The Comprehensive Guide to VIX Yahoo Finance: Exploring Volatility Index and its Impact on the Market

Are you curious about VIX Yahoo Finance and its significance in the financial world? Look no further! In this comprehensive guide, we will delve into the depths of the Volatility Index (VIX) and its relationship with Yahoo Finance. Whether you are a seasoned investor or just starting your journey in the stock market, understanding the VIX and its implications can be a game-changer for your financial endeavors.

Before we dive into the details, let's briefly introduce what VIX Yahoo Finance entails. The VIX, also known as the "fear index," measures the market's expectation of volatility over the next 30 days. It is often considered a reliable indicator of investor sentiment, reflecting the level of uncertainty or fear in the market. Yahoo Finance, on the other hand, is a popular financial platform that provides real-time stock quotes, news, and financial information to millions of users worldwide.

1. What is VIX and How Does it Work?

In this section, we will explore the fundamentals of the VIX, including its calculation and interpretation. By understanding how the VIX functions, you will be able to grasp its significance in the financial landscape and make informed investment decisions.

2. The Relationship Between VIX and Market Volatility

This section will delve into the intricate relationship between the VIX and market volatility. We will explore how changes in the VIX affect various asset classes and understand its implications for traders and investors alike.

3. VIX Yahoo Finance: A Powerful Tool for Investors

Discover the features and benefits of utilizing VIX Yahoo Finance as part of your investment toolkit. From analyzing historical data to tracking market trends, this section will shed light on how you can leverage Yahoo Finance to gain a competitive edge in the financial world.

4. Interpreting VIX: Key Factors to Consider

Interpreting the VIX requires a deep understanding of various factors that influence its movement. From geopolitical events to economic indicators, we will highlight the key elements that can impact the VIX and guide you in making well-informed investment choices.

5. VIX Trading Strategies: Navigating Volatility with Confidence

Explore different trading strategies that can be employed using the VIX as a tool. Whether you are a risk-averse investor or a seasoned trader, this section will provide insights into how you can profitably navigate the markets with VIX-based trading strategies.

6. The Role of VIX in Risk Management

Risk management is vital in any investment endeavor, and the VIX plays a crucial role in assessing market risk. Learn how to incorporate the VIX into your risk management strategies to protect your portfolio against potential downturns.

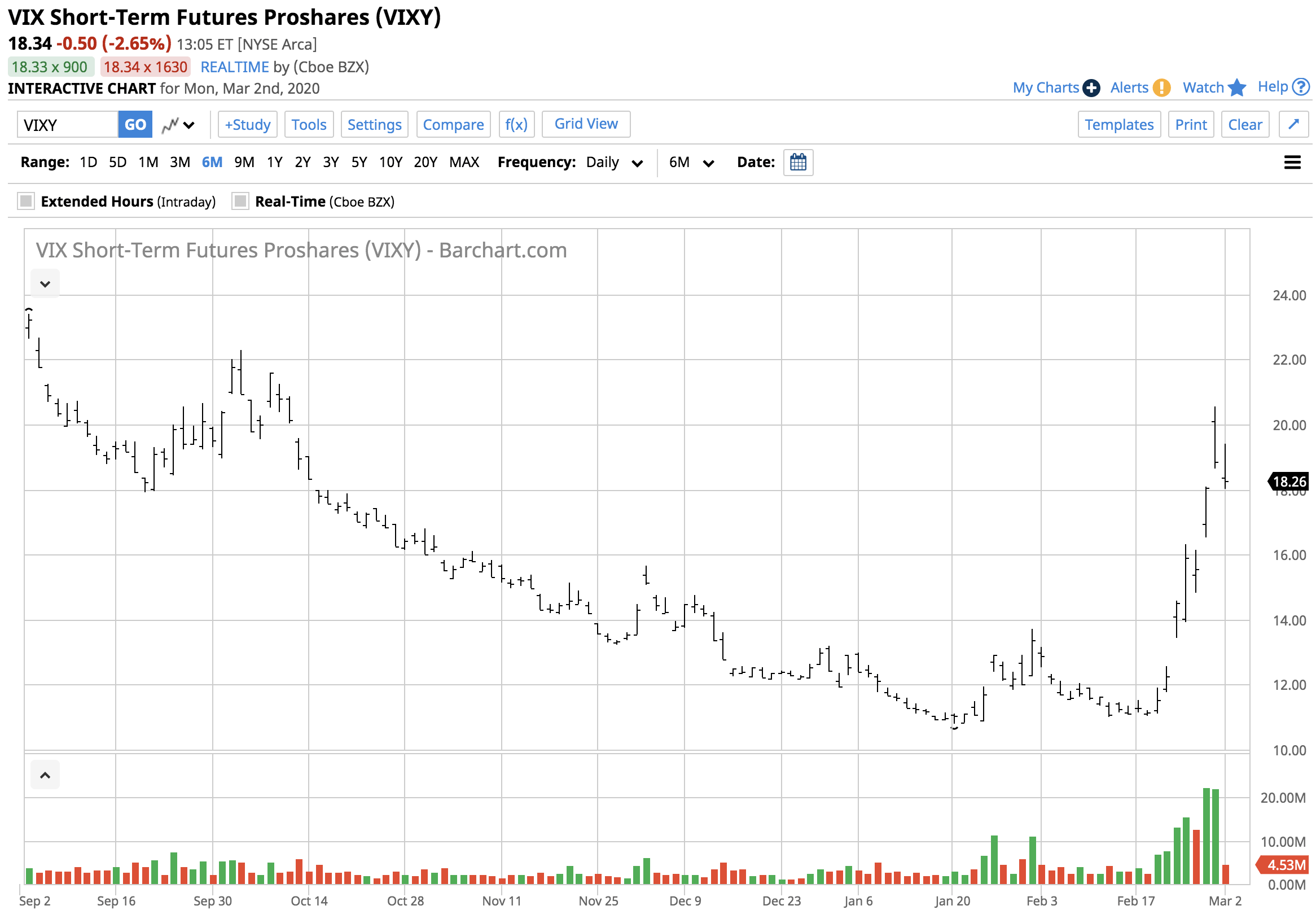

7. VIX ETFs and Their Impact on the Market

Exchange-Traded Funds (ETFs) linked to the VIX have gained significant popularity in recent years. This section will explore the pros and cons of investing in VIX ETFs and examine their impact on the broader market.

8. Historical Analysis: VIX Performance during Market Crashes

Take a closer look at historical market crashes and their correlation with the VIX. By analyzing past events, we can gain insights into how the VIX behaves during periods of extreme market volatility and draw lessons for future investments.

9. VIX and Its Influence on Option Pricing

Discover the close relationship between the VIX and option pricing. This section will provide an overview of how changes in the VIX affect option premiums and explore the implications for options traders.

10. VIX Contango and Backwardation: Unraveling the Mysteries

Contango and backwardation are two essential concepts related to the VIX futures market. Unravel the mysteries surrounding these terms in this section and understand their significance in predicting future market trends.

Conclusion

In conclusion, understanding VIX Yahoo Finance is crucial for anyone seeking to navigate the complexities of the financial market successfully. By delving into the intricacies of the VIX, its relationship with market volatility, and utilizing Yahoo Finance as a powerful tool, you can make informed investment decisions and potentially enhance your financial success. So, why wait? Begin your journey into the world of VIX Yahoo Finance today and unlock a world of opportunities.

Have any lingering questions about VIX Yahoo Finance and its implications? Let's address some of the most frequently asked questions:

Q1: How often is the VIX calculated and updated?

The VIX is calculated and updated in real-time throughout the trading day. It provides an up-to-date measure of market volatility, reflecting the current sentiment of investors.

Q2: Can the VIX predict market crashes?

While the VIX is a valuable indicator of market sentiment and volatility, it is important to note that it does not directly predict market crashes. However, sharp increases in the VIX are often associated with heightened market uncertainty.

Q3: Are there any alternative volatility indexes apart from the VIX?

Yes, there are several alternative volatility indexes available, such as the VXN (Nasdaq-100 Volatility Index) and the RVX (Russell 2000 Volatility Index). These indexes focus on specific market segments and provide additional insights into volatility trends.

Q4: How can I access VIX Yahoo Finance on the Yahoo Finance platform?

To access the VIX on Yahoo Finance, simply search for "VIX" or "Volatility Index" in the search bar. The VIX data, along with relevant news and analysis, will be readily available for your reference.

Q5: Can I trade the VIX directly?

Yes, you can trade the VIX directly through VIX futures contracts or Exchange-Traded Products (ETPs) linked to the VIX, such as VIX ETFs. However, it is important to note that trading the VIX can be complex and may require a thorough understanding of volatility products.

Post a Comment for "The Comprehensive Guide to VIX Yahoo Finance: Exploring Volatility Index and its Impact on the Market"