Construction Finance: A Comprehensive Guide to Financing Your Construction Projects

Construction finance is a crucial aspect of any construction project, as it serves as the backbone for successful completion. Whether you are a contractor, developer, or investor, understanding the ins and outs of construction finance is essential for managing costs, securing funding, and ensuring profitability. In this comprehensive guide, we will delve into the world of construction finance, providing you with valuable insights and practical tips to navigate the financial aspects of your construction projects.

Before embarking on a construction project, it is crucial to have a solid understanding of the financing options available. This guide will explore various avenues of construction finance, such as traditional bank loans, alternative financing options, and government grants. We will discuss the pros and cons of each option, helping you make informed decisions that align with your project's needs and financial goals.

1. Understanding Construction Finance: An Overview

In this section, we will provide a comprehensive overview of construction finance, explaining its role in the construction industry and the key parties involved. We will also discuss the importance of financial planning and budgeting for a successful construction project.

Summary: This section will provide readers with a clear understanding of what construction finance entails, its significance, and the importance of proper financial planning.

2. Traditional Construction Financing: Bank Loans and Mortgages

Traditional bank loans and mortgages have long been a popular choice for financing construction projects. In this section, we will explore the requirements, benefits, and potential drawbacks of obtaining construction finance through traditional banking institutions.

Summary: This section will shed light on the process of securing construction finance through traditional bank loans and mortgages, highlighting the advantages and disadvantages associated with this financing option.

3. Alternative Financing Options for Construction Projects

Aside from traditional bank loans, there are alternative financing options that can help fund your construction projects. This section will explore options such as private lenders, crowdfunding, and joint ventures, providing insights into their benefits and potential risks.

Summary: Readers will gain knowledge about alternative financing options available for construction projects, enabling them to explore different avenues beyond traditional banking institutions.

4. Government Grants and Subsidies for Construction Projects

The government offers various grants and subsidies to support construction projects, particularly those focused on sustainable development and infrastructure improvement. In this section, we will discuss how to navigate the process of applying for and securing government funding.

Summary: This section will inform readers about the potential financial assistance they can obtain from government grants and subsidies, encouraging them to explore these opportunities for their construction projects.

5. Managing Construction Project Costs and Budgeting

Cost management and budgeting are essential components of construction finance. In this section, we will delve into effective strategies for managing costs, creating accurate budgets, and controlling expenses throughout the construction project lifecycle.

Summary: This section will equip readers with practical tips on managing construction project costs and creating realistic budgets, enabling them to stay on track financially throughout their projects.

6. Risk Management in Construction Finance

Risk is inherent in any construction project, and understanding how to mitigate financial risks is crucial for success. In this section, we will explore various risk management techniques and insurance options available in construction finance.

Summary: Readers will learn about the importance of risk management in construction finance and gain insights into effective risk mitigation strategies.

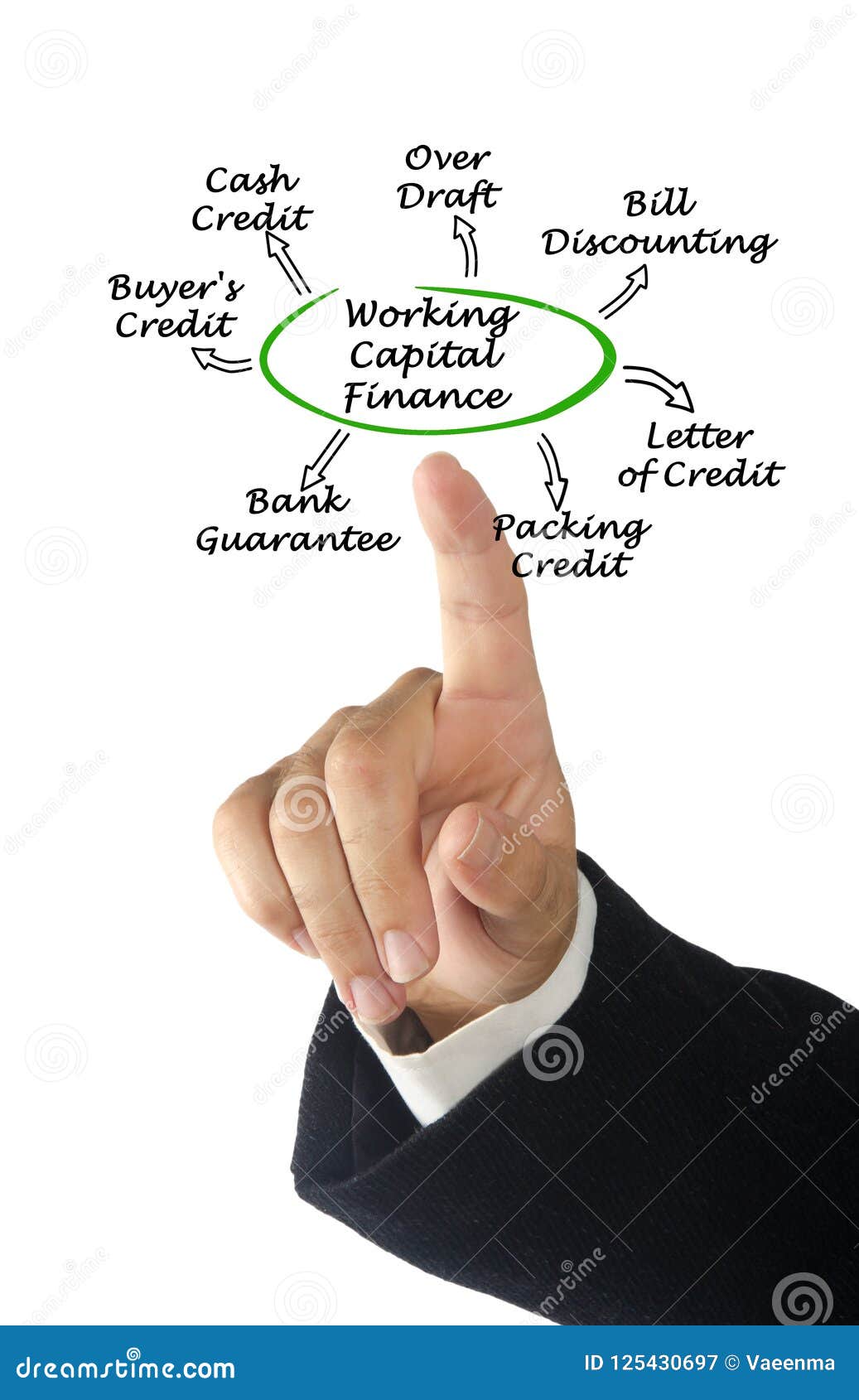

7. Cash Flow Management for Construction Projects

Cash flow is the lifeblood of any construction project, and effective cash flow management is essential for project success. This section will delve into the intricacies of cash flow management, including strategies for optimizing cash flow and overcoming common cash flow challenges in the construction industry.

Summary: This section will provide readers with a comprehensive understanding of cash flow management and equip them with strategies to maintain a healthy cash flow throughout their construction projects.

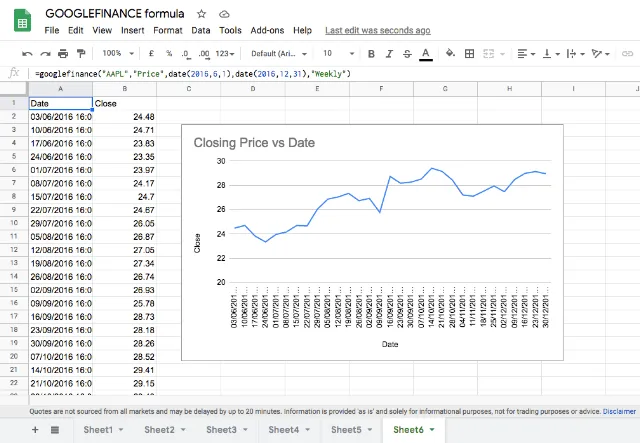

8. Construction Finance and Financial Reporting

Accurate financial reporting is crucial for monitoring the financial health of a construction project and ensuring compliance with regulatory requirements. This section will explore the key financial reports required in construction finance and provide insights into effective financial reporting practices.

Summary: Readers will gain knowledge about the importance of financial reporting in construction finance and understand how to generate accurate financial reports for their projects.

9. Financing Construction Projects: Tips for Success

In this section, we will share valuable tips and best practices for financing construction projects. From building strong relationships with lenders to exploring creative financing options, readers will gain practical insights to enhance their chances of securing funding and achieving project success.

Summary: This section will provide readers with actionable tips and advice to increase their chances of securing construction finance and ensuring the financial success of their projects.

10. The Future of Construction Finance

In this final section, we will explore emerging trends and innovations in construction finance. From blockchain technology to green financing, readers will gain a glimpse into the future of construction finance and how it may shape the industry.

Summary: Readers will be inspired to embrace the future of construction finance and leverage emerging trends to stay ahead in this rapidly evolving industry.

In conclusion, understanding construction finance is paramount for the successful execution of construction projects. By familiarizing yourself with the various financing options, managing costs, mitigating risks, and optimizing cash flow, you can set your construction projects on the path to financial success. Remember to explore both traditional and alternative financing options, as well as government grants and subsidies, to find the best fit for your project's needs. By following the tips and insights provided in this comprehensive guide, you can navigate the complex world of construction finance with confidence and achieve your construction goals.

Question and Answer:

Q: What are the main financing options for construction projects?

A: The main financing options for construction projects include traditional bank loans, alternative financing options such as private lenders and crowdfunding, and government grants and subsidies.

Q: How can I effectively manage cash flow in a construction project?

A: Effective cash flow management in a construction project involves optimizing cash inflows, monitoring expenses, and implementing strategies to ensure a steady flow of funds throughout the project's lifecycle.

Q: Are there risks associated with construction finance?

A: Yes, construction finance involves inherent risks. However, proper risk management techniques, such as insurance coverage and proactive risk mitigation strategies, can help minimize these risks.

Q: What is the future of construction finance?

A: The future of construction finance is marked by emerging trends and innovations, including the use of blockchain technology for secure transactions and green financing for sustainable construction projects.

Q: How can I increase my chances of securing construction finance?

A: Building strong relationships with lenders, maintaining a solid track record, exploring alternative financing options, and presenting a comprehensive project plan can increase your chances of securing construction finance.

Post a Comment for "Construction Finance: A Comprehensive Guide to Financing Your Construction Projects"