Welcome to our comprehensive guide on Capital One Auto Finance! If you're in the market for a new car or looking to refinance your current vehicle, Capital One Auto Finance offers a range of solutions to meet your needs. In this article, we will explore the ins and outs of Capital One Auto Finance, providing you with all the information you need to make an informed decision.

Whether you're a first-time car buyer or a seasoned pro, understanding the financing options available to you is crucial. Capital One Auto Finance provides competitive rates, personalized loan options, and a streamlined application process. We'll walk you through the benefits of choosing Capital One Auto Finance and how to get started.

1. How Does Capital One Auto Finance Work?

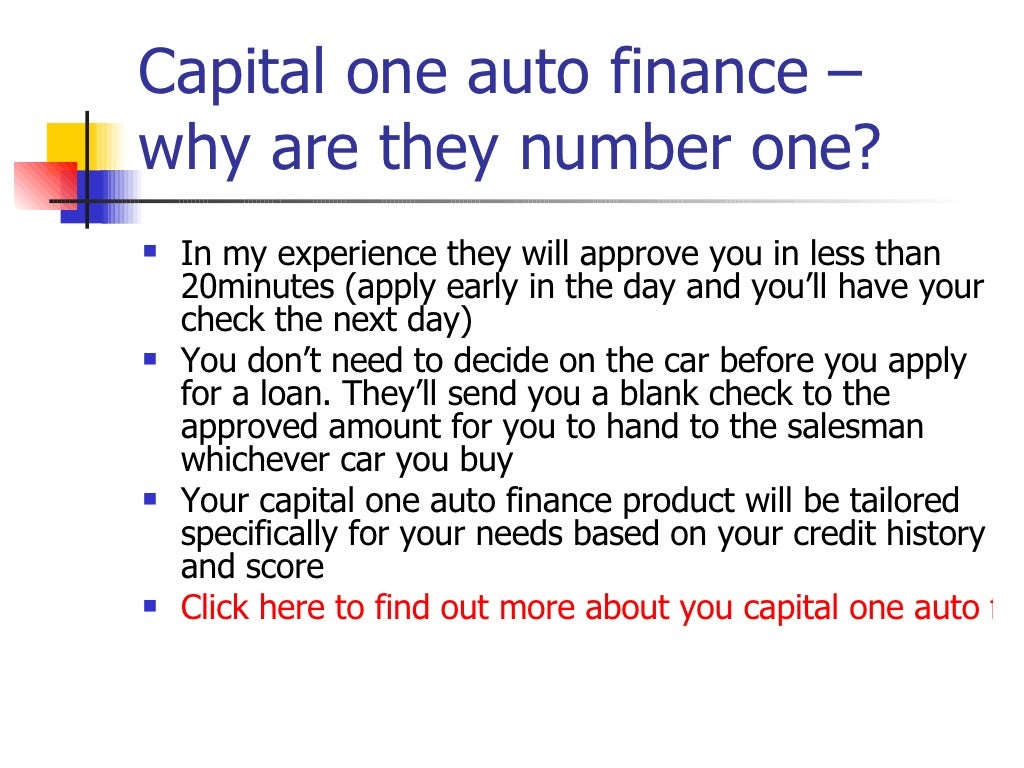

In this section, we will explain the process of obtaining an auto loan through Capital One. From pre-approval to loan disbursement, we'll cover each step in detail, ensuring you have a clear understanding of the process.

2. What Are the Benefits of Capital One Auto Finance?

Discover the advantages of choosing Capital One Auto Finance for your car loan needs. We'll discuss competitive interest rates, flexible loan terms, and additional perks that set Capital One apart from other lenders.

3. Understanding Capital One Auto Loan Rates

Interest rates play a crucial role in determining the cost of your auto loan. In this section, we'll explain how Capital One determines loan rates and provide tips on securing the best possible rate for your specific situation.

4. Personalized Loan Options with Capital One

Not all car buyers have the same financial circumstances. Capital One Auto Finance understands this and offers personalized loan options to meet varying needs. We'll explore the different loan types available and how to choose the right one for you.

5. Applying for an Auto Loan with Capital One

Ready to take the next step? Applying for an auto loan with Capital One is straightforward. In this section, we'll guide you through the application process, highlighting the necessary documents and providing tips for a successful application.

6. Capital One Auto Navigator: A Convenient Car Shopping Tool

Capital One Auto Navigator is a powerful online tool that simplifies the car shopping experience. Learn how to use this tool to find your dream car, get personalized financing options, and streamline the buying process.

7. Capital One Auto Finance for Refinancing

If you already have an auto loan but want to explore better options, Capital One Auto Finance also offers refinancing solutions. Discover the benefits of refinancing and how Capital One can help you save money on your monthly payments.

8. Capital One Auto Finance Customer Reviews

Don't just take our word for it! Hear from real customers who have experienced Capital One Auto Finance firsthand. We'll share their stories and provide insights into the customer satisfaction levels you can expect.

9. Frequently Asked Questions about Capital One Auto Finance

Here, we'll address some of the most common questions people have about Capital One Auto Finance. From credit requirements to loan terms, we'll provide clear and concise answers to ensure you have all the information you need.

10. Tips for Successful Car Financing with Capital One

In this final section, we'll share some expert tips to make the most of your car financing experience with Capital One. From improving your credit score to negotiating with dealers, we'll equip you with the knowledge to secure the best possible deal.

Capital One Auto Finance offers a comprehensive range of auto financing options, ensuring you can find the right solution for your needs. With competitive rates, personalized loan options, and a user-friendly application process, Capital One is an excellent choice for all types of car buyers.

Remember, whether you're purchasing a new car or looking to refinance an existing loan, it's essential to do your research and compare different lenders. By understanding the ins and outs of Capital One Auto Finance, you can make an informed decision that aligns with your financial goals.

If you have any further questions or need assistance, don't hesitate to reach out to Capital One's dedicated customer support team. Happy car shopping!

Question and Answer

1. What are the minimum credit requirements for Capital One Auto Finance?

Capital One Auto Finance does not disclose specific credit score requirements. However, they consider various factors, including credit history, income, and debt-to-income ratio, when evaluating loan applications.

2. Can I apply for a Capital One Auto loan if I have bad credit?

Yes, Capital One considers applicants with less-than-perfect credit. However, keep in mind that individuals with lower credit scores may face higher interest rates or additional requirements.

3. How long does the Capital One Auto Finance application process typically take?

The application process can vary depending on individual circumstances. In most cases, Capital One provides a decision within minutes of submitting the application, allowing you to quickly move forward with your car purchase.

4. Can I refinance my existing auto loan with Capital One Auto Finance?

Absolutely! Capital One Auto Finance offers refinancing options for individuals looking to lower their monthly payments or secure better loan terms. It's a great way to save money on your current auto loan.

5. Is Capital One Auto Navigator available for all car dealerships?

While Capital One Auto Navigator is widely accepted, it's always a good idea to check with your preferred dealership to ensure they accept this financing tool. Most reputable dealerships are familiar with Capital One's services and can guide you through the process.