The Ultimate Guide to Using a Mortgage Finance Calculator for Home Buyers

In today's real estate market, buying a home can be an overwhelming process. From searching for the perfect property to securing a mortgage, there are numerous factors to consider. One essential tool that can help prospective home buyers make informed decisions is a mortgage finance calculator. This powerful tool enables you to estimate your monthly mortgage payments, determine affordability, and explore different loan options. In this comprehensive guide, we will delve into the ins and outs of using a mortgage finance calculator to aid you in your home buying journey.

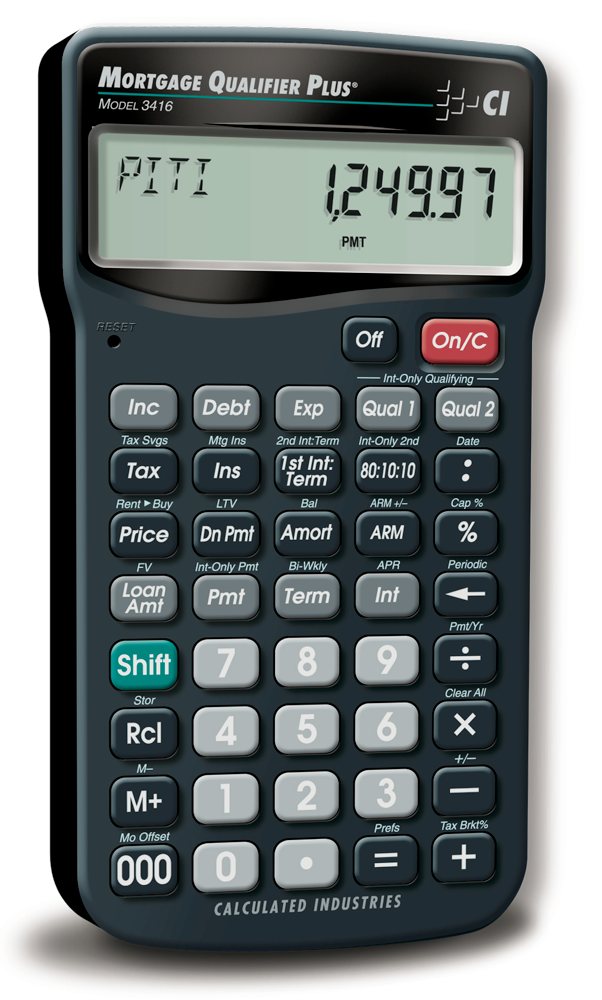

Section 1: Understanding Mortgage Finance Calculators

Summary: Learn what a mortgage finance calculator is, how it works, and the key components it takes into consideration, such as loan amount, interest rate, loan term, and down payment.

Section 2: Calculating Monthly Mortgage Payments

Summary: Discover how to use a mortgage finance calculator to determine your monthly mortgage payments, including principal and interest, property taxes, homeowners insurance, and private mortgage insurance (PMI) if applicable.

Section 3: Assessing Affordability and Budgeting

Summary: Explore how a mortgage finance calculator can help you assess your affordability by analyzing your income, debts, and expenses. Learn how to set a budget and find a mortgage that aligns with your financial situation and goals.

Section 4: Comparing Loan Options

Summary: Find out how a mortgage finance calculator enables you to compare different loan options, including fixed-rate mortgages, adjustable-rate mortgages, and various loan terms. Analyze the impact of interest rates on your payments and total interest paid over the life of the loan.

Section 5: Estimating Down Payment Requirements

Summary: Learn how to use a mortgage finance calculator to determine the down payment amount needed based on the loan type, loan-to-value ratio, and other factors. Explore strategies to save for a down payment and understand down payment assistance programs.

Section 6: Analyzing Amortization Schedules

Summary: Gain insights into how a mortgage finance calculator can provide you with an amortization schedule, which outlines the distribution of your monthly payments between principal and interest over the life of the loan. Understand how making additional payments can save you money in interest and shorten your loan term.

Section 7: Factoring in Closing Costs

Summary: Discover how to estimate your closing costs using a mortgage finance calculator. Learn about the different types of closing costs, such as loan origination fees, appraisal fees, title insurance, and more, and how they impact your overall mortgage expenses.

Section 8: Planning for Prepayment and Refinancing

Summary: Explore how a mortgage finance calculator can assist you in planning for prepayment or refinancing opportunities. Understand the benefits of making extra principal payments or refinancing to a lower interest rate and how it can impact your overall financial goals.

Section 9: Using a Mortgage Finance Calculator for Investment Properties

Summary: Gain insights into using a mortgage finance calculator for investment properties. Learn how to analyze potential rental income, calculate cash flow, and evaluate the return on investment (ROI) for different scenarios.

Section 10: Seek Professional Advice

Summary: Understand the importance of seeking professional advice from mortgage brokers or financial advisors. Learn how they can provide personalized guidance and help you maximize the benefits of using a mortgage finance calculator in your home buying journey.

Conclusion:

In conclusion, a mortgage finance calculator is an invaluable tool for anyone considering purchasing a home. By using this tool effectively, you can gain a clear understanding of your financial capabilities, compare different loan options, plan for future expenses, and make informed decisions that align with your goals. Remember, always seek professional advice to ensure you are making the best choices for your unique circumstances. So, why wait? Start using a mortgage finance calculator today and embark on your exciting journey towards homeownership!

Question and Answer:

Q1: Can I use a mortgage finance calculator if I'm not ready to buy a home yet?

A1: Absolutely! A mortgage finance calculator can be incredibly helpful even if you're not ready to buy a home right away. It allows you to assess your affordability, set financial goals, and plan for the future. You can experiment with different scenarios and make adjustments as needed.

Q2: Are mortgage finance calculators accurate?

A2: While mortgage finance calculators provide estimates, they are generally accurate when you input the correct information. Keep in mind that these calculators rely on the data you provide and the assumptions they make. To get the most accurate results, ensure you have the latest interest rates and consult with professionals for personalized advice.

Q3: Can I use a mortgage finance calculator for refinancing my existing mortgage?

A3: Absolutely! Mortgage finance calculators are versatile tools that can be used for refinancing as well. By inputting your current loan details and desired refinance terms, you can determine if refinancing makes financial sense for you and compare the potential savings.

Q4: Is it necessary to consult a professional if I use a mortgage finance calculator?

A4: While a mortgage finance calculator can provide valuable insights, it's always recommended to consult with professionals, such as mortgage brokers or financial advisors. They can offer personalized advice, guide you through the process, and help you navigate any complexities that may arise.

Q5: Are there any additional costs associated with using a mortgage finance calculator?

A5: No, mortgage finance calculators are typically free to use. You can find them on various financial websites, lender platforms, or even as mobile apps. Take advantage of these tools to gain a better understanding of your mortgage options without incurring any additional costs.

Post a Comment for "The Ultimate Guide to Using a Mortgage Finance Calculator for Home Buyers"