Embedded Finance: The Future of Financial Services

In today's digital age, the way we handle our finances is constantly evolving. With the rise of technology, embedded finance has emerged as a game-changer, revolutionizing the financial services industry. This blog article will explore the concept of embedded finance, its implications for businesses and consumers, and its potential to reshape the future of financial services.

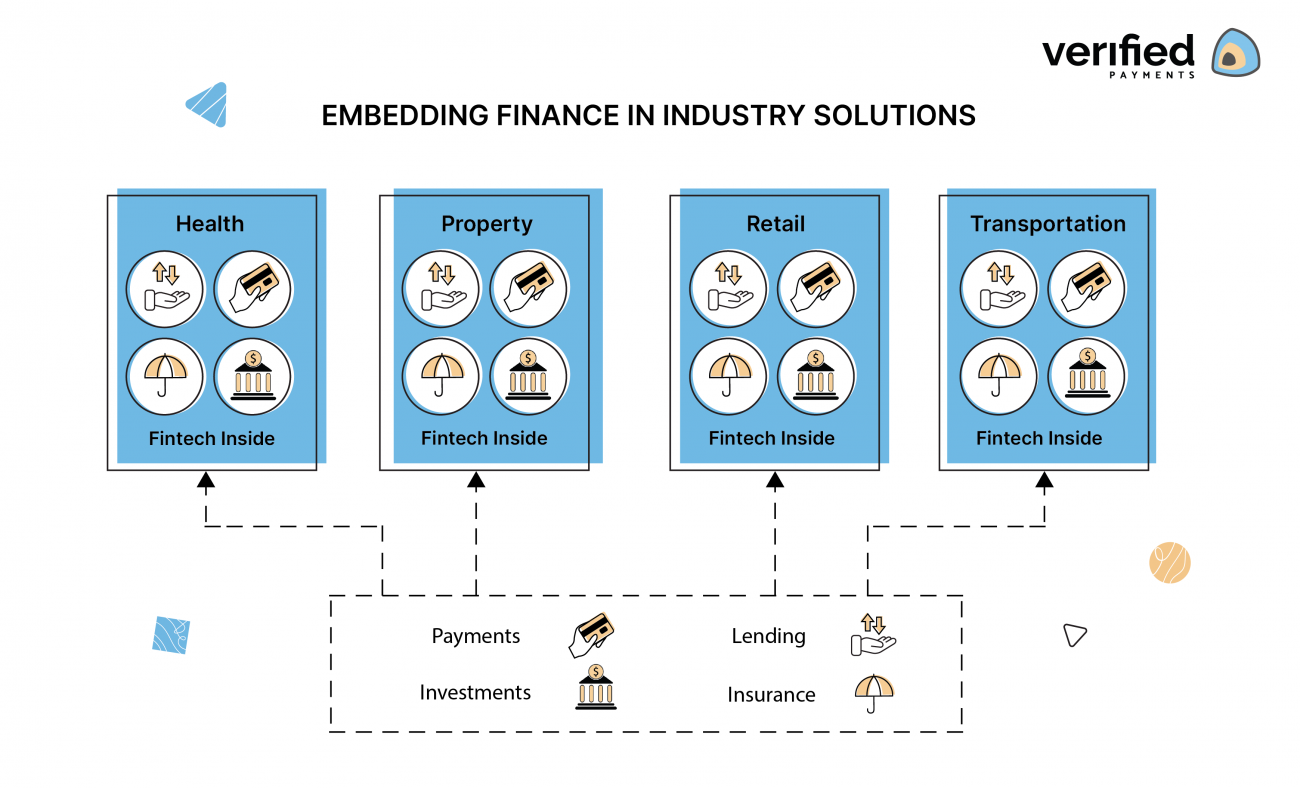

Embedded finance refers to the integration of financial services into non-financial platforms, such as e-commerce websites, social media platforms, or even smart devices. It enables businesses to offer seamless financial products and services directly to their customers, eliminating the need for traditional banking intermediaries. This integration allows for greater convenience, accessibility, and personalization in managing one's finances.

1. The Rise of Embedded Finance

As technology continues to advance, embedded finance has gained traction across various industries. This section will delve into the factors contributing to its growth and the benefits it offers to both businesses and consumers.

Summary: Explore the drivers behind the rise of embedded finance and discuss the advantages it brings to businesses and consumers, such as enhanced customer experience and increased revenue opportunities.

2. The Role of APIs in Embedded Finance

Application Programming Interfaces (APIs) play a crucial role in enabling seamless integration between non-financial platforms and financial service providers. This section will delve into the technical aspects of APIs and their significance in driving embedded finance.

Summary: Discuss the importance of APIs in facilitating the integration of financial services into diverse platforms, enabling real-time data exchange and secure transactions.

3. Embedded Finance in E-commerce

E-commerce has become an integral part of our lives, and embedded finance has the potential to transform the way we transact online. This section will explore how embedded finance is reshaping the e-commerce landscape, from simplified checkout experiences to personalized financing options.

Summary: Highlight the impact of embedded finance on e-commerce platforms, including the benefits for businesses, such as increased conversion rates, and the convenience it offers to consumers.

4. The Role of Big Tech in Embedded Finance

Big tech companies have recognized the potential of embedded finance and have started to offer financial services alongside their core products. This section will examine the influence of tech giants in driving the adoption of embedded finance and the implications for traditional financial institutions.

Summary: Discuss the entry of big tech companies into the financial services space through embedded finance and the challenges they pose to traditional banks and financial institutions.

5. Embedded Finance and Financial Inclusion

Embedded finance has the potential to bridge the gap between the unbanked or underbanked population and financial services. This section will explore how embedded finance can contribute to financial inclusion by providing accessible and affordable financial products to underserved individuals and businesses.

Summary: Discuss the role of embedded finance in promoting financial inclusion, empowering marginalized communities, and fostering economic growth.

Conclusion

In conclusion, embedded finance represents a paradigm shift in the way financial services are delivered and consumed. Its integration into non-financial platforms opens up new possibilities for businesses and individuals alike. As technology continues to advance, it is crucial for traditional financial institutions to adapt and embrace embedded finance to stay relevant in this rapidly evolving landscape.

Summary: Emphasize the transformative potential of embedded finance and the need for businesses and financial institutions to embrace this innovative approach to stay ahead in the digital era.

Question 1: How does embedded finance enhance customer experience?

Answer: Embedded finance offers a seamless and convenient way for customers to access and manage financial services directly through their preferred platforms. This eliminates the need for multiple logins or tedious processes, providing a frictionless experience.

Question 2: What are the risks associated with embedded finance?

Answer: While embedded finance offers numerous benefits, it also presents certain risks such as data privacy concerns, cybersecurity threats, and potential concentration of power in the hands of big tech companies. Proper regulations and security measures are necessary to mitigate these risks.

Question 3: How can embedded finance contribute to financial inclusion?

Answer: By integrating financial services into non-financial platforms that are accessible to underserved populations, embedded finance can provide affordable and tailored financial products, promoting financial inclusion and empowering marginalized communities.

Question 4: Will embedded finance replace traditional banks?

Answer: While embedded finance may disrupt traditional banking models, it is unlikely to completely replace banks. Traditional financial institutions can adapt and collaborate with embedded finance providers to offer innovative solutions and maintain their relevance in the evolving financial landscape.

Question 5: What are the key challenges in implementing embedded finance?

Answer: Some key challenges include regulatory compliance, interoperability between platforms, and ensuring data privacy and security. Addressing these challenges will be crucial for the successful implementation of embedded finance.

Post a Comment for "Embedded Finance: The Future of Financial Services"