Understanding Working Capital Finance: A Comprehensive Guide

Are you a business owner or an entrepreneur looking to manage your finances effectively? If so, understanding working capital finance is crucial for the success and growth of your business. In this blog article, we will provide you with a detailed and comprehensive guide on working capital finance, its importance, and how it can benefit your business. So, let's dive in!

Working capital finance refers to the funds a company uses to cover its day-to-day operational expenses. It represents the difference between a company's current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable, short-term loans, and credit card balances). By effectively managing working capital finance, businesses can ensure smooth operations, maintain a healthy cash flow, and seize growth opportunities.

1. Definition of Working Capital Finance

In this section, we will provide a concise definition of working capital finance, explaining its significance and role in the financial health of a business. We will highlight its components and how they impact a company's operations.

2. Importance of Working Capital Finance

Here, we will delve into the importance of working capital finance for businesses of all sizes. We will discuss how it enables companies to meet short-term obligations, manage inventory effectively, and invest in growth initiatives, ultimately leading to improved profitability.

3. Calculating Working Capital

In this section, we will walk you through the process of calculating working capital. We will explain the formula, provide examples, and offer insights on interpreting the results. Understanding how to calculate working capital is vital for assessing a company's financial health and making informed decisions.

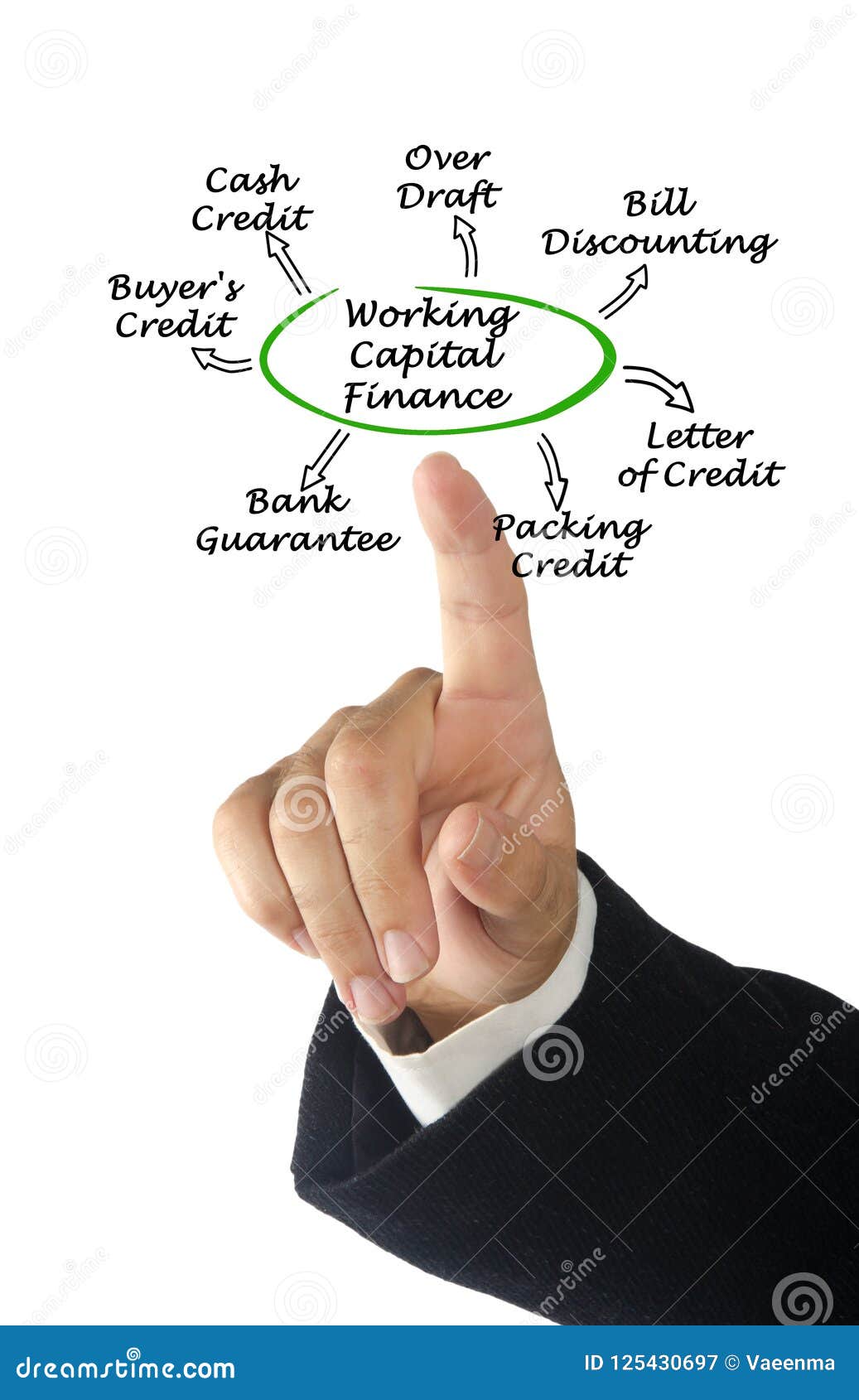

4. Types of Working Capital Finance

Here, we will explore the various sources of working capital finance available to businesses. We will discuss traditional financing options, such as bank loans and lines of credit, as well as alternative methods like invoice financing and trade credit. By understanding these options, you can choose the most suitable one for your business.

5. Benefits and Risks of Working Capital Finance

This section will provide an overview of the benefits and risks associated with utilizing working capital finance. We will discuss how it can help businesses grow, seize opportunities, and improve cash flow. Simultaneously, we will address potential risks, such as increased debt and interest expenses, and how to mitigate them.

6. Tips for Effective Working Capital Management

Here, we will share practical tips and strategies for effectively managing your business's working capital. From optimizing inventory levels to negotiating favorable payment terms with suppliers, these tips will help you improve cash flow, reduce costs, and enhance profitability.

7. Case Studies: Successful Working Capital Management

Inspiration often comes from real-life examples. In this section, we will analyze case studies of companies that have successfully managed their working capital. By examining their strategies and best practices, you can gain valuable insights to apply to your own business.

8. Common Challenges in Working Capital Finance

Working capital finance is not without its challenges. In this section, we will discuss the common obstacles businesses face when managing their working capital. From late payments to unexpected expenses, we will offer solutions and proactive measures to overcome these challenges.

9. The Role of Technology in Working Capital Management

Technology plays a crucial role in streamlining financial processes, including working capital management. Here, we will explore how innovative tools and software can help businesses automate tasks, improve efficiency, and gain real-time insights into their working capital.

10. Future Trends in Working Capital Finance

Lastly, we will discuss the future trends and developments in working capital finance. We will explore how changing business landscapes, advancements in technology, and evolving financial practices will impact working capital management in the years to come.

In conclusion, working capital finance is an essential aspect of managing a successful business. By understanding its definition, calculating it accurately, and exploring various financing options, you can optimize your business's financial health. Remember to effectively manage your working capital, implement best practices, and adapt to future trends to ensure long-term growth and profitability. If you have any further questions or need assistance, don't hesitate to reach out!

Question and Answer:

Q: How can working capital finance benefit my business?

A: Working capital finance allows businesses to cover their day-to-day operational expenses, manage inventory effectively, and invest in growth initiatives. By ensuring a healthy cash flow and meeting short-term obligations, businesses can improve profitability and seize opportunities.

Q: What are the common challenges in working capital finance?

A: Some common challenges include late payments, unexpected expenses, and difficulties in managing inventory levels. However, with proactive measures and effective strategies, these challenges can be overcome to optimize working capital management.

Q: How can technology help in working capital management?

A: Technology plays a vital role in streamlining financial processes. Innovative tools and software can automate tasks, improve efficiency, and provide real-time insights into working capital. This enables businesses to make data-driven decisions and effectively manage their finances.

Q: What are the future trends in working capital finance?

A: Future trends include advancements in technology, such as artificial intelligence and machine learning, which will further automate financial processes. Additionally, changing business landscapes and evolving financial practices will shape the way businesses manage their working capital in the coming years.

Q: How can I effectively manage my working capital?

A: Effective working capital management involves optimizing inventory levels, negotiating favorable payment terms with suppliers, and closely monitoring cash flow. By implementing best practices and regularly reviewing your financial performance, you can ensure efficient working capital management.

Post a Comment for "Understanding Working Capital Finance: A Comprehensive Guide"