Certification Programs in Finance: A Comprehensive Guide to Advancing Your Career

Are you looking to take your career in finance to the next level? One way to enhance your knowledge, skills, and credibility in this competitive industry is by pursuing certification programs. Whether you are a recent graduate or a seasoned professional, these programs offer a valuable opportunity to expand your expertise and open doors to exciting career prospects.

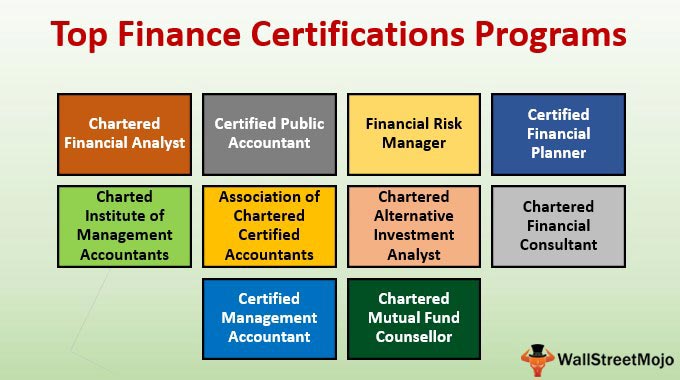

In this comprehensive guide, we will explore the top certification programs in finance that can help you stand out in a crowd of applicants and boost your chances of career success. From prestigious designations in investment management to specialized certifications in financial planning, we will cover everything you need to know to make an informed decision.

1. CFA® Program: Elevating Your Investment Management Skills

The Chartered Financial Analyst (CFA) Program is widely recognized as the gold standard in investment management. This section provides an overview of the program, its curriculum, and the benefits of earning the CFA charter.

2. CPA: Becoming a Certified Public Accountant

The Certified Public Accountant (CPA) designation is a must-have for professionals pursuing a career in accounting. This section explores the requirements, exam structure, and career opportunities that come with being a CPA.

3. CFP® Certification: Mastering the Art of Financial Planning

For individuals interested in providing comprehensive financial planning services, the Certified Financial Planner (CFP) certification is essential. This section delves into the core components of the CFP program and the advantages it offers in the financial planning industry.

4. FRM® Certification: Gaining Expertise in Risk Management

The Financial Risk Manager (FRM) certification equips professionals with the skills to assess and manage risks in the financial sector. This section highlights the key features of the FRM program and the career prospects it unlocks.

5. CIMA® Certification: Excelling in Management Accounting

The Chartered Institute of Management Accountants (CIMA) certification focuses on the strategic role of management accountants in driving business success. This section explores the CIMA program's structure, syllabus, and the value it brings to professionals in management accounting.

6. CAIA® Program: Specializing in Alternative Investments

The Chartered Alternative Investment Analyst (CAIA) program offers a comprehensive understanding of alternative investments and their role in portfolio management. This section discusses the CAIA program's curriculum, exam format, and the opportunities it presents in the investment industry.

7. Series 7: Mastering Securities Industry Essentials

The Series 7 certification is a prerequisite for professionals seeking to become registered representatives and trade securities. This section explains the Series 7 exam content, its importance, and the career paths it opens up.

8. CMA® Certification: Advancing Your Management Accounting Career

The Certified Management Accountant (CMA) certification focuses on financial planning, analysis, control, and decision support in organizations. This section explores the benefits of earning the CMA designation and the skills it imparts to professionals in management accounting.

9. CFP® vs. CFA®: Choosing the Right Path

For individuals torn between pursuing financial planning or investment management, this section provides a detailed comparison of the CFP and CFA programs, helping you make an informed decision based on your career goals and interests.

10. Choosing the Best Certification Program for You

With a multitude of finance certification programs available, selecting the right one can be challenging. This section provides guidance on factors to consider, such as career aspirations, educational background, and industry demands, to help you choose the best certification program suited to your individual needs.

In conclusion, investing in a finance certification program can significantly enhance your career prospects and set you apart in today's competitive job market. Whether you aim to specialize in investment management, financial planning, risk management, or accounting, there is a certification program tailored to your goals. By choosing the right certification and committing to the rigorous preparation, you can unlock a world of opportunities and take your finance career to new heights.

Question and Answers:

Q1: Are certification programs in finance worth it?

A1: Absolutely! Certification programs in finance offer numerous benefits, including enhanced knowledge, improved career prospects, and increased credibility in the industry. They demonstrate your commitment to professional development and can significantly boost your earning potential.

Q2: Can I pursue a finance certification program without a finance background?

A2: Yes, many certification programs in finance do not require a specific educational background. However, having a solid foundation in finance or related fields can facilitate your understanding of the program's content and increase your chances of success.

Q3: How long does it take to complete a finance certification program?

A3: The duration varies depending on the program. Some certifications can be completed within a few months, while others may require several years of study and work experience. It is essential to thoroughly research the program you are interested in to determine its time requirements.

Q4: Will a finance certification guarantee me a job?

A4: While earning a finance certification significantly improves your job prospects, it does not guarantee employment. However, it can make you more competitive in the job market and increase your chances of securing desirable positions. Combining a certification with relevant work experience and networking can further enhance your career opportunities.

Q5: Can I pursue multiple finance certifications simultaneously?

A5: Yes, it is possible to pursue multiple finance certifications simultaneously, provided you can manage the workload and meet the requirements of each program. However, it is essential to consider the time commitment, cost, and potential overlap of content before embarking on this endeavor.

Post a Comment for "Certification Programs in Finance: A Comprehensive Guide to Advancing Your Career"