The Ultimate Guide to Snap Finance Application: Everything You Need to Know

Are you in need of financial assistance for your purchases but struggling to find a suitable solution? Look no further! In this comprehensive guide, we will walk you through everything you need to know about the Snap Finance application. Whether you want to buy a new gadget, furniture, or even pay for medical expenses, Snap Finance offers a convenient way to finance your purchases. Read on to discover how this application works, its benefits, and how to make the most out of it.

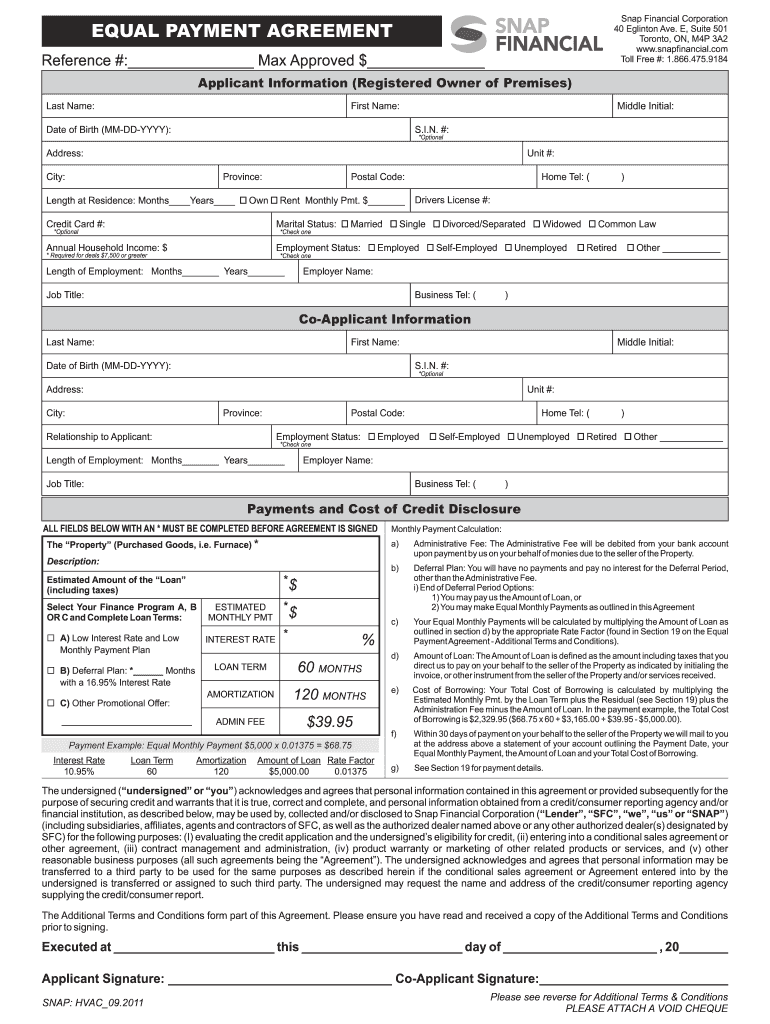

First and foremost, let's understand what Snap Finance is all about. Snap Finance is a digital platform that provides customers with instant access to financing options for their purchases. Whether you have a good credit score or not, Snap Finance offers a hassle-free application process, making it accessible to a wide range of individuals. With Snap Finance, you can enjoy flexible payment plans, low-interest rates, and quick approval, making it an ideal choice for those seeking financial assistance.

1. How Does Snap Finance Application Work?

In this section, we will delve into the details of how the Snap Finance application process works. From eligibility requirements to the step-by-step application process, we will guide you through each stage, ensuring a smooth experience.

Summary: This section will provide an overview of the eligibility criteria and the step-by-step procedure to apply for Snap Finance.

2. The Benefits of Using Snap Finance Application

Discover the numerous advantages of using Snap Finance for your purchases. From flexible repayment options to competitive interest rates, Snap Finance offers a range of benefits that make it a popular choice among consumers.

Summary: This section will highlight the key benefits of using Snap Finance, including low-interest rates, quick approval process, and the ability to build credit.

3. How to Make the Most Out of Snap Finance

Learn some valuable tips and tricks to optimize your experience with Snap Finance. By understanding how to navigate the platform, you can make informed decisions, choose the best payment plan, and utilize the features to your advantage.

Summary: This section will provide practical advice on maximizing the benefits of Snap Finance, such as selecting the right payment plan and managing your monthly payments efficiently.

4. Frequently Asked Questions About Snap Finance Application

Have some burning questions about Snap Finance? In this section, we will address the most commonly asked questions to ensure all your doubts are cleared. From interest rates to repayment terms, we've got you covered.

Summary: This section will cover the most frequently asked questions about Snap Finance, providing concise and informative answers.

5. How Snap Finance Can Help You Improve Your Credit Score

Did you know that using Snap Finance responsibly can contribute to building or improving your credit score? In this section, we will explain how Snap Finance can play a role in enhancing your creditworthiness.

Summary: This section will discuss the relationship between Snap Finance and credit scores, highlighting how responsible use can positively impact your financial standing.

6. Alternatives to Snap Finance Application

While Snap Finance offers numerous benefits, it's always good to explore other options. In this section, we will discuss some alternative financing solutions available to you, giving you a comprehensive understanding of the choices at your disposal.

Summary: This section will present alternative financing options for readers to consider, providing a brief overview of each.

7. Tips for a Successful Snap Finance Application

Want to increase your chances of getting approved for Snap Finance? We've got you covered! In this section, we will share some valuable tips and insights to help you submit a successful application.

Summary: This section will provide practical tips on how to increase the likelihood of approval when applying for Snap Finance.

8. Snap Finance vs. Traditional Financing: Which is Better?

In this section, we will compare Snap Finance with traditional financing options, such as credit cards and personal loans. By weighing the pros and cons of each, you can make an informed decision based on your specific needs.

Summary: This section will provide a comparative analysis of Snap Finance and traditional financing, highlighting the advantages and disadvantages of each.

9. How to Avoid Common Mistakes when Using Snap Finance

While Snap Finance offers great convenience, it's essential to be aware of potential pitfalls. In this section, we will discuss common mistakes to avoid when using Snap Finance, ensuring a smooth and trouble-free experience.

Summary: This section will outline common mistakes users may make when utilizing Snap Finance and provide tips on how to avoid them.

10. Real Stories: How Snap Finance Changed Lives

Inspiring stories of individuals who have benefited from Snap Finance can provide a glimpse into its true impact. In this section, we will share real-life stories that highlight the positive difference Snap Finance has made in people's lives.

Summary: This section will feature heartwarming stories of individuals who have experienced life-changing moments with the help of Snap Finance.

In conclusion, Snap Finance application is a game-changer for those seeking convenient and accessible financing options. With its user-friendly platform, flexible payment plans, and quick approval process, Snap Finance opens doors to a world of possibilities. By following the tips and insights provided in this guide, you can make the most out of Snap Finance and achieve your financial goals. So, why wait? Start your Snap Finance journey today and experience the difference it can make in your life!

Post a Comment for "The Ultimate Guide to Snap Finance Application: Everything You Need to Know"