The Comprehensive Guide to Receivables Finance: Everything You Need to Know

Are you a business owner struggling to maintain a steady cash flow? Receivables finance might just be the solution you're looking for. In this comprehensive guide, we will delve deep into the world of receivables finance, explaining what it is, how it works, and why it could be beneficial for your business. So, let's get started!

Section 1: Understanding Receivables Finance

In this section, we will provide an overview of receivables finance. We will discuss what it means, how it differs from traditional financing, and the different types of receivables finance available. You'll gain a clear understanding of how this financial tool can help your business grow.

Section 2: The Benefits of Receivables Finance

Here, we'll explore the various advantages of receivables finance. From improving cash flow and increasing working capital to reducing bad debt and gaining access to flexible funding, you'll discover the many ways in which receivables finance can benefit your business.

Section 3: The Process of Receivables Financing

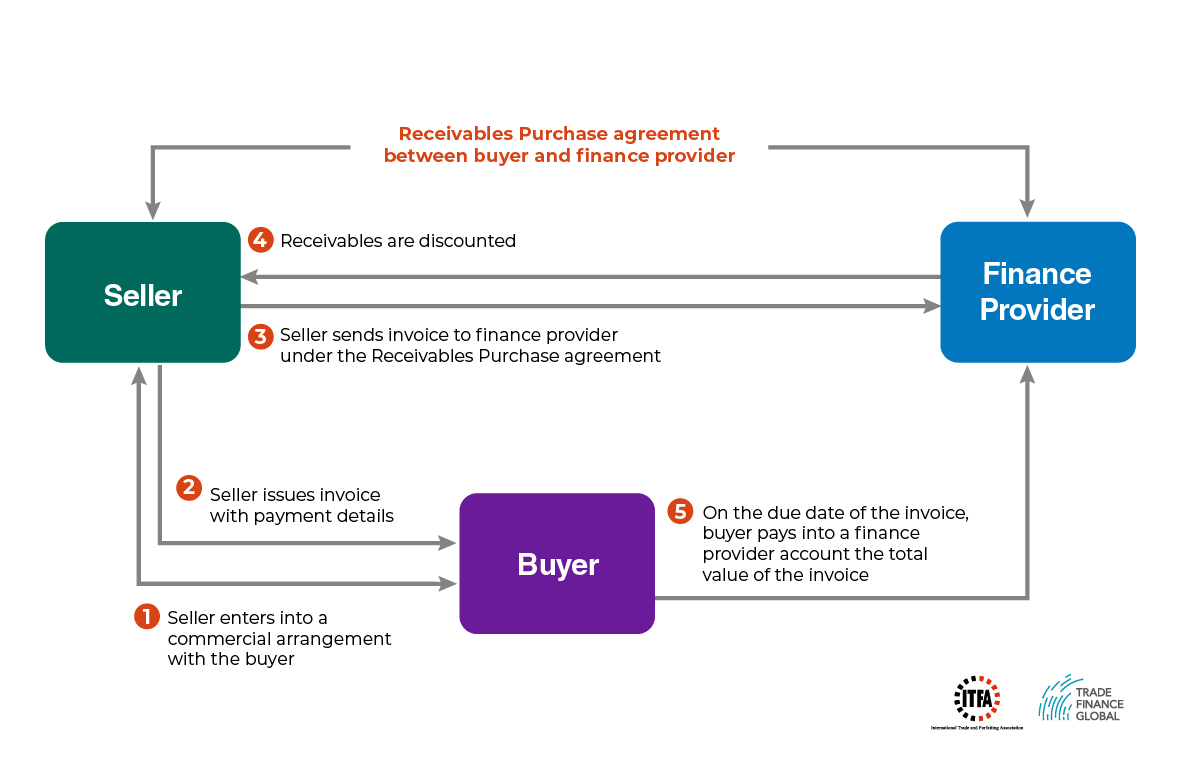

In this section, we'll walk you through the step-by-step process of receivables financing. From selecting the right financing provider to submitting your invoices and receiving funding, we'll guide you through each stage, ensuring you have a clear understanding of how it all works.

Section 4: Choosing the Right Receivables Finance Provider

Not all receivables finance providers are created equal. In this section, we'll help you navigate the selection process, providing tips on what to look for in a provider. We'll also discuss the importance of reputation, flexibility, and transparency when choosing the right partner for your receivables finance needs.

Section 5: Common Misconceptions About Receivables Finance

There are several misconceptions surrounding receivables finance that may deter businesses from exploring this viable option. In this section, we'll debunk these myths and provide clarity on common misconceptions, ensuring you have accurate information to make an informed decision.

Section 6: Case Studies: Success Stories of Receivables Finance

Real-life success stories can be incredibly inspiring. In this section, we'll present case studies that highlight how businesses across various industries have benefited from receivables finance. These stories will demonstrate the potential for growth and success that can be achieved through this financial tool.

Section 7: Risks and Considerations in Receivables Finance

Like any financial product, receivables finance comes with its own set of risks and considerations. In this section, we'll identify and discuss these potential risks, equipping you with the knowledge to make informed decisions and mitigate any associated challenges.

Section 8: Alternatives to Receivables Finance

While receivables finance can be a powerful tool, it's important to explore alternative options as well. In this section, we'll introduce and explore other financing options available to businesses, allowing you to make a well-rounded decision based on your specific needs and circumstances.

Section 9: How to Maximize the Benefits of Receivables Finance

Now that you understand the ins and outs of receivables finance, it's time to delve into strategies for maximizing its benefits. In this section, we'll provide tips and best practices to help you make the most of this financial tool, ensuring optimal growth and success for your business.

Section 10: The Future of Receivables Finance

In this final section, we'll discuss the future trends and developments in receivables finance. From advancements in technology to changing regulations, we'll explore what lies ahead in the world of receivables finance and how it may impact your business.

Conclusion

In conclusion, receivables finance offers businesses a valuable solution to improve cash flow and access much-needed working capital. By understanding the fundamentals of receivables finance, selecting the right provider, and implementing best practices, businesses can reap the numerous benefits this financial tool has to offer. As the future of receivables finance continues to evolve, staying informed and adaptable will be key to staying ahead in the ever-changing business landscape.

Have any questions about receivables finance? We've got you covered!

Q: How does receivables finance differ from traditional financing?

A: Unlike traditional financing, which relies on collateral such as property or equipment, receivables finance leverages a company's outstanding invoices as collateral. This allows businesses to access funds quickly and efficiently, based on the value of their outstanding receivables.

Q: What types of businesses can benefit from receivables finance?

A: Receivables finance can benefit businesses across various industries and sizes. Whether you're a small startup looking to stabilize cash flow or a large corporation seeking to optimize working capital, receivables finance can provide the necessary funding to support your growth and operational needs.

Q: How long does the receivables finance process typically take?

A: The duration of the process can vary depending on the provider and the complexity of the financing arrangement. However, with streamlined digital platforms and efficient processes, businesses can often receive funding within a matter of days, providing them with the agility and flexibility needed to thrive in today's fast-paced business environment.

Q: Can receivables finance help reduce bad debt?

A: Yes, receivables finance can help mitigate the risk of bad debt. By selling their outstanding invoices to a financing provider, businesses transfer the credit risk to the provider, ensuring they receive payment even if the customer fails to pay. This can significantly reduce the impact of bad debt on a company's financial health.

Q: How can businesses maximize the benefits of receivables finance?

A: To maximize the benefits of receivables finance, businesses should focus on maintaining accurate and up-to-date invoices, selecting a reputable and flexible financing provider, and implementing efficient cash flow management practices. Additionally, regularly reviewing and adjusting financing arrangements as business needs evolve will ensure ongoing optimization of receivables finance benefits.

Post a Comment for "The Comprehensive Guide to Receivables Finance: Everything You Need to Know"