Exploring the Dynamics of Worldwide Finance: A Comprehensive Guide

Finance plays a pivotal role in the global economy, shaping the trajectory of businesses, individuals, and nations. In this blog article, we delve into the intricate world of worldwide finance, uncovering its complexities and shedding light on its fundamental principles. Whether you're an aspiring finance professional or simply curious about how the global financial system operates, this comprehensive guide aims to provide you with a deeper understanding of the intricacies and dynamics of worldwide finance.

From the multinational corporations exerting influence on the global stage to the intricate web of financial markets connecting economies worldwide, the realm of worldwide finance is vast and ever-evolving. With this article, we aim to demystify this complex domain by breaking it down into ten key sessions, each focusing on a specific aspect of worldwide finance.

1. Understanding Global Financial Systems

In this session, we explore the foundations of global financial systems, examining the roles of central banks, regulatory bodies, and international financial institutions. We delve into the mechanisms that facilitate global trade and investment, including the importance of exchange rates and capital flows. Understanding these systems is crucial for grasping the dynamics of worldwide finance.

2. The Role of Multinational Corporations

This session sheds light on the significance of multinational corporations (MNCs) in the global financial landscape. We delve into their operations, organizational structures, and the impact they have on economies worldwide. Additionally, we analyze the strategies MNCs employ to navigate the complexities of global markets.

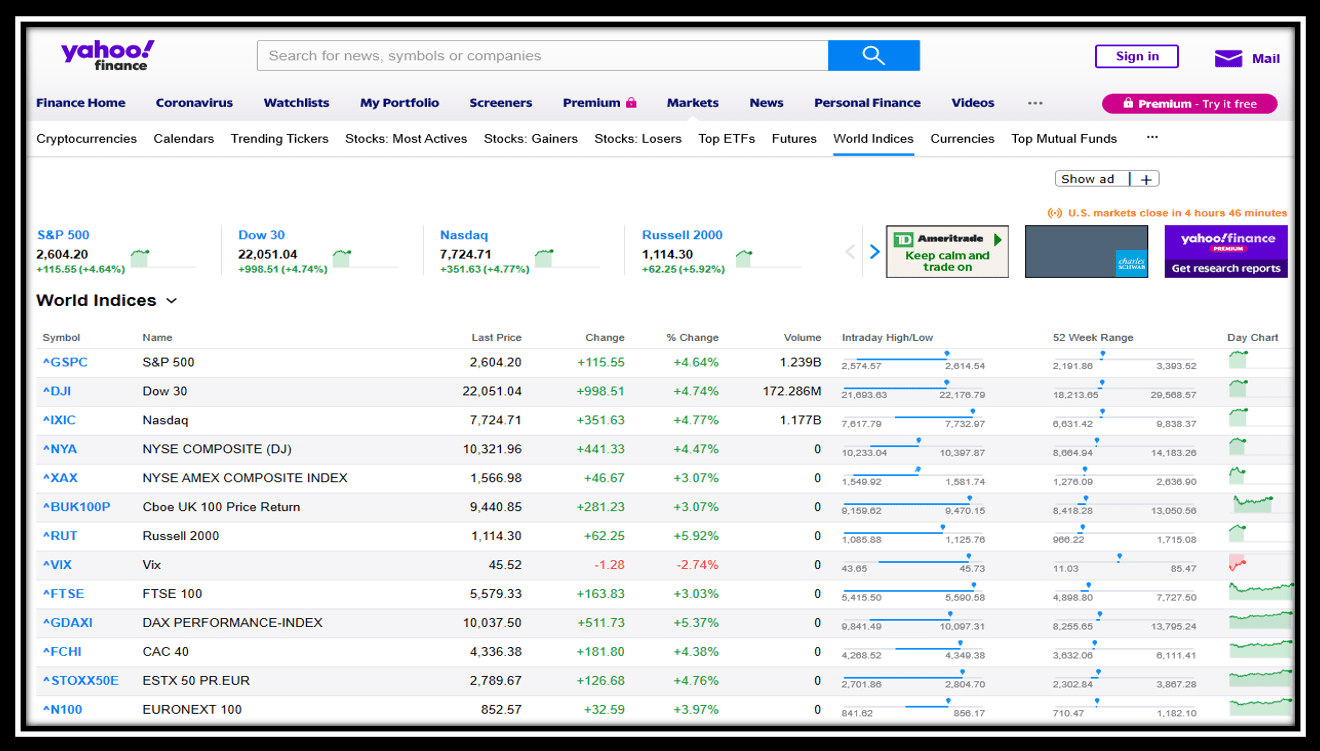

3. International Financial Markets

In this session, we explore the interconnected web of international financial markets, including stock markets, bond markets, and currency markets. We examine how these markets facilitate capital allocation, investment, and risk management on a global scale, while also considering the factors that influence their volatility and stability.

4. Global Banking and Financial Institutions

Here, we delve into the world of global banking and financial institutions, examining their pivotal roles as intermediaries, lenders, and regulators. We analyze the functions of commercial banks, investment banks, and other financial entities, highlighting their significance in ensuring financial stability and enabling economic growth.

5. International Trade and Finance

This session focuses on the intricate relationship between international trade and finance. We explore the mechanisms through which countries conduct cross-border transactions, including trade financing, foreign exchange markets, and international payment systems. Understanding these dynamics is essential for comprehending the global flow of goods and services.

6. Foreign Direct Investment (FDI)

Here, we delve into the realm of foreign direct investment (FDI), examining its impact on economies and the factors that drive and shape these investments. We analyze the benefits and risks associated with FDI, while also considering the role of governments in attracting and regulating foreign investments.

7. Global Financial Crises

In this session, we explore the historical context and causes of global financial crises, examining the impact they have on economies and individuals. We delve into the role of financial regulation and crisis management, seeking to understand how lessons from past crises can inform policies and safeguard against future economic downturns.

8. Emerging Markets and Global Finance

Here, we shine a spotlight on emerging markets and their significance in the global financial landscape. We analyze the unique opportunities and challenges these markets present, including the role of technology, foreign investment, and economic reforms in shaping their trajectories.

9. Sustainable Finance

This session explores the growing importance of sustainable finance, focusing on the integration of environmental, social, and governance (ESG) factors into financial decision-making. We examine the role of sustainable investments, green bonds, and corporate social responsibility in promoting a more environmentally and socially conscious financial system.

10. The Future of Worldwide Finance

Concluding our journey through worldwide finance, we peer into the future, considering the potential disruptions and transformations that lie ahead. From the impact of technological advancements to changing geopolitical landscapes, we ponder the possibilities and challenges that await the global financial system.

In conclusion, worldwide finance encompasses a vast and intricate realm that influences economies and individuals across the globe. By exploring its various facets in this comprehensive guide, we aim to provide a deeper understanding of the dynamics and complexities of worldwide finance. Whether you're a finance enthusiast or simply seeking to expand your knowledge on this subject, we hope this article has shed light on the fascinating world of worldwide finance.

Question and Answer:

Q: How does worldwide finance impact the global economy?

A: Worldwide finance plays a pivotal role in shaping the global economy by facilitating cross-border transactions, enabling investments, and influencing economic policies. It allows countries to access capital, manage risks, and foster economic growth, making it a crucial factor in determining the trajectory of nations.

Q: What are some key challenges faced by multinational corporations in worldwide finance?

A: Multinational corporations face various challenges in the realm of worldwide finance, including currency fluctuations, regulatory differences, geopolitical risks, and cultural barriers. Navigating these complexities requires careful financial planning, risk management strategies, and cultural sensitivity.

Q: How can sustainable finance contribute to a more responsible global financial system?

A: Sustainable finance integrates environmental, social, and governance factors into financial decision-making, promoting investments that have a positive impact on society and the environment. By encouraging responsible and ethical practices, sustainable finance aims to create a more sustainable and socially conscious global financial system.

Q: What role do international financial institutions play in worldwide finance?

A: International financial institutions, such as the International Monetary Fund (IMF) and the World Bank, play crucial roles in worldwide finance. They provide financial assistance, promote economic stability, facilitate global trade, and offer policy advice to member countries, contributing to the overall functioning of the global financial system.

Q: How can emerging markets shape the future of worldwide finance?

A: Emerging markets have the potential to significantly influence the future of worldwide finance. With their rapid economic growth, technological advancements, and increasing integration into the global economy, emerging markets present opportunities for innovation, diversification, and new investment avenues, thus reshaping the dynamics of worldwide finance.

Post a Comment for "Exploring the Dynamics of Worldwide Finance: A Comprehensive Guide"