Car on Finance: A Comprehensive Guide to Financing Your Dream Ride

When it comes to purchasing a car, many people opt for car finance as a convenient and flexible option. Car on finance allows you to spread the cost of your dream ride over a set period, making it more affordable and accessible. In this blog article, we will delve into the world of car finance, exploring the various options available, the benefits it offers, and the factors to consider when choosing the right finance package for your needs.

Whether you are a first-time buyer or looking to upgrade your current vehicle, car finance provides an excellent opportunity to get behind the wheel of your dream car without breaking the bank. In the following sections, we will break down the key aspects of car finance, providing you with the knowledge needed to make an informed decision. So, let's dive in and explore all there is to know about financing your next car!

1. Understanding Car Finance: An Overview

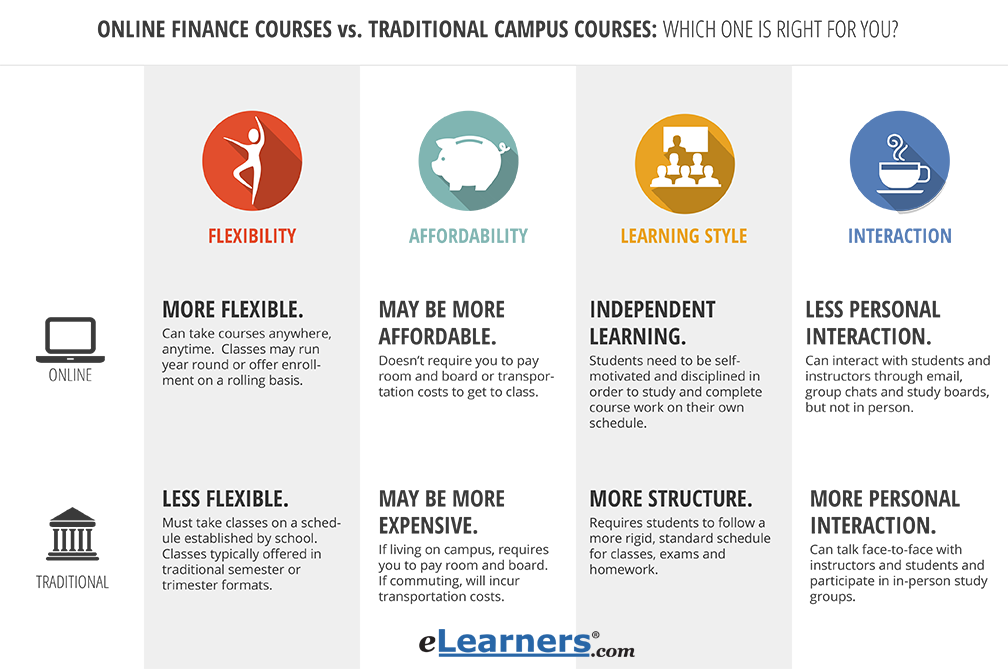

In this section, we will provide a comprehensive understanding of car finance, including its definition, types, and how it works. We will explore the difference between personal contract purchase (PCP), hire purchase (HP), and personal loans, giving you a clear understanding of the various options available.

2. Benefits of Car Finance

Discover the advantages of opting for car finance over other payment methods. From the flexibility it offers to the potential tax benefits, we will outline the key reasons why car finance might be the ideal choice for financing your next vehicle.

3. Factors to Consider Before Choosing Car Finance

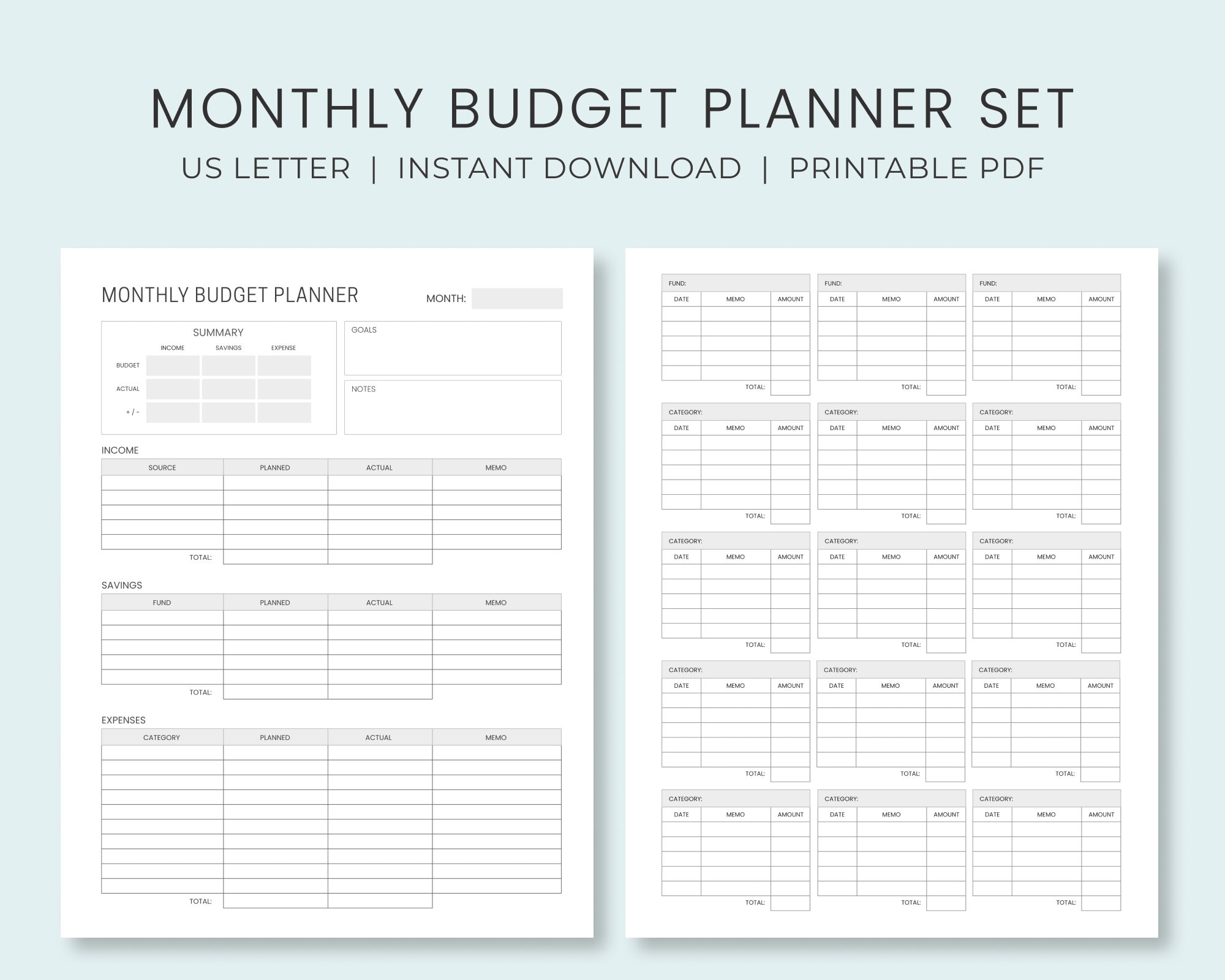

In this section, we will discuss the important factors that should be taken into consideration before selecting a car finance package. From interest rates and loan terms to your credit score and budget, we will guide you through the decision-making process to ensure you make the right choice.

4. Applying for Car Finance: A Step-by-Step Guide

Learn about the step-by-step process involved in applying for car finance. From gathering the necessary documents to choosing a reputable lender, we will provide you with a comprehensive guide to help you navigate through the application process seamlessly.

5. Tips for Getting Approved for Car Finance

In this section, we will share valuable tips and tricks to increase your chances of getting approved for car finance. From improving your credit score to considering a joint application, we will provide you with expert advice to enhance your approval prospects.

6. Understanding Interest Rates and APR

Discover the ins and outs of interest rates and APR (Annual Percentage Rate) in car finance. We will explain the difference between fixed and variable interest rates, how APR affects your repayments, and the importance of comparing rates to secure the best deal.

7. Repaying Car Finance: Options and Strategies

In this section, we will explore the various options available for repaying your car finance. From making monthly repayments to settling the balance early, we will discuss different strategies to help you manage your finance effectively.

8. The Implications of Car Finance on Insurance

Learn about the impact of car finance on your insurance policy. We will discuss the different insurance options available and how financing your vehicle might affect the cost and coverage of your insurance plan.

9. Buying or Leasing: Which is the Right Choice?

Discover whether buying or leasing a car is the ideal choice for your circumstances. We will compare the benefits and drawbacks of each option, helping you make an informed decision that aligns with your preferences and financial situation.

10. Common Mistakes to Avoid in Car Finance

In this final section, we will highlight some common mistakes to avoid when considering car finance. From overlooking the fine print to not thoroughly researching your options, we will help you steer clear of potential pitfalls and ensure a smooth car finance experience.

Car finance offers a flexible and accessible way to purchase your dream car without straining your finances. In this comprehensive guide, we have explored the various aspects of car finance, from its definition and benefits to the application process and repayment strategies. By understanding the different options available and considering essential factors, you can make a well-informed decision that suits your needs and budget.

Remember to always compare rates, read the fine print, and seek professional advice if needed. Now that you are equipped with valuable knowledge about car finance, you can confidently embark on your journey to owning your dream ride!

Question and Answer:

Q: Can I get car finance with bad credit?

A: Yes, it is possible to get car finance with bad credit. However, the interest rates may be higher, and you may need to provide a larger deposit or have a guarantor.

Q: Is car finance better than a personal loan?

A: Car finance can be a better option than a personal loan as it offers lower interest rates and flexible repayment terms specifically tailored for purchasing a car.

Q: Can I pay off my car finance early?

A: Yes, you can pay off your car finance early. However, it is important to check if there are any early repayment fees or penalties involved.

Q: Will financing a car affect my credit score?

A: Financing a car can either positively or negatively impact your credit score, depending on how responsibly you manage the repayments. Consistently making payments on time can help improve your credit score.

Q: Is it better to buy or lease a car?

A: The decision between buying or leasing a car depends on your personal circumstances and preferences. Buying offers long-term ownership, while leasing provides flexibility and the ability to drive a new car every few years.

Post a Comment for "Car on Finance: A Comprehensive Guide to Financing Your Dream Ride"