-being. By understanding the intricacies of public finance, individuals can actively engage in public policy discussions and contribute to shaping a better future for their communities and nations.

As you navigate the world of public finance, keep in mind that its principles and practices evolve over time. Staying informed about the latest developments and reforms in public finance will enable you to grasp the dynamic nature of this field and its implications for the broader economy.

Question and Answer

1. What are the main sources of government revenue?

2. How does public finance contribute to economic stability?

3. What is the role of budgeting in public finance?

4. What are the potential risks of deficit financing?

5. How does public finance support sustainable development?

Post a Comment for "Understanding Public Finance: A Comprehensive Guide"