Lendmark Finance: Providing Financial Solutions for Your Every Need

Are you in need of financial assistance? Look no further than Lendmark Finance, your trusted partner in providing personalized loan options to meet your unique requirements. With a commitment to exceptional customer service and a wide range of flexible loan products, Lendmark Finance has become a leading name in the industry. In this comprehensive blog article, we will delve into the various aspects of Lendmark Finance, highlighting its services, benefits, and the reasons why it should be your first choice. Read on to discover how Lendmark Finance can help you achieve your financial goals.

Founded with the vision of helping individuals and businesses access the funds they need, Lendmark Finance offers a variety of loan options tailored to suit different financial needs. Whether you require funds for home improvements, medical expenses, debt consolidation, or even starting your own business, Lendmark Finance has got you covered. With their easy application process and quick approval times, you can get the funds you need without any unnecessary hassle.

1. Personal Loans: Tailored to Your Needs

Summary: Dive into the world of Lendmark Finance's personal loans, designed to cater to your individual requirements. Discover the various features and benefits of these loans, including competitive interest rates, flexible terms, and convenient repayment options.

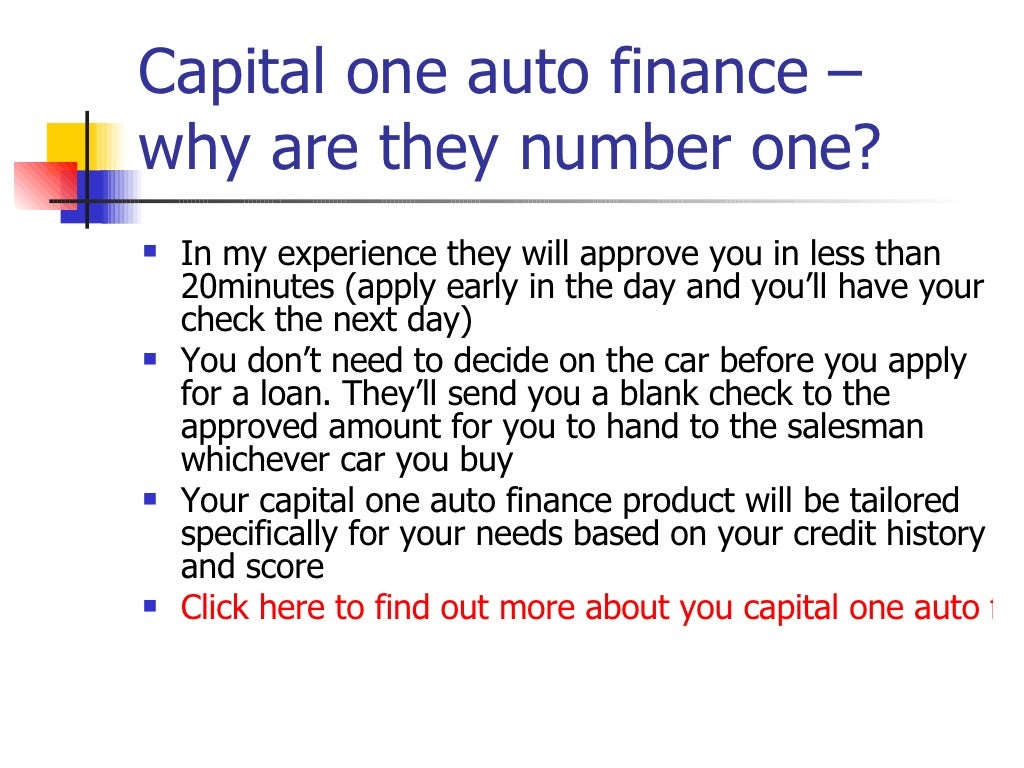

2. Auto Loans: Drive Your Dreams

Summary: Learn about Lendmark Finance's auto loans, enabling you to bring your dream car home. Uncover the advantages of their auto loan offerings, such as low rates, easy application process, and expert guidance throughout the loan journey.

3. Home Improvement Loans: Transform Your Space

Summary: Explore Lendmark Finance's home improvement loans, designed to help you renovate or upgrade your living space. Discover how these loans can provide the necessary financial support to turn your house into your dream home.

4. Debt Consolidation: Simplify Your Finances

Summary: Find out how Lendmark Finance's debt consolidation loans can help you streamline your debts, making it easier to manage your finances. Learn about the benefits of consolidating your debts with Lendmark Finance, including potentially lowering your interest rates and monthly payments.

5. Small Business Loans: Fuel Your Entrepreneurial Spirit

Summary: Delve into Lendmark Finance's small business loans, specially crafted for aspiring entrepreneurs. Discover how these loans can provide the necessary capital to fund your business ideas and help you turn your dreams into reality.

6. Credit Insurance: Protecting Your Assets

Summary: Learn about Lendmark Finance's credit insurance options, designed to safeguard your loan and protect your assets in unforeseen circumstances. Explore the advantages of credit insurance and how it can provide you with peace of mind.

7. Online Account Management: Convenience at Your Fingertips

Summary: Discover the ease and convenience of Lendmark Finance's online account management system. Learn how this user-friendly platform allows you to handle your loan repayments, view statements, and manage your account details from the comfort of your own home.

8. Customer Support: Your Partner Every Step of the Way

Summary: Explore Lendmark Finance's commitment to exceptional customer support. From the initial loan application to the final repayment, find out how their dedicated team is there to assist and guide you throughout the entire loan process.

9. Financial Education: Empowering Your Financial Journey

Summary: Discover Lendmark Finance's focus on financial education and empowerment. Learn about the various resources and tools they offer to help you make informed financial decisions and improve your financial well-being.

10. Community Involvement: Giving Back

Summary: Uncover Lendmark Finance's commitment to giving back to the communities they serve. Learn about their philanthropic efforts and partnerships aimed at making a positive impact on society.

In conclusion, Lendmark Finance is your go-to financial partner for all your loan needs. With a wide range of loan options, exceptional customer service, and a commitment to your financial well-being, Lendmark Finance stands out as a reliable and trustworthy choice. Whether you need a personal loan, auto loan, home improvement loan, debt consolidation loan, or small business loan, Lendmark Finance has the solution tailored just for you. Don't let financial constraints hold you back; turn to Lendmark Finance and take control of your financial future today!

Question and Answer Section:

Q1: How long does it take to get approved for a loan with Lendmark Finance?

A1: The approval process at Lendmark Finance is quick and efficient. In many cases, you can receive a loan decision within hours, allowing you to access the funds you need in a timely manner.

Q2: Can I apply for a loan with Lendmark Finance if I have bad credit?

A2: Yes, Lendmark Finance understands that everyone's financial situation is unique. They consider applications from individuals with various credit backgrounds and strive to find suitable solutions for each customer.

Q3: Are there any prepayment penalties if I decide to repay my loan early?

A3: Lendmark Finance does not charge any prepayment penalties. If you choose to pay off your loan ahead of schedule, you can do so without incurring any additional fees.

Q4: Can I manage my Lendmark Finance loan online?

A4: Absolutely! Lendmark Finance offers an easy-to-use online account management system, allowing you to conveniently handle your loan repayments, view statements, and manage your account details from anywhere, at any time.

Q5: Does Lendmark Finance offer any resources to help improve financial literacy?

A5: Yes, Lendmark Finance believes in empowering their customers. They provide various financial education resources and tools to help individuals make informed decisions and enhance their financial well-being.

Post a Comment for "Lendmark Finance: Providing Financial Solutions for Your Every Need"