Personal Capital Finance: Mastering Your Financial Journey

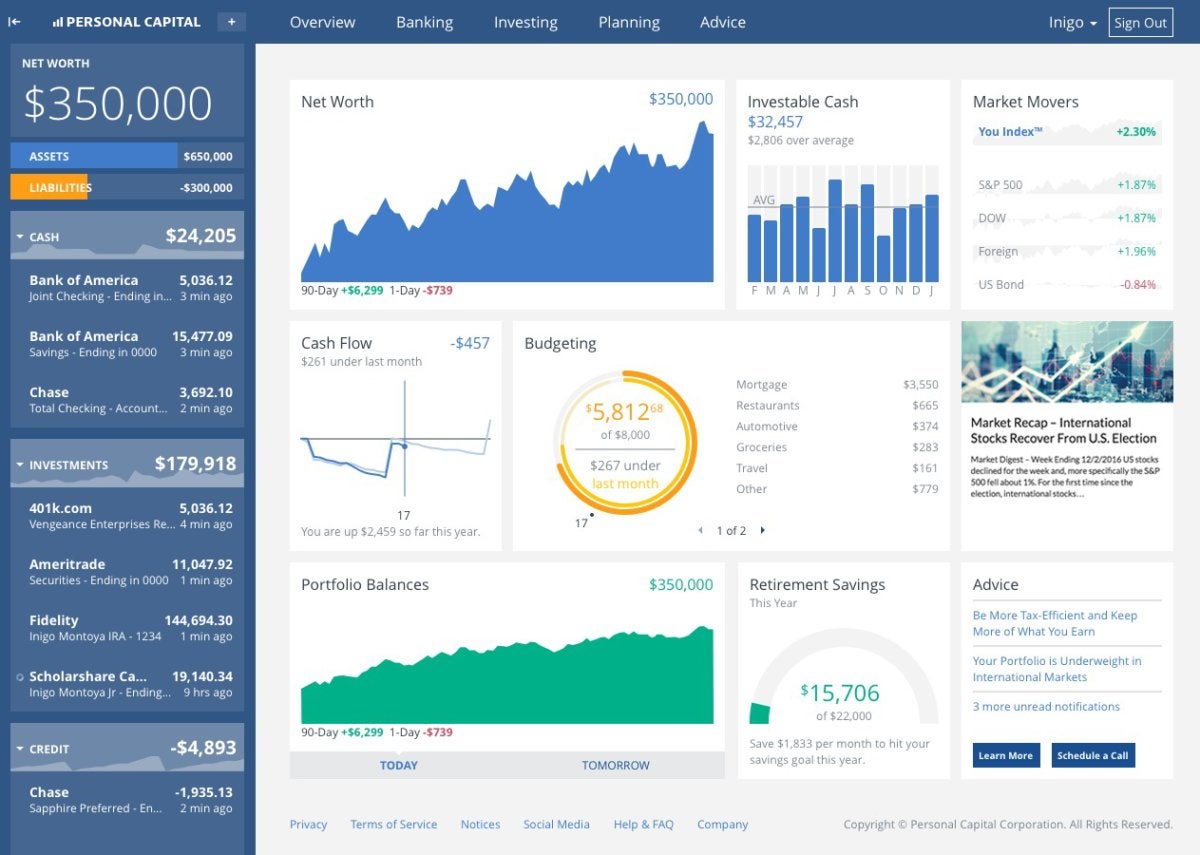

When it comes to personal finance, managing your capital effectively is the key to securing a prosperous future. Whether you are just starting out on your financial journey or looking to enhance your existing strategies, understanding the ins and outs of personal capital finance is essential. In this comprehensive guide, we will delve into the various aspects of personal capital finance, providing you with the knowledge and tools you need to take control of your financial well-being.

From budgeting and saving to investing and retirement planning, this article will cover it all. We will explore different strategies and techniques that can help you optimize your financial resources and make informed decisions. Whether you dream of owning a home, traveling the world, or simply achieving financial stability, personal capital finance is the foundation that can turn your dreams into reality.

1. The Importance of Budgeting

In this section, we will discuss the significance of budgeting in personal finance. We will explore how to create a budget, track your expenses, and set realistic financial goals. By implementing effective budgeting techniques, you can gain control over your spending habits and make your money work for you.

2. Building an Emergency Fund

Having an emergency fund is crucial for any financial plan. In this section, we will outline the steps to establish and grow an emergency fund. We will also discuss the benefits of having a safety net to protect yourself from unexpected expenses and financial setbacks.

3. Managing Debt Wisely

Debt can be a significant burden on your financial well-being. In this section, we will explore strategies to manage and reduce debt effectively. We will discuss the importance of prioritizing debt payments, consolidating loans, and negotiating with creditors to regain control over your financial situation.

4. Understanding Credit Scores

Your credit score plays a vital role in many aspects of your financial life. In this section, we will explain what a credit score is, how it is calculated, and why it matters. We will also provide tips on how to improve your credit score and leverage it to your advantage.

5. Investing for the Future

Investing is a key component of personal capital finance. In this section, we will discuss various investment options, such as stocks, bonds, real estate, and mutual funds. We will explore the basics of investing, risk management, and how to create a diversified portfolio tailored to your financial goals.

6. Retirement Planning

Retirement planning is essential for long-term financial security. In this section, we will delve into the various retirement plans available, such as 401(k)s, IRAs, and pensions. We will also discuss the importance of starting early, calculating retirement needs, and maximizing your savings potential.

7. Tax Strategies and Optimization

Taxes can significantly impact your personal capital finance. In this section, we will explore tax-efficient strategies to minimize your tax liability and maximize your savings. We will discuss deductions, credits, and other tax incentives that can help you keep more money in your pocket.

8. Protecting Your Financial Future

Insurance is a crucial aspect of personal capital finance. In this section, we will discuss different types of insurance, such as health, life, and property insurance. We will examine the importance of protecting yourself and your loved ones from unforeseen circumstances that can have a significant financial impact.

9. Estate Planning and Wealth Preservation

Planning for the future includes safeguarding your assets and ensuring your legacy. In this section, we will explore estate planning strategies, such as wills, trusts, and power of attorney. We will discuss how to preserve your wealth and pass it on to future generations according to your wishes.

10. Continuous Learning and Adaptation

Personal capital finance is a lifelong journey of growth and adaptation. In this final section, we will emphasize the importance of continuous learning and staying up-to-date with financial trends and opportunities. We will provide resources and tips for expanding your financial knowledge and adjusting your strategies as needed.

Conclusion

Mastering personal capital finance is the key to achieving financial freedom and turning your dreams into reality. By implementing the strategies and techniques covered in this comprehensive guide, you can take control of your financial journey and secure a prosperous future. Remember, personal finance is not a one-size-fits-all approach, so tailor these insights to your unique circumstances and goals. With dedication, discipline, and ongoing education, you can navigate the intricacies of personal capital finance and embark on a path towards financial success.

Question and Answer:

Q: How can budgeting help in personal finance?

A: Budgeting helps you track your expenses, control your spending, and set realistic financial goals. It enables you to make informed decisions and allocate your resources effectively.

Q: Why is an emergency fund essential?

A: An emergency fund provides a safety net to protect yourself from unexpected expenses and financial setbacks. It ensures you have the necessary funds to cover emergencies without derailing your financial plans.

Q: How can I improve my credit score?

A: Improving your credit score involves paying bills on time, reducing debt, maintaining a low credit utilization ratio, and regularly reviewing your credit report for errors or discrepancies.

Q: Why is investing important for the future?

A: Investing allows your money to grow over time, beat inflation, and build wealth for the future. It is a way to achieve financial goals, such as retirement, education, or purchasing a home.

Q: What is the significance of estate planning?

A: Estate planning ensures that your assets are protected and distributed according to your wishes. It also minimizes potential conflicts and taxes, preserving your wealth for future generations.

Post a Comment for "Personal Capital Finance: Mastering Your Financial Journey"