Inhouse Car Finance Dealerships: A Comprehensive Guide to Getting Your Dream Car

Are you tired of the endless search for a car dealership that offers inhouse car finance? Look no further! Inhouse car finance dealerships provide a one-stop solution for individuals who are looking to buy their dream car without the hassle of dealing with traditional lenders. In this blog article, we will delve into the world of inhouse car finance dealerships, exploring what they are, how they work, and the benefits they offer. So, buckle up and get ready to hit the road towards your dream car!

Inhouse car finance dealerships are a game-changer for many car buyers. Traditional car financing options often involve dealing with banks, credit unions, or other financial institutions. This process can be time-consuming and frustrating, especially for individuals with less-than-perfect credit scores. Inhouse car finance dealerships, on the other hand, offer financing options directly from the dealership itself, making the process easier and more convenient.

1. Understanding Inhouse Car Finance Dealerships

In this section, we will provide a comprehensive overview of what inhouse car finance dealerships are and how they differ from traditional financing options. We will explore the advantages and disadvantages of choosing this route, helping you make an informed decision.

2. The Benefits of Inhouse Car Finance Dealerships

Discover the numerous benefits of opting for inhouse car finance dealerships. From flexible loan terms to simplified approval processes, we will delve into why this financing option is gaining popularity among car buyers.

3. How to Qualify for Inhouse Car Financing

Learn about the eligibility criteria for inhouse car financing and how you can increase your chances of approval. From income requirements to credit history, we will provide valuable insights to help you secure your dream car.

4. Tips for Choosing the Right Inhouse Car Finance Dealership

Not all inhouse car finance dealerships are created equal. In this section, we will share essential tips to consider when selecting the right dealership for your needs. From reputation and customer reviews to the range of car models available, we've got you covered.

5. Exploring the Application Process

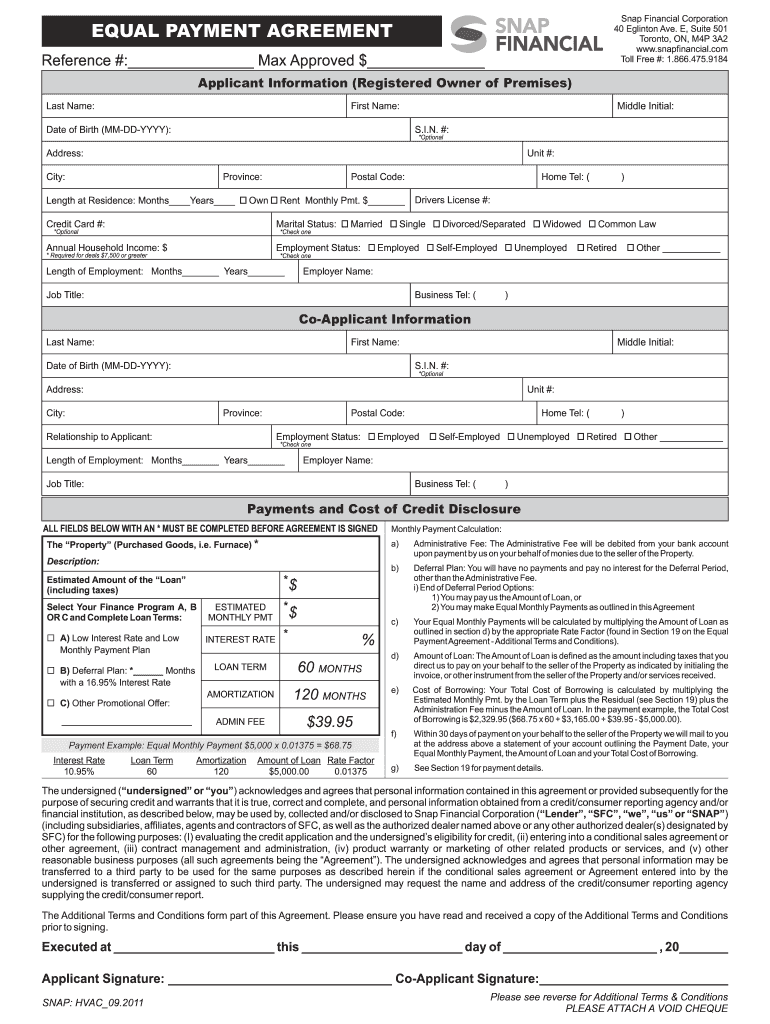

Ready to take the plunge? Discover the step-by-step application process for inhouse car financing. We will guide you through the necessary paperwork, documentation, and other requirements to make your car-buying journey a breeze.

6. Negotiating Deals with Inhouse Car Finance Dealerships

Learn valuable negotiation tactics to ensure you get the best deal possible when working with inhouse car finance dealerships. From interest rates to down payments, we will equip you with the necessary skills to drive away with a smile on your face.

7. Understanding the Fine Print

Before signing any contracts, it's crucial to understand the fine print. In this section, we will guide you through the intricacies of inhouse car financing agreements, ensuring you are aware of all the terms and conditions.

8. Building Credit with Inhouse Car Finance

Inhouse car financing can be an excellent opportunity to improve your credit score. Find out how timely payments and responsible borrowing can have a positive impact on your credit history, opening doors to better financing options in the future.

9. Common Misconceptions About Inhouse Car Finance

There are often misconceptions surrounding inhouse car finance dealerships. In this section, we will debunk common myths and provide clarity on the realities of this financing option.

10. Frequently Asked Questions About Inhouse Car Finance

Still have some burning questions? We've got you covered! In this section, we will address frequently asked questions about inhouse car finance, providing answers to help you make an informed decision.

In conclusion, inhouse car finance dealerships offer a convenient and accessible solution for individuals looking to purchase a car. From understanding the basics to navigating the application process and building credit, this comprehensive guide has equipped you with the knowledge you need to make the best possible decision. So, why wait? Start exploring inhouse car finance dealerships today and drive away with your dream car!

Question and Answer:

Q: Are inhouse car finance dealerships only for individuals with bad credit?

A: While inhouse car finance dealerships can be a great option for individuals with less-than-perfect credit scores, they are not exclusive to this group. Inhouse car financing is available to anyone who prefers a simplified and convenient financing process directly from the dealership.

Q: Is the interest rate higher for inhouse car financing?

A: The interest rates for inhouse car financing can vary depending on factors such as your credit history, the dealership, and the specific financing terms. It's important to shop around and compare rates to ensure you are getting the best deal possible.

Q: Can I trade in my current vehicle when opting for inhouse car financing?

A: Yes, many inhouse car finance dealerships offer the option to trade in your current vehicle as part of the financing process. This can be a convenient way to offset the cost of your new car and simplify the overall transaction.

Q: What happens if I miss a payment on my inhouse car finance loan?

A: Missing a payment on your inhouse car finance loan can have consequences, including late fees and potential damage to your credit score. It's important to communicate with the dealership if you are facing financial difficulties to explore possible solutions before missing a payment.

Q: Can I refinance my inhouse car finance loan?

A: Depending on the terms of your inhouse car finance loan, refinancing may be an option. It's best to consult with the dealership or a financial advisor to determine if refinancing is a viable solution for your specific situation.

Post a Comment for "Inhouse Car Finance Dealerships: A Comprehensive Guide to Getting Your Dream Car"