The Ultimate Guide to the Highest Paying Finance Jobs: Unlocking Lucrative Career Opportunities

Are you searching for a career path that offers both financial stability and growth potential? Look no further! In this comprehensive guide, we will delve into the world of finance and explore the highest paying jobs in the industry. Whether you are a recent graduate or an experienced professional looking for a change, this article will provide you with valuable insights and help you make informed decisions about your future.

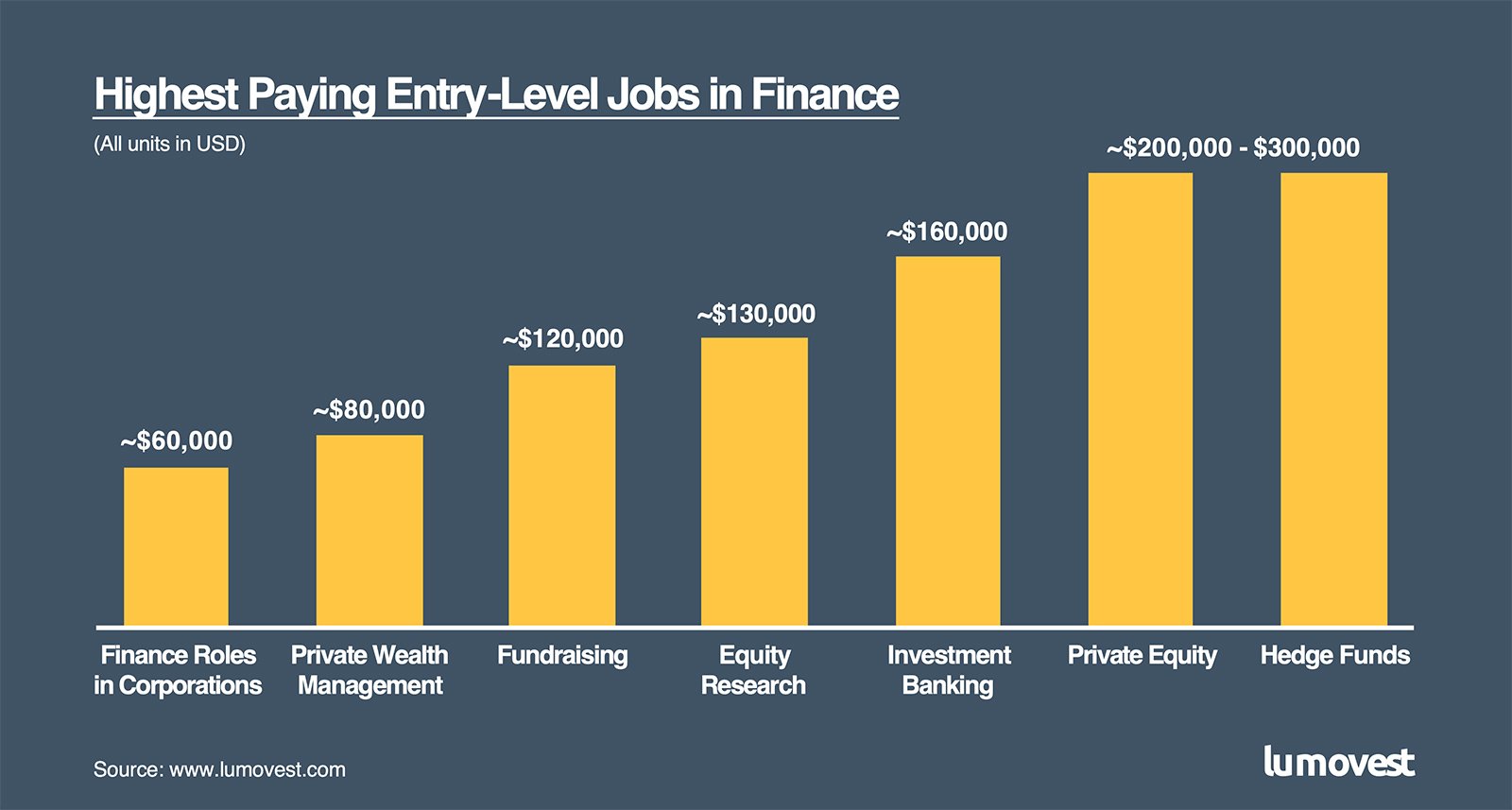

Finance is a vast field with numerous lucrative opportunities, and it can be overwhelming to determine which path to pursue. That's why we have compiled a list of the highest paying finance jobs to help you narrow down your options. From investment banking to financial management, we will explore each profession's earning potential, required qualifications, and the skills necessary to succeed.

1. Investment Banking: Unlocking the Doors to Financial Success

Investment banking is renowned for its sky-high salaries, making it one of the most coveted professions in finance. In this section, we will delve into the world of investment banking, discussing the roles and responsibilities, salary expectations, and the steps you can take to break into this competitive field.

2. Financial Management: Balancing the Books and the Bank Account

If you have a knack for numbers and a passion for strategic decision-making, a career in financial management might be the perfect fit for you. In this section, we will explore the various roles within financial management, including CFOs and financial controllers, while shedding light on the earning potential and career progression in this field.

3. Actuarial Science: Calculating Risk for Lucrative Rewards

Are you a math whiz with a passion for assessing risk? If so, a career in actuarial science might be your calling. In this section, we will discuss the specialized field of actuarial science, the qualifications required, and the potential earnings that await those who enter this fascinating profession.

4. Private Equity: Investing in Success

Private equity professionals play a crucial role in driving growth and profitability for businesses. In this section, we will explore the world of private equity, discussing the various career paths available, the skills needed to succeed, and the high earning potential that comes with this challenging yet rewarding career.

5. Hedge Fund Management: Riding the Waves of Financial Markets

Hedge fund managers are known for their ability to navigate volatile financial markets and generate substantial returns. In this section, we will explore the world of hedge fund management, discussing the skills required, the potential earnings, and the steps you can take to enter this exciting field.

6. Financial Analysis: Unveiling the Secrets of Numbers

If you have a passion for analyzing financial data and uncovering valuable insights, a career in financial analysis might be the perfect fit for you. In this section, we will discuss the roles and responsibilities of financial analysts, the earning potential, and the qualifications needed to excel in this field.

7. Risk Management: Safeguarding Companies and Securing Success

Risk management professionals play a crucial role in identifying and mitigating potential threats to businesses. In this section, we will explore the world of risk management, discussing the various career paths available, the earning potential, and the skills needed to excel in this critical field.

8. Corporate Law: Combining Finance and Legal Expertise

If you have a passion for both finance and the law, a career in corporate law might offer the perfect blend of your interests. In this section, we will discuss the earning potential, required qualifications, and the exciting opportunities that come with being a corporate lawyer in the finance industry.

9. Quantitative Analysis: Crunching Numbers for Profit

Quantitative analysts, also known as quants, utilize advanced mathematical models to identify profitable investment opportunities. In this section, we will delve into the world of quantitative analysis, discussing the earning potential, required skills, and the steps you can take to pursue a career in this data-driven field.

10. Financial Planning: Mapping Out Wealth and Security

Financial planners are experts in helping individuals and businesses achieve their financial goals. In this section, we will explore the world of financial planning, discussing the earning potential, required certifications, and the skills needed to provide comprehensive financial advice and guidance.

In conclusion, the finance industry offers a plethora of high-paying career paths for individuals with diverse skill sets and interests. Whether you have a passion for numbers, risk assessment, or strategic decision-making, there is a finance job out there that can fulfill your aspirations. By understanding the earning potential, qualifications, and skills required for each profession, you can make an informed decision and embark on a rewarding and lucrative career in finance.

Have questions about the highest paying finance jobs? Check out the Q&A section below:

Q&A:

1. What is the highest paying finance job?

The investment banking sector offers some of the highest-paying finance jobs, with roles such as investment banker and managing director often commanding substantial salaries.

2. Do I need a specific degree to pursue a high-paying finance job?

While a degree in finance or a related field is often preferred, many high-paying finance jobs value experience and skills just as much as formal education. It's essential to develop a strong understanding of finance principles and stay updated on industry trends.

3. Are there any finance jobs that offer a good work-life balance?

While some finance jobs, such as investment banking, are notorious for demanding long hours, there are other roles within finance that offer better work-life balance. Financial planning and risk management, for example, often provide more flexibility in terms of working hours.

4. How can I break into the finance industry?

Breaking into the finance industry requires a combination of education, relevant experience, and networking. Consider pursuing internships, obtaining certifications, and building a strong professional network to increase your chances of securing a high-paying finance job.

5. What skills are essential for success in high-paying finance jobs?

While the specific skills vary depending on the job, some fundamental skills that can contribute to success in high-paying finance jobs include analytical thinking, problem-solving, strong communication, attention to detail, and the ability to work under pressure.

Post a Comment for "The Ultimate Guide to the Highest Paying Finance Jobs: Unlocking Lucrative Career Opportunities"