Exploring Regional Finance Locations: A Comprehensive Guide

When it comes to financial services, finding the right location is crucial. Whether you're looking for a bank branch, investment firm, or insurance provider, understanding the regional finance landscape can help you make informed decisions. In this comprehensive guide, we will delve into the various regional finance locations and highlight key features and services they offer. From bustling financial hubs to niche markets, get ready to explore the diverse world of regional finance.

Before we dive into the specifics, let's define what we mean by "regional finance locations." These are places that cater to the financial needs of a specific region, offering a range of financial services tailored to the local market. From small towns to cosmopolitan cities, regional finance locations play a vital role in supporting businesses and individuals alike, ensuring economic growth and stability.

1. Understanding the Role of Regional Finance Locations

In this section, we will explore the significance of regional finance locations and how they contribute to the overall economic landscape. From facilitating local businesses to providing employment opportunities, these locations are the backbone of the regional financial ecosystem.

Summary: This section will shed light on the purpose and importance of regional finance locations in fostering economic growth and stability within a specific region.

2. Major Financial Hubs Around the World

Discover the world's most prominent financial hubs, such as New York, London, and Hong Kong. We will delve into their rich history, key players, and the diverse range of financial services they offer. From Wall Street to the City of London, get ready to explore these bustling centers of global finance.

Summary: This section will provide an overview of the major financial hubs worldwide and highlight their significance in shaping the global financial landscape.

3. Exploring Regional Finance Centers in Small Towns

While major cities often dominate the financial scene, small towns have their own unique regional finance centers. We will take a closer look at these hidden gems, their role in serving local communities, and the specialized services they provide. From rural banks to credit unions, discover how these centers cater to the financial needs of small-town residents.

Summary: This section will highlight the importance of regional finance centers in small towns and shed light on the specialized services they offer.

4. Niche Markets: Specialized Regional Finance Locations

Some regions are known for their expertise in specific financial sectors. In this section, we will explore niche markets such as cryptocurrency hubs, insurance clusters, and commodity trading centers. Uncover the reasons behind their specialization, the benefits they bring, and the opportunities they offer for investors and businesses.

Summary: This section will explore niche markets with specialized regional finance locations and discuss the advantages they provide for specific financial sectors.

5. Emerging Regional Finance Locations

As the global economy evolves, new regional finance locations are emerging. We will focus on these up-and-coming areas, their potential for growth, and the services they aim to provide. From emerging fintech hubs to developing financial districts, discover the future stars of regional finance.

Summary: This section will highlight the rising regional finance locations and discuss their potential for economic growth and innovation.

6. Factors to Consider When Choosing a Regional Finance Location

Choosing the right regional finance location is crucial for individuals and businesses. In this section, we will outline the key factors to consider, including proximity to clients, regulatory environment, access to talent, and infrastructure. By understanding these factors, you can make an informed decision that aligns with your financial goals.

Summary: This section will provide valuable insights into the factors individuals and businesses should consider when selecting a regional finance location.

7. Benefits and Challenges of Regional Finance Locations

Regional finance locations offer unique advantages, but they also come with their own set of challenges. We will explore the benefits, such as personalized service and local expertise, as well as the challenges, such as limited access to certain financial products. By understanding both sides, you can assess whether a regional finance location is the right fit for your needs.

Summary: This section will discuss the benefits and challenges associated with regional finance locations, allowing readers to make an informed decision.

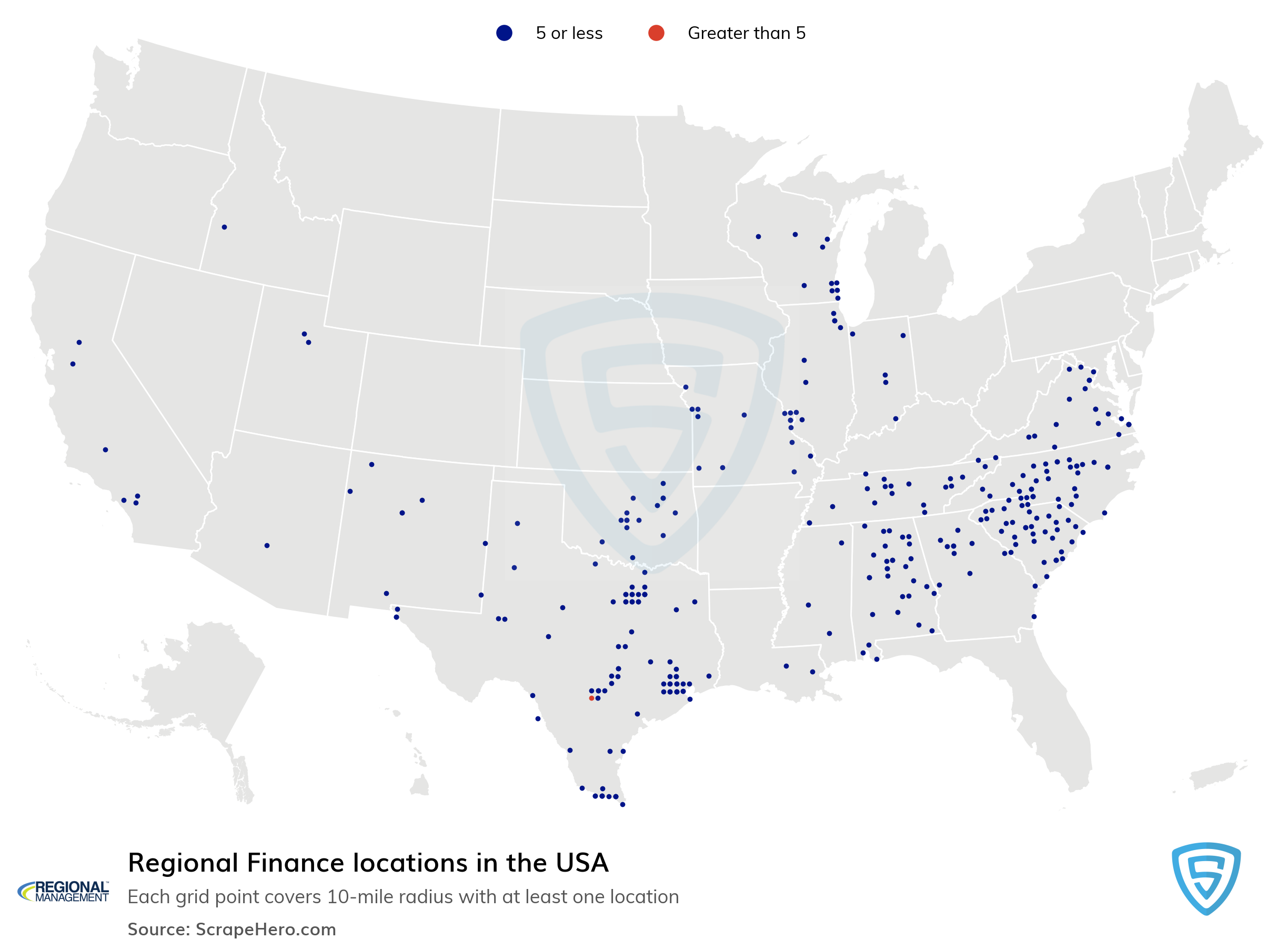

8. Prominent Regional Finance Locations in North America

North America is home to several prominent regional finance locations. In this section, we will focus on key cities like Toronto, Chicago, and Houston, highlighting their unique financial landscapes and the services they offer. Discover the regional finance centers that shape the North American financial industry.

Summary: This section will provide an overview of the major regional finance locations in North America and their significance in the continent's financial ecosystem.

9. Prominent Regional Finance Locations in Europe

Europe boasts a rich tapestry of regional finance locations. From Frankfurt's role as a banking powerhouse to Zurich's reputation as a global wealth management center, we will explore the financial hotspots across the continent. Embark on a journey through Europe's diverse regional finance landscape.

Summary: This section will highlight the prominent regional finance locations in Europe, showcasing the continent's financial diversity and expertise.

10. Prominent Regional Finance Locations in Asia

Asia is a dynamic region with thriving financial centers. From Singapore's reputation as a fintech hub to Mumbai's status as the financial capital of India, we will delve into the key regional finance locations in Asia. Uncover the unique offerings and opportunities presented by these fast-growing financial markets.

Summary: This section will explore the prominent regional finance locations in Asia and highlight their significance in the region's financial landscape.

In conclusion, regional finance locations play a vital role in supporting the financial needs of specific regions. Whether you're looking for a local bank, investment services, or insurance providers, understanding the regional finance landscape is essential. By exploring major financial hubs, small-town centers, niche markets, and emerging locations, you can make informed decisions and leverage the advantages offered by regional finance. Remember to consider various factors and weigh the benefits and challenges before selecting the right regional finance location for your needs.

Question and Answer:

Q: How do regional finance locations contribute to economic growth?

A: Regional finance locations facilitate local businesses, providing them with financial services and support. By fostering economic growth and stability, these locations contribute to job creation and overall prosperity within the region.

Q: What factors should one consider when choosing a regional finance location?

A: Factors such as proximity to clients, regulatory environment, access to talent, and infrastructure are important considerations when selecting a regional finance location. These factors can impact the ease of doing business and the availability of specific financial services.

Q: Are there any advantages to choosing a niche regional finance location?

A: Yes, niche regional finance locations often specialize in specific financial sectors, such as cryptocurrency or insurance. Choosing such a location can provide access to specialized expertise, networking opportunities, and tailored services that cater to the needs of those sectors.

Q: What are some emerging regional finance locations to watch out for?

A: Emerging fintech hubs and developing financial districts are worth keeping an eye on. These locations often offer innovative financial services, attract investment, and contribute to the growth of the regional economy.

Q: Do regional finance locations offer personalized services?

A: Yes, regional finance locations often pride themselves on providing personalized services and local expertise. This can result in more tailored solutions and a deeper understanding of the local market.

Post a Comment for "Exploring Regional Finance Locations: A Comprehensive Guide"