Understanding Business Finance: A Comprehensive Guide to Financial Management

Finance plays a pivotal role in the success of any business. From managing cash flow to making strategic investment decisions, it is crucial for entrepreneurs and business owners to have a strong understanding of business finance. In this comprehensive guide, we will explore the fundamentals of business finance, providing you with valuable insights and practical tips to effectively manage your company's financial health.

Whether you are a startup founder looking to secure funding or a seasoned business owner aiming to optimize your financial strategies, this article will serve as your go-to resource. So, let's dive into the world of business finance and unlock the secrets to financial success!

1. The Importance of Financial Management

In this section, we will discuss the significance of financial management in running a successful business. We will outline the key objectives and benefits of effective financial management, ensuring you understand why it should be a top priority for every business.

2. Understanding Financial Statements

Financial statements provide a snapshot of a company's financial position and performance. In this session, we will delve into the different types of financial statements and their components. We will also guide you on how to interpret and analyze financial statements to gain valuable insights into your business.

3. Budgeting and Forecasting

Creating a budget and accurate financial forecasts are essential tools for managing your business's finances effectively. In this section, we will explore the process of budgeting and forecasting, providing you with practical tips to develop realistic financial plans and track your progress.

4. Cash Flow Management

Managing cash flow is a critical aspect of financial management. In this session, we will discuss the importance of cash flow management, explore various cash flow forecasting techniques, and provide strategies to improve your cash flow efficiency.

5. Financing Options for Businesses

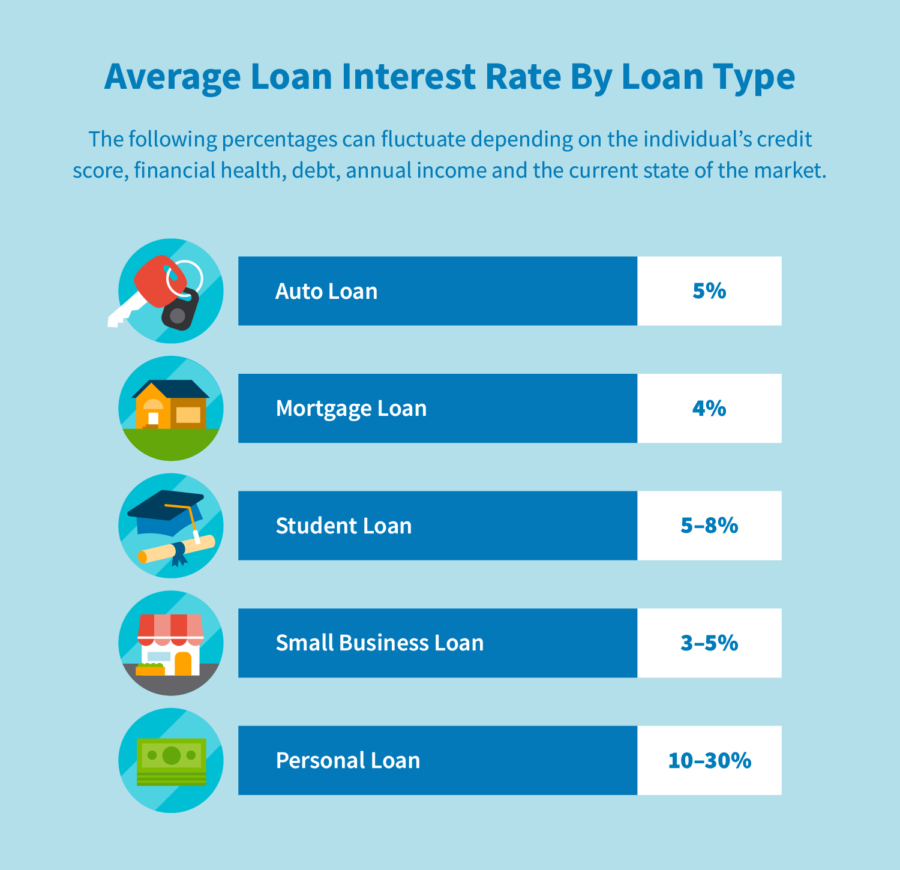

Every business requires capital to grow and thrive. In this section, we will explore different financing options available to businesses, such as bank loans, venture capital, and crowdfunding. We will outline the advantages and disadvantages of each option, helping you make informed decisions when seeking funding.

6. Investment Decisions and Capital Budgeting

Investing in new projects or ventures can be a game-changer for businesses. In this session, we will discuss the process of capital budgeting, evaluate investment appraisal techniques, and provide insights into making sound investment decisions that align with your business goals.

7. Risk Management and Insurance

Every business faces various risks, both internal and external. In this section, we will explore the importance of risk management and how it can protect your business from potential financial setbacks. We will also delve into the world of business insurance and guide you on choosing the right coverage for your specific needs.

8. Financial Ratios and Performance Analysis

Financial ratios are powerful tools for assessing a company's financial performance and health. In this session, we will explain the most important financial ratios and how to calculate them. We will also guide you on interpreting these ratios to evaluate your business's financial well-being and identify areas for improvement.

9. Tax Planning and Compliance

Taxation is a significant aspect of business finance. In this section, we will shed light on tax planning strategies that can help you minimize your business's tax liabilities while complying with legal requirements. We will also discuss the importance of maintaining accurate financial records to ensure smooth tax filing.

10. Financial Tools and Technologies

The digital age has revolutionized the way businesses manage their finances. In this final session, we will explore various financial tools and technologies that can streamline your financial management processes. From accounting software to online payment systems, we will provide an overview of the latest innovations to enhance your business finance operations.

In conclusion, understanding business finance is crucial for the success and growth of any organization. By mastering the fundamentals of financial management, you can make informed decisions, optimize cash flow, manage risks, and drive your business towards financial prosperity. So, start implementing the insights and strategies shared in this comprehensive guide, and watch your business thrive!

Q1: Why is financial management important for businesses?

A1: Financial management is vital for businesses as it helps in maintaining a healthy cash flow, making informed investment decisions, and ensuring long-term financial stability.

Q2: How can I improve my cash flow management?

A2: To enhance cash flow management, consider implementing strategies such as efficient billing and collection processes, negotiating better payment terms with suppliers, and closely monitoring expenses.

Q3: What are the key components of a financial statement?

A3: The key components of a financial statement include the income statement, balance sheet, and cash flow statement. These statements provide insights into a company's profitability, assets, liabilities, and cash flow.

Q4: What are the different financing options available for businesses?

A4: Businesses can explore options like bank loans, venture capital, angel investors, crowdfunding, or even self-funding to secure the necessary capital for their operations and growth.

Q5: How can financial ratios help in analyzing business performance?

A5: Financial ratios provide a quantitative analysis of a company's financial performance, highlighting its liquidity, profitability, efficiency, and solvency. By comparing ratios over time and against industry benchmarks, businesses can identify areas of strength and weakness.

Post a Comment for "Understanding Business Finance: A Comprehensive Guide to Financial Management"