The Ultimate Guide to a Successful Finance Career Path

Are you considering a career in finance but unsure of the path to take? Look no further! In this comprehensive guide, we will walk you through the various steps and options available to build a successful finance career. Whether you're a fresh graduate or someone looking to make a career change, we've got you covered!

In today's fast-paced and dynamic world, the finance industry offers a plethora of opportunities for individuals with a keen interest in numbers, analysis, and problem-solving. From investment banking to financial planning, there are numerous paths you can explore and carve out a rewarding career. Let's dive right in!

1. Understanding the Finance Industry

Summary: Gain insights into the diverse sectors of the finance industry, including investment banking, commercial banking, asset management, and more. Learn about the roles and responsibilities within each sector and identify which area aligns best with your skills and interests.

2. Building a Strong Educational Foundation

Summary: Discover the various educational paths to pursue a finance career, such as obtaining a bachelor's degree in finance, economics, or business administration. Explore the importance of internships, certifications, and advanced degrees in enhancing your knowledge and employability.

3. Developing Essential Skills for Success

Summary: Highlight the key skills required for a finance career, including analytical thinking, problem-solving, communication, and teamwork. Explore ways to develop and showcase these skills through internships, extracurricular activities, and professional development opportunities.

4. Navigating Entry-Level Finance Jobs

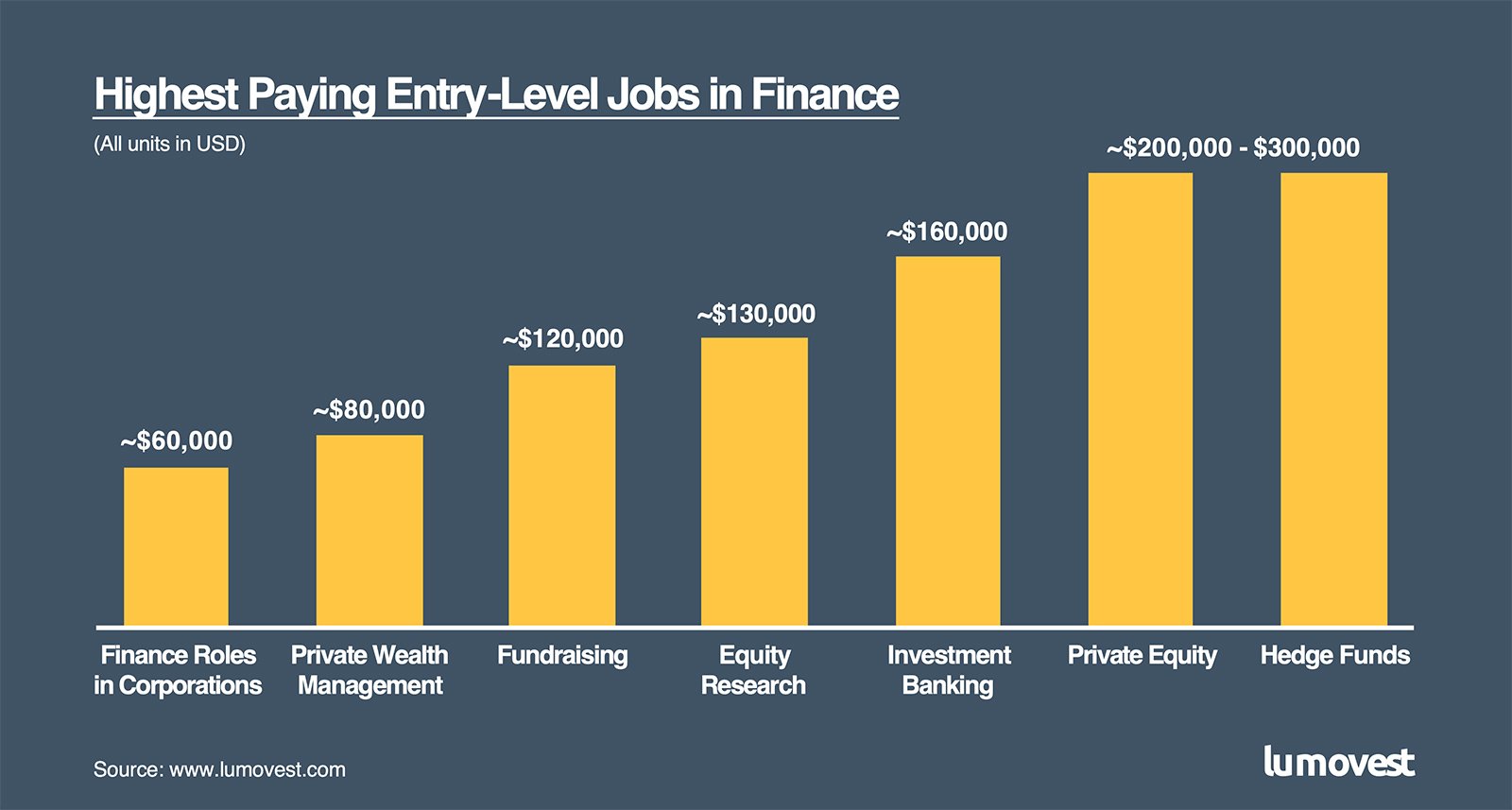

Summary: Learn about the various entry-level positions available in the finance industry, such as financial analyst, credit analyst, and investment banking analyst. Discover the skills and qualifications required for these roles and gain tips on how to secure your first job in finance.

5. Advancing Your Finance Career

Summary: Explore the different paths to advance your finance career, such as pursuing an MBA, obtaining professional certifications like CFA or CPA, or specializing in a specific area like risk management or financial planning. Gain insights into the benefits and opportunities each path offers.

6. Mastering Financial Analysis and Reporting

Summary: Dive into the world of financial analysis and reporting, a crucial skill for finance professionals. Learn about financial statements, ratio analysis, forecasting, and budgeting techniques. Understand how to interpret and present financial data to make informed business decisions.

7. Exploring Investment and Portfolio Management

Summary: Delve into the exciting field of investment and portfolio management. Gain insights into the process of selecting and managing investments, understanding risk and return, and building a diversified portfolio. Discover the tools and strategies used by successful portfolio managers.

8. Unveiling the World of Corporate Finance

Summary: Get acquainted with the realm of corporate finance, focusing on financial planning, capital budgeting, and mergers and acquisitions. Learn how finance professionals support companies in making strategic financial decisions and maximizing shareholder value.

9. Pursuing a Career in Financial Planning

Summary: Explore the rewarding field of financial planning, where professionals assist individuals and families in managing their finances, setting financial goals, and creating long-term wealth. Understand the steps to become a certified financial planner and provide personalized financial advice.

10. Embracing Technology in Finance

Summary: Witness the impact of technology on the finance industry and the increasing demand for professionals with expertise in financial technology (FinTech). Discover the emerging trends, such as blockchain, artificial intelligence, and robo-advisors, and their implications for finance careers.

In conclusion, a finance career offers a wide range of opportunities for those with a passion for numbers and a desire to make a significant impact. By understanding the industry, acquiring a strong educational foundation, and developing essential skills, you can pave the way for a rewarding finance career. Remember to continuously adapt to industry changes, embrace lifelong learning, and seek mentorship to thrive in this ever-evolving field. So, are you ready to embark on your finance career journey?

Question and Answer

Q: What are the key skills required for a finance career?

A: Some key skills required for a finance career include analytical thinking, problem-solving, communication, teamwork, and attention to detail. These skills are essential for financial analysis, decision-making, and effective collaboration with colleagues and clients.

Q: How can I advance my finance career?

A: There are several ways to advance your finance career. You can pursue an advanced degree like an MBA, obtain professional certifications such as CFA or CPA, specialize in a specific area within finance, or seek leadership positions within your organization. Continuous learning, networking, and staying updated with industry trends are also crucial for career advancement.

Q: What is the role of technology in finance?

A: Technology has revolutionized the finance industry, enabling faster and more efficient processes. It has facilitated the development of financial technology (FinTech), leading to innovations like online banking, digital payments, and automated investment platforms. Professionals with expertise in FinTech are in high demand to drive technological advancements in finance.

Q: Is a finance career suitable for recent graduates?

A: Yes, a finance career can be suitable for recent graduates. Entry-level positions such as financial analyst or credit analyst provide opportunities to gain practical experience and develop foundational skills. Many organizations also offer structured training programs for graduates to kickstart their finance careers.

Q: How important is networking in the finance industry?

A: Networking plays a crucial role in the finance industry. Building relationships with professionals in the field can lead to job opportunities, mentorship, and access to valuable industry insights. Attending networking events, joining professional associations, and utilizing online platforms can help expand your network and enhance your career prospects.

Post a Comment for "The Ultimate Guide to a Successful Finance Career Path"